Do you have a Wealth Plan? If you do, when was the last time you reviewed it? Have your life and circumstances changed since then? Wealth planning is about empowerment and providing a framework for making informed decisions that center around your family’s financial security. By incorporating both financial and estate planning, a comprehensive wealth plan reflects your particular goals and circumstances and will evolve with you over time.

To complement this article, we have compiled a Wealth Planning Checklist you may download to help you review your personal situation.

Wealth planning is personal and revolves around your relationship with money and your relationships with others. Utilizing a skilled planning team to help facilitate your wealth planning can transform a potentially daunting process into an empowering experience. Your wealth plan will develop with you as your circumstances change. As a result, wealth planning can be viewed as an ongoing, comprehensive seven-step process.

1. Identify Personal Priorities

Wealth planning begins with identifying what is important to you. Sometimes priorities are readily apparent, and other times they become apparent when you consider the people or experiences that matter to you. Priorities vary greatly but often include spending time with loved ones or having a special place where family memories can be created. Other priorities sometimes include leisure time, education, travel, charitable intentions, or wealth transfer, to name a few. Priorities can even include avoiding things that concern you. Priorities, like many things, often change with time, which is one of the reasons your wealth plan needs to be revisited periodically.

2. Translate Personal Priorities into Goals

Your priorities serve as a backdrop for the clear articulation of your current and future goals. Priorities are translated into goals that become the foundation of your wealth plan. Goals usually, but not always, have a direct financial component, and can be long or short term in nature. At this step of your wealth planning, not all goals need to be immediately attainable and may not even seem realistic. Your goals should be articulated in a way that is specific to you. Depending on your stage in life and level of wealth, the same goal will be viewed from different angles. This can be illustrated with the following common goals:

- Comfortable Support during your Retirement Years: When contemplating retirement, it is always advisable to conservatively plan to spend more than you think for a period that is longer than you anticipate. This may help you determine approximately how much you need to be comfortable during your retirement years. If you are a pre-retiree, a retirement goal may have a financial planning emphasis focusing on whether your current investments and future savings will be sufficient for you to retire comfortably in the future, and help you determine at what point you will stop working.

If you are already retired, this goal might have a financial planning emphasis that involves understanding what you are currently spending and whether that is sustainable. For those with sufficient wealth, your retirement goal may be viewed alongside philanthropic or family wealth transfer goals, and as a result may involve determining what level of assets you need to retain in order to be financially secure. Your wealth transfer plan may involve family and philanthropic intentions and could involve transfer strategies that utilize annual exclusion gifts, funding a donor-advised fund, or establishing and funding irrevocable trusts either during your lifetime or through your estate plan.

- Real Estate Purchase: Whether this goal is for your primary residence or a second home, it often involves careful planning on how to fund the purchase and assess what impact ongoing home ownership expenses will have on your finances. Purchasing real estate can be a highly emotional goal, which is why careful consideration as to affordability and sustainability are important. Should investment assets be used for the purchase or should a mortgage be obtained? In addition to financial planning considerations, estate planning considerations may come into play if the particular parcel of real estate is something to be kept in the family for generations.

- Education: Education can be both a personal priority and a goal. In addition to paying for college, private elementary or secondary education for your children or grandchildren may be a goal. With some colleges today costing over $300,000 for four years, having a plan to pay for education costs is advisable. From a financial planning perspective, this can involve saving diligently, while from a wealth transfer perspective it often involves grandparents helping with expenses.

- Philanthropy: Deciding which charities to support, how much to give, and what funding vehicles to utilize is important if charitable giving is one of your goals. Incorporating family members into your philanthropic activities by enlisting their help with evaluating charities, volunteering, or allocating gifts, coupled with meaningful conversations around finances, can be an effective way to transfer your values to your children or grandchildren. To maximize current year tax deductions while planning for future charitable gifts, consider utilizing a donor-advised fund. Charitable intentions can also be funded through your estate plan.

