Donor-Advised Fund Program

We are an innovative partner in maximizing the impact of giving.

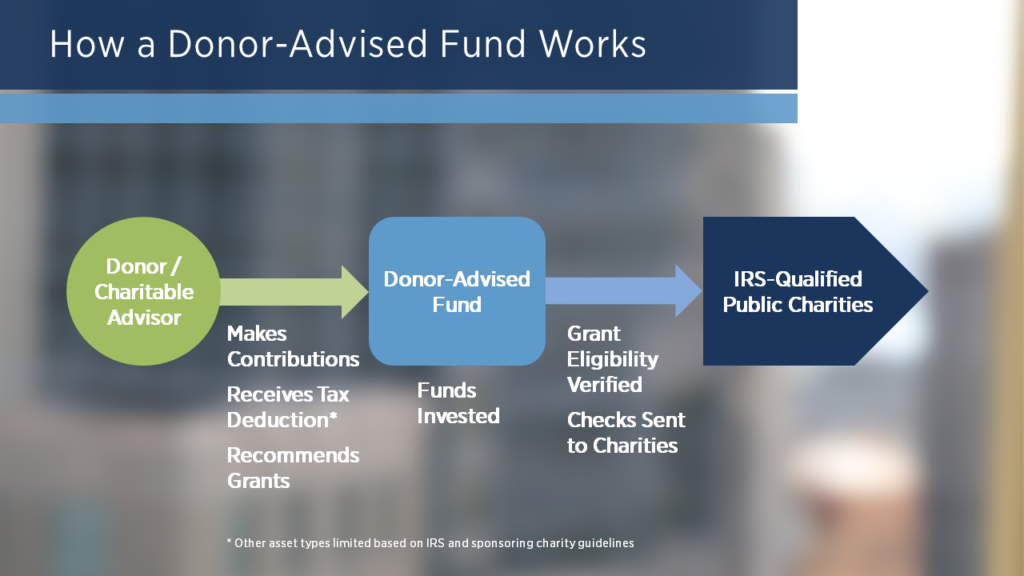

How a Donor-Advised Fund Works.

A donor-advised fund (DAF) is sponsored by a public charity, in this case, Fiduciary Trust Charitable. The donor generally receives an immediate income tax deduction for contributions to the fund and can recommend that grants be made from the fund to IRS-qualified charities at any time. DAFs, with their flexibility, low costs, and tax advantages are an important vehicle for charitable giving.

This video by our donor-advised fund partner, Fiduciary Trust Charitable, outlines how a donor-advised fund can be used for charitable giving.

What Makes Our Program Distinctive

For donors who value flexibility, service and expertise

At Fiduciary, we partner you with an advisor who will provide personal service, a tailored investment approach, and access to any philanthropic specialists you need. We can also connect you to legal experts who can assist with private foundation conversions to donor-advised funds.

For donors who value flexibility, service and expertise.

At Fiduciary, we partner you with an advisor who will provide personal service, a tailored investment approach, and access to any philanthropic specialists you need. We also have access to legal experts who can assist with private foundation conversions to donor-advised funds.

-

Personal Service

Your dedicated, experienced advisor can integrate servicing and planning for DAFs and other accounts. You also have online and mobile account access.

-

Expertise

Our philanthropic and legal specialists have extensive experience in a variety of charitable giving vehicles and techniques, including converting private foundations to donor-advised funds.

-

Flexibility & Innovation

Your DAF investment advisor can choose from a broad universe of publicly-traded investments as well as approved private investments. Fiduciary Trust Charitable and Fiduciary Trust Company have been recognized among peers for innovation, including the Fiduciary Flexible Endowment™ program.

-

Sustainable Practices

We are committed to sustainability through our environmentally-friendly operating practices as well as a range of sustainable investment options. Fiduciary Trust Charitable lives by the “Hate is not Charitable” pledge and under the aegis of an independent board and auditors.

An Approach Tailored to Your Needs

We help donors fulfill their charitable goals through customized services backed by deep expertise. Learn about our distinctive approach in our donor-advised fund program with Fiduciary Trust Charitable.