The Fiduciary Trust investment team actively engages with the managers of funds in which we invest. Beyond fund-level due diligence and continuous monitoring, we hold regular investment discussions, which expand our intellectual capital and inform our own investment decisions. We believe that engaging as an investment partner provides us with asset allocation insights.

The ongoing active vs. passive debate — whether it is worthwhile to use an active investment manager as opposed to a low-cost, passive index fund — typically looms over any given discussion of active management. Many active investors regularly underperform their benchmarks, particularly over long periods of time, raising the question: is there an inherent advantage to using active management? We have discussed in prior pieces how we select areas for using active management.

A less often discussed topic is how to maximize returns from active managers. One important factor is the timing of an investment (i.e., when investors add money to funds, and how much). According to a 2025 Morningstar study, active fund investors lose out on about 1.50% of annualized performance simply from their timing decisions — even more than the 1.30% “gap” that index (passive) investors lose out on.1 This is because investors tend to sell at lows and buy at highs.

For example, if you invested in a manager ten years ago and the manager reports an annualized return of 7% over the last ten years, your actual return could be substantially lower than 7% depending on investment timing throughout that period. A 1.5% gap would result in a 5.5% annualized return in this case, or a cumulative 26% reduction in returns over ten years. On the other hand, the reverse is also true: if one has forward insight into either asset allocation or manager performance, advantageous timing decisions would result in returns higher than what the manager reported.

We believe Fiduciary’s regular engagement with managers gives us an advantage in determining when to invest. We are constantly in dialogue with our managers throughout the year. We have these discussions not just in reaction to market events, but as part of a systemized process to pool all the intellectual capital available to us. We focus on asset allocation insights, as asset allocation generally drives the majority of portfolio returns.2

Discussion Generates Ideas; Portfolio Activity Provides a Signal

Gleaning asset allocation insights from managers is not as simple as surveying their opinions. For one, managers have a vested interest in drumming up excitement for their asset class. Also, most of them recognize that their job is to be security selectors and are cautious in making asset allocation recommendations. Informal discussions certainly provide value to an asset allocator like Fiduciary, but actual portfolio activity provides the core insight.

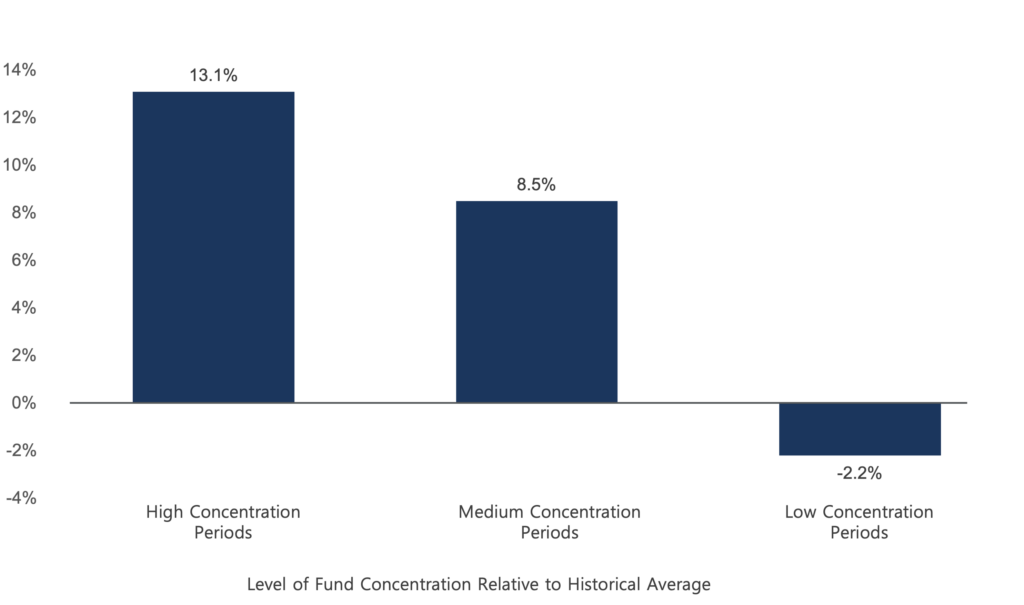

One interesting example involves examining the number of holdings that a fundamental, concentrated equity manager has in the portfolio. Intuition suggests that managers would concentrate their portfolio in a smaller number of positions when they have the highest conviction in their investment universe, and are reaching for outsized returns. In contrast, managers with gloomy prospects for the investment universe might dilute their best ideas over a larger number of holdings, seeking more benchmark-like returns.