Learn More: “Choosing the Best Charitable Giving Approach”

- Wealth Transfer: Wealth transfer can be a goal during your lifetime or at your death. If your goal is to transfer wealth during your lifetime, your transfer plan may utilize annual exclusion gifts of up to $18,000 per person (based on IRS rules for 2024), either outright or in trust. Paying tuition or medical expenses directly to the provider can be a terrific way to transfer wealth without it being considered a gift for tax purposes. From an estate planning perspective, you may wish to consider making larger gifts as well, either outright or to ongoing trusts.

- Other Goals: Just as priorities are personal, so are the goals that flow from them. Time should be taken to fully develop the goal list. Some other examples of goals include paying off a mortgage, helping a child with a down payment, providing for long-term care costs, moving into a continuous care community, buying a boat, traveling, and providing for special needs. Some goals are ongoing, while others are temporary. Identifying and quantifying goals is one of the core functions of wealth planning.

3. Review Financial Resources

Separate from your goals, your financial resources – such as your current savings, retirement assets, and income sources – must be identified. It is important to be realistic in determining future income sources, along with how long and at what income level you plan to work. If you are a beneficiary of a trust, this is a good time to review the trust terms and understand how trust assets may be a resource for meeting your goals either now or in the future. If you expect a significant inheritance, that can be factored in as well, but should not be overestimated. Putting together a personal balance sheet to identify assets and liabilities, as well as how they are owned, is a useful element in this step.

Taxes should also be considered with this step. You should understand your current and expected future taxable income, including capital gains. Projected federal and state estate taxes should also be calculated. Future taxes will have implications on how to structure and manage your assets in order to minimize current and future taxes.

4. Articulate Any Obstacles

As you consider your goals and resources together, financial and other obstacles often become more apparent. Maybe you are spending beyond your means or your goals are not realistic given your financial picture. You may have a history of being overly generous with your adult children and struggle to set limits for them. Determining who to name as guardian for minor children can be an obstacle in the estate planning process, while an inability to give up control can hinder various aspects of wealth transfer.

Another common obstacle revolves around personal biases that may impact investment management. Hiring a competent investment professional to assist you in developing an appropriate asset allocation given your goals and risk profile is advisable. Your advisor can help mitigate any personal biases that may inadvertently increase your risk profile through activity such as market timing, chasing returns, or making emotional investment decisions. It is important to not underestimate your investment time horizon and to coordinate the asset allocation of retirement assets with your plan as well. Your financial planning should help inform your investment strategy.

