New Hampshire Trusts

We combine the favorable trust and tax laws of New Hampshire with 140 years of wealth management experience.

Potential Benefits to Clients Nationwide

Today, trustees and beneficiaries have choices when deciding where to administer their trusts. We believe New Hampshire is the best state for this, with its numerous tax and other benefits. These advantages are often available for trusts established outside of New Hampshire and with beneficiaries residing in other states.

State Income Tax Savings

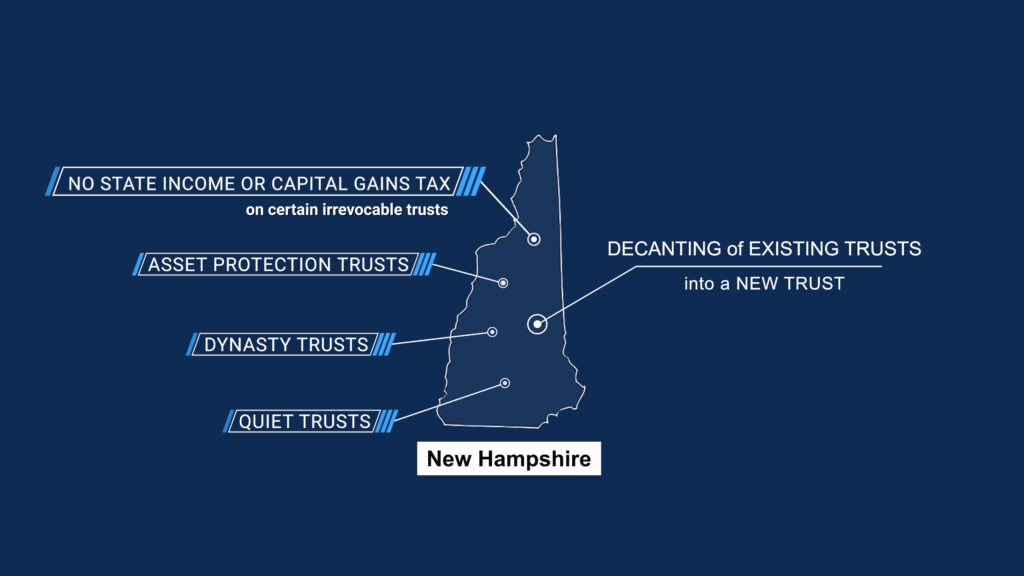

There are no state capital gains or income taxes on New Hampshire irrevocable trusts that meet certain criteria.

Perpetual Trusts

Unlike most states, New Hampshire law allows an individual to create a perpetual or dynasty trust with no specific termination date.

Asset Protection Trusts

New Hampshire law allows for the creation of trusts that protect trust assets against a settlor’s or beneficiary’s creditors.

Directed Trusts

New Hampshire law allows for investment, administrative, and other responsibilities to be clearly divided among trustees, investment advisors, and other fiduciaries.

Sustainable Investing

New Hampshire was one of the first states to allow trustees to pursue a sustainable investing strategy, regardless of investment performance.

Dedicated Trust Court and Long Case History

New Hampshire has a dedicated trust court, which can result in more predictable and timely trust litigation outcomes for trustees and beneficiaries, such as in the case of a beneficiary's divorce.

Trust Protectors and Trust Advisors

New Hampshire law recognizes the roles of trust protectors and trust advisors who can oversee or advise the trustees or investment manager.

Decanting

New Hampshire trust law allows for decanting, a process by which a trustee creates a new trust and transfers assets from an old trust to the new trust, enabling some level of trust modification (and modernization) of the old trust.

New Hampshire's Trust Advantages

The Granite State's trust laws are available to families nationwide and internationally. Their use can deliver tremendous benefits in tax savings, asset protection, and multi-generational asset transfer as well as several other advantages.

Fiduciary Trust of New England

Fiduciary Trust of New England (FTNE) is the premier provider of New Hampshire trust services. We combine the 140 years of experience and independence of our Massachusetts affiliate, Fiduciary Trust Company (FTC), with the favorable trust and tax laws of New Hampshire. FTNE has been named a “Best Trust Company” and a “Most Advisor-Friendly Trust Company” by Wealth Advisor.