After strengthening for more than 15 years following the global financial crisis, the U.S. dollar has started to weaken amid recent market volatility. The dollar recently hit a 10-year low against the Swiss franc and was down nearly 10% against a basket of major currencies in the first quarter. Should investors be worried?

Historically, a strong dollar has been a sign of global confidence in the health of our economy and global demand for American goods and financial assets. Dollar strength can also help ease inflationary pressures, as U.S. consumers would pay less for imported goods in periods when the dollar gains value.

Yet throughout the campaign and since taking office, President Trump has expressed his desire for the dollar to weaken.1 In fact, underlying his administration’s ongoing efforts to transform the nation’s trade policies is the belief that the dollar has long been overvalued, creating systemic imbalances that are at the root of some of the biggest issues facing the domestic economy.2

The advantages of a strong or weak dollar aren’t always clear cut. Currency fluctuations affect and are impacted by a variety of interconnected factors including the economy, the markets, interest rates, and geo-politics. However, understanding why the dollar is likely to strengthen or weaken — and what that might mean for the markets and your investments — is critical for managing risks and establishing a long-term plan.

The Case for and Against a Strong Dollar

The value of the dollar isn’t merely a reflection of global judgement on the U.S. economy. It also directly impacts economic growth, the financial markets, corporate profits, and investors’ potential results from their overseas holdings.

When the dollar strengthens, it increases the buying power of U.S. consumers for imported goods, potentially easing inflationary pressures in the economy. Also, since most global commodities are priced in U.S. dollars, commodity prices tend to fall when the dollar rises. A strong dollar makes commodities more expensive for non-US buyers, which weakens demand, leading to lower prices.

However, a weak dollar has several advantages, too. For instance, it becomes less expensive for foreign buyers to purchase U.S.-made goods, potentially boosting overseas sales of U.S. multinationals. This is not an insignificant issue, as 41% of the revenues of companies in the S&P 500 Index are derived outside the United States.3 This is also a big reason why the Trump administration has been talking about wanting a weaker dollar — to make U.S. manufactured products more competitive globally and to address the sizeable trade deficits the U.S. has with major trading partners such as China, Mexico, and Vietnam.4

A weak dollar can also boost earnings for U.S.-based multinationals. When American businesses convert their foreign profits back into dollars, a weakening currency increases the value of earnings generated abroad while a strengthening dollar cuts into profits.

What Drives the Dollar?

The value of the dollar, like any other asset or security, is largely (though not entirely) driven by the laws of supply and demand. A strengthening dollar can be a reflection of the fact that more money is flowing into the U.S. than in the other direction. One place where that plays out is with the balance of trade. Typically, if the U.S. is importing more goods and services than it is exporting — meaning we are running a persistent trade deficit — that imbalance is likely to weaken the dollar.

But that’s not always the case, especially once tariffs come into the picture. In early April, the White House announced a sweeping set of tariffs on imported goods with a baseline levy of 10% on all imported goods, with higher assessments on specific countries.5