5. Create a Wealth Plan for Meeting Goals

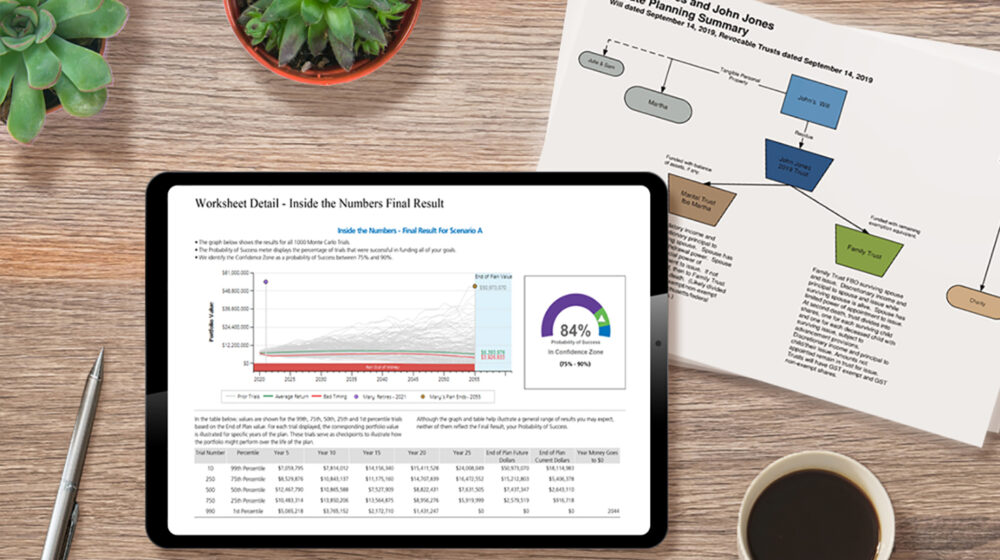

As you consider your goals, resources, and potential obstacles, you develop an understanding of not only where you are but where you would like to go. Informed decisions flow from the knowledge that you developed in the previous steps as you plan to meet your goals and overcome any obstacles. At this point in the process some goals may need to be prioritized or scaled back. From a financial planning perspective, all of this comes together into a financial plan that includes various projections. Through cash flow projections and Monte Carlo simulations, a likelihood of success can be offered. Discussing this in context is critical to understanding your overall situation and provides you with a foundation from which you can make informed financial decisions while developing peace of mind that you have a viable plan that addresses and meets your goals.

Your estate plan can be simple or complex, depending on your circumstances. Existing estate planning documents should be reviewed at this stage to determine if they reflect your current wishes as expressed in your wealth planning. Or if you have not done so already, this is the appropriate time to prepare your core estate planning documents. Core documents include a healthcare proxy and related documents, durable power of attorney, will, and revocable trust. It is your will that names the guardian for your minor children. If your estate plan has not been updated in a while, you may wish to consider adding provisions for digital assets and account access. Although often overlooked, it is important that family members over the age of 18 have at least a healthcare proxy and related healthcare documents in place.

Learn More: “Ten Items to Consider When Turning 18”

In addition, depending on your level of wealth, family circumstances, and wealth transfer objectives, your estate plan may include the establishment and funding of one or more irrevocable trusts. Each trust may have separate goals, functions, terms, and beneficiaries. Irrevocable trusts are generally not amendable after being signed, so great care should be taken when thinking through their terms before funding. The trustee will be responsible for carrying out the terms of the trust, and these terms should be both an expression of your wishes and aligned with your wealth plan.

6. Implement Your Wealth Plan

Implementation is an ongoing process and is when you really put your financial house in order. Implementation, like all aspects of your wealth plan, include many facets and will vary with your personal circumstances. Areas to consider during implementation include:

- Review Asset Ownership: Make sure assets are owned in the appropriate names, including assets held jointly. If you have a revocable trust, make sure you transfer assets into the trust, as this will help avoid public financial disclosures involved in the probate process. If you own an account in your individual name, consider adding a Transfer on Death or similar designation to facilitate its transfer at your passing. Be sure to review how real estate is held as well.

- Review Beneficiary Designations: Update beneficiary designations as necessary to ensure that the desired beneficiaries are named for life insurance policies, annuity contracts, 401(k) plans, and IRAs. Consider naming a trust as the beneficiary for your retirement assets.

Learn More: “Naming a Trust as IRA Beneficiary: Key Considerations”

- Understand Your Spending: Do you know how much you are actually spending? Tracking and assessing your spending will help you to be more intentional in choices around your allocation of resources. Once you understand your spending today, you should also consider how your cash flow needs will change over time. When will your mortgage be paid off? Will you travel more in retirement? What if you buy a second home? What will change during retirement?

- Examine Your Saving Habits: If you are still in the wealth accumulation phase, are you saving enough when you consider your goals? Major priorities always include an emergency fund and accumulating assets for retirement. Are you maximizing your contributions, and any company match, to your 401(k) or similar plan? Saving for education can be tricky. Although a goal for many, efforts towards education savings should not compromise your retirement saving goal. Along with this, you should also review your savings vehicles. Are you utilizing a Roth 401(k) or Roth IRA for tax-free growth or a traditional 401(k) or IRA for tax-deferred growth? Are you funding a health savings account (HSA)? Is a 529 college savings plan appropriate for your family? Grandparents should be sure to understand the consequences of using a 529 plan if their grandchildren are likely to apply for financial aid.

- Manage Your Debt and, by Extension, Your Credit Score: Some debts are better than others, but all debt needs to be properly managed or the results can be devastating. If you have a mortgage, consider if it would be appropriate to refinance it. Credit cards should be paid off monthly, otherwise you can end up paying for something many times over. Managing debt is important for financial purposes and can affect your credit score, which will impact your ability to obtain credit in the future.