We analyzed a 10-year period for 138 active international equity funds with fewer than 150 holdings. For each of the forty quarters, we reviewed their number of holdings and assigned a percentage-rank relative to the manager’s own 10-year history. We found that managers holding more stocks than their typical amount was associated with lower returns for the overall market (Exhibit A), significant at a 99% confidence level.

Exhibit A: International Developed Markets Index Total Returns in Different Periods of Fund Holdings Concentration

Source: Bloomberg, Fiduciary Trust Company. International Developed Market Total returns based on the MSCI EAFE index. Periods of fund concentration are categorized (High / Medium / Low) based on the top, middle and bottom third periods of concentration from 2015-2024 and includes international funds with under 150 holdings and evaluated quarterly.

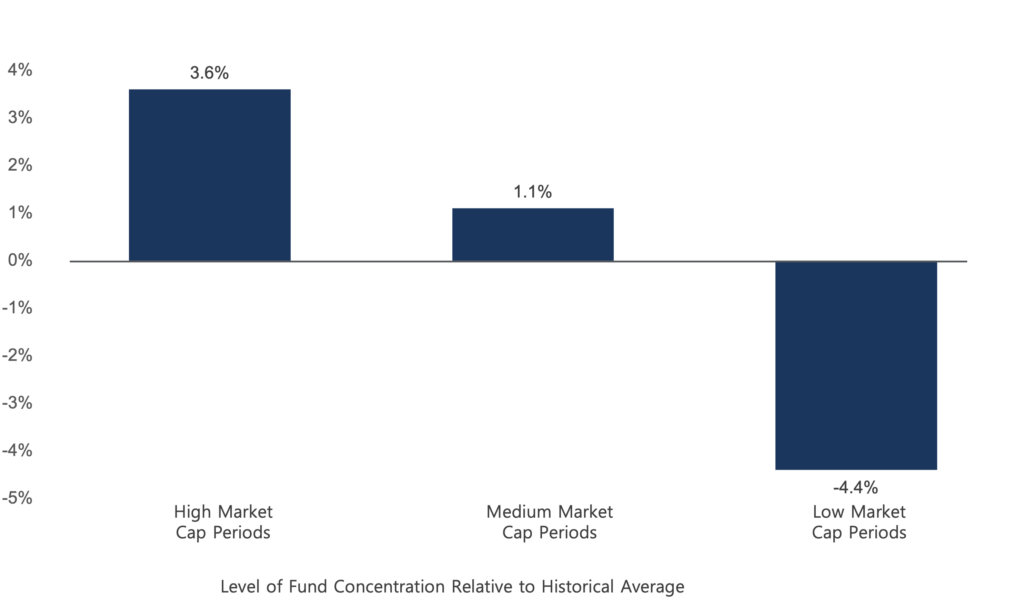

Another example of a manager “signal” would be the size of companies in which they are investing. We hypothesize that when managers invest in stocks with larger market capitalizations, they are finding more value in these bigger companies, suggesting these would have higher forward returns than smaller companies.

Using the same universe and percentile approach previously described, we found that the periods when managers were invested in higher market cap equities did, in fact, correlate with forward one-year outperformance of the international developed market index (MSCI EAFE) over the small cap version of the index (MSCI EAFE Small Cap), again at a 99% confidence level. Accordingly, during the top third periods of “size,” (when holdings were highest in market cap), MSCI EAFE tended to outperform its small cap counterpart by an average of 3.6%. Conversely, small caps outperformed by an average of 4.4% when managers were positioned in smaller market cap companies. Exhibit B below shows this relative performance.

Exhibit B: Outperformance of International Developed Large/Mid Cap Stocks Over Small Cap in Different Periods of Fund Market Cap Positioning

Source: Bloomberg, Fiduciary Trust Company. International Developed Large/Mid Cap based on the MSCI EAFE index. International Developed Small Cap based on the MSCI EAFE Small Cap Index. Periods of fund market cap are categorized (High / Medium / Low) based on the top, middle and bottom third periods of market cap (using the average market cap of each fund’s holdings) from 2015-2024 and includes international funds with under 150 holdings and evaluated quarterly.

Interpreting Signals is an Art

Of course, there are many other factors that go into manager decisions. Portfolio management is a multidimensional puzzle — not to mention the fact that active choices are sometimes wrong. We also examined geographic positioning of these same managers, for example, and found little predictive power of their active weights of different countries regarding prospective country-level returns.

Thus, manager signals cannot be taken in isolation. In order to be meaningful, interpreting signals requires familiarity with the manager, and sometimes qualitative commentary. For instance, at the time this article is being written, the median emerging markets manager is about 10% underweight China, according to Bloomberg. We suspect this is related to China’s perceived regulatory and governance risks. However, when speaking to a manager that is underweight China