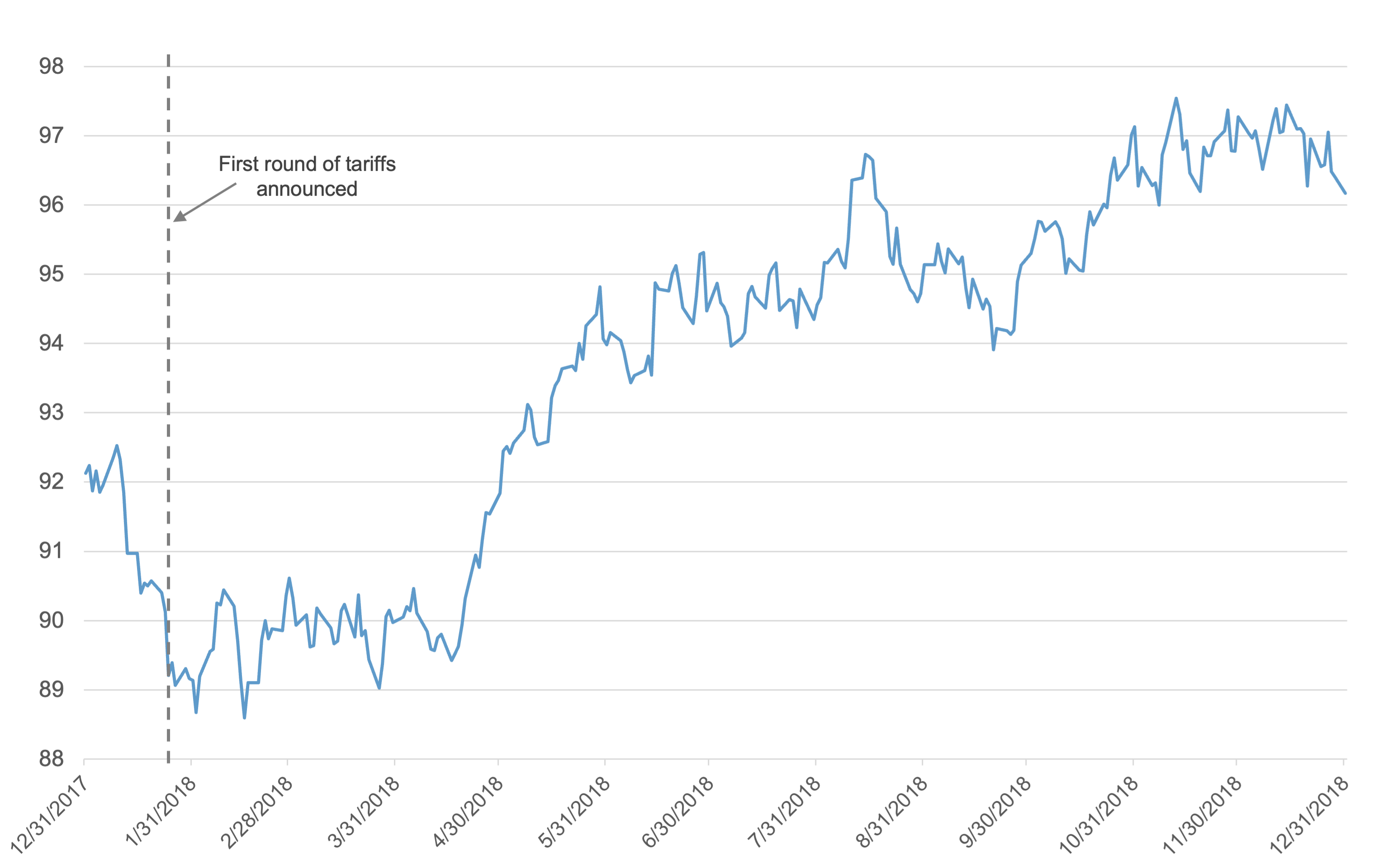

President Trump has indicated that the goal of tariffs is to make U.S. manufactured goods more competitive against imports while boosting domestic manufacturing. However, they have historically led to a stronger dollar because the expected result of imposing such levies is an improving trade balance, which is likely to boost the dollar’s value. Indeed, after President Trump imposed tariffs during his first term in 2018, the dollar largely appreciated.

Exhibit A: U.S. Dollar Index in 2018

Source: Bloomberg, Fiduciary Trust Company. Data from December 31, 2017 to December 31, 2018. Tariff announcement date of January 22, 2018.

In the immediate aftermath of the administration’s tariff announcement in April, however, the dollar continued to weaken to the surprise of many, illustrating that trade is only one of several variables that drive money flows and the value of the greenback.6

Relative confidence in the U.S. economy and U.S. financial assets is another factor. If global investors believe U.S. stocks or bonds are the best place to invest their capital, they’ll convert their local currencies into dollars to initiate those trades, which can strengthen the dollar. Conversely, if investors feel the U.S. markets are at risk, that could diminish demand for U.S. financial assets in the short term, which could weaken the greenback.

In the first quarter, the odds of a recession rose in the U.S. as consumer and business confidence sank amid growing uncertainties surrounding fiscal policy including tariffs. While economic anxieties were not unique to the United States, worries about a downturn in Europe have been partially offset by accelerating defense spending and other fiscal stimulus in the region. Lawmakers in Germany, for instance, recently voted to create a €500 billion infrastructure fund and exempted defense expenditures from the country’s strict debt limits, paving the way for a sharp increase in military spending.7 These efforts may help explain why the Euro has strengthened nearly 10% against the dollar since March.

Interest rates also play a role in the value of the dollar, as short-term money will often be parked where it can earn higher yields, propelling that currency. The absolute level of rates is one factor but also the future expected differential among global rates also matters. For instance, despite the United States having higher rates than the Eurozone, the dollar appreciated last fall when the Fed began to signal a potential pause in rate cuts as early as November 2024,8 while the European Central Bank signaled further reductions in policy rates.9

There’s one more factor at work: The U.S. dollar has historically been the world’s reserve currency. Dollar-denominated assets represent 59% of global foreign currency reserves10 while nearly two-thirds of all global debt also denominated in U.S. dollars.11 Because of this and the sheer size of the U.S. economy and financial markets, many investors have regarded the dollar as a “safe haven,” which tends to become evident during times of crisis, such as during the pandemic. This can make the dollar act in ways that are hard to predict on strictly economic terms.

This year, some investors have begun to question whether the dollar might lose that status, as global investors began selling Treasuries and moving out of the dollar in March and April despite concerns about a global slowdown and market volatility. It remains to be seen whether this sell-off was a short-term reaction to U.S. tariffs or part of a larger trend, but it’s something worth watching.

The Dollar’s Impact on Market Returns

Though predicting short-term fluctuations in the dollar can be just as difficult as forecasting day-to-day movements in the stock market, the direction of the dollar cannot be ignored by investors. For starters, strength or weakness in the dollar can directly impact the profit outlook for your portfolio. This is particularly true for holdings in the S&P 500 as well as foreign stocks, especially in the emerging markets. By one estimate, a 10% increase in the dollar’s value can reduce economic output in emerging market economies by 1.9% in a year’s time.12 At the same time, however, companies that rely on U.S. demand — for example, Japanese exporters like Toyota — would stand to benefit from a stronger dollar.

Dollar appreciation or depreciation also can significantly impact the returns American investors earn on their overseas holdings. Consider that the MSCI EMU Index, composed of large- and mid-sized companies in the European Economic and Monetary Union, generated returns of 11.4% in 2024 in local currencies. But for American investors who had to translate those gains back into the strengthening dollar, the same index resulted in gains for them of just 2.6% last year. Just as with U.S. corporations repatriating overseas profits, American investors stand to do better with their foreign holdings when the dollar is weakening.

Assessing the impact of the dollar can be as complicated as it is important. Having a trusted advisor can help you understand the potential risks that currency fluctuations pose — and how to diversify your strategy to address those risks. If you would like to discuss how Fiduciary Trust Company can help you achieve your financial and personal goals, please reach out to Sid Queler at queler@fiduciary-trust.com.