- Consider Risk Management: Review your insurance coverage to ensure that insurance contracts are in force and appropriate given your risk profile.

- Life Insurance: Make sure coverage is sufficient and review insurance company ratings. Order in force illustrations for any non-term policies to review viability of policies.

- Disability Insurance: Review employment-based disability insurance coverage levels to be sure they are sufficient. If you rely on bonuses or other earnings in excess of your base pay, or if your base pay is beyond company maximums, consider obtaining private disability insurance as well.

- Property and Casualty Insurance: Review coverage levels to make sure you are adequately protected.

- Umbrella or Excess Liability Insurance: This insurance helps protect from liabilities that go beyond other insurance coverages, such as your home and auto policies. It is relatively inexpensive, and invaluable if you ever need it. The key here is to make sure you have sufficient coverage so that the insurance company’s interests and your interests are properly aligned if there ever is a claim.

- Long-term Care Insurance: This insurance helps pay for the cost of care if you need ongoing care due to severe cognitive impairment or the inability to perform two or more of the activities of daily living, such as eating, bathing, toileting, transferring, dressing, or continence care. Long-term care insurance can be expensive and difficult to obtain, but can provide peace of mind in the right circumstance. It may also be available in a hybrid product that incorporates life insurance or annuity products.

Learn More: “Understanding Long-Term Care Insurance”

- Fund Trusts and Make Gifts: If you have decided to engage in wealth transfer, this is the stage when you will actually fund the irrevocable trusts you have established and/or make gifts to those people or causes you care about. For philanthropic goals, you may establish and fund a donor-advised fund.

- Converse with Family Members: At a minimum, make sure family members – including those not named in the healthcare documents – understand your care wishes. This may make it easier for those who need to make difficult decisions. Beyond healthcare conversations, when the time is right, you may wish to have conversations with family members to help them understand what they may or may not be inheriting someday, and under what terms.

- Develop a Centralized List of Institutions and Financial Accounts: This list will be invaluable to your loved ones if you are ever incapacitated or pass unexpectedly. This has become even more important as more accounts and statements have transformed to being fully digital without a traditional paper trail. Items on your list should include accounts such as checking, savings, and investment; safe deposit boxes; insurance policies of all kinds; credit cards; and mortgages. In addition, it should be noted where copies or originals of birth certificates, driver’s licenses, Social Security cards, passports, health insurance cards, and recent tax returns are located. Include the names and contact information for your financial advisors and estate planning attorneys and note the location of your original will document. Digital assets and online financial accounts, including passwords, should also be noted.

7. Periodically Revisit Your Wealth Plan

Although there is no set time for reviewing your wealth plan, it should be reviewed and updated periodically. It begins with reassessing your personal priorities, and should be undertaken every few years or any time there is a change in your circumstances. Appropriate times to review your plan include changes in:

- Family Circumstances: Common changes include a birth, adoption, death, marriage, or divorce

- Wealth Level: This can be from the sale of a business or receipt of an inheritance, among others

- Domicile: If you move, you should review your estate plan for potential recommended updates

- Employment: If you are retiring or contemplating retirement

- Spending: This may include considering a major purchase, such as a second home, or increased care needs for an elderly family member, among others

- Health: This can lead to a reset of priorities that can have a significant impact on your wealth plan

- Tax Law: This might include a change or anticipated change in income tax rates or a change to estate and gift tax exemption amounts either at the federal or state level

- It Has Been a While: If you do not remember what your wealth plan says, then it is likely time to review it

Be intentional in all that you do in your financial life, and remember to control the controllable. Life is busy and not all priorities get the attention they deserve. But today is a new day, and whether you have never done any wealth planning or simply have not reviewed and updated your plan in a while, taking a moment to prioritize the financial well-being of your family can be time well spent.

Fiduciary Trust provides customized wealth planning services which are integrated with investment management, trust, estate, tax, custody, and other services, as appropriate. If you would like to discuss your wealth planning needs, please reach out to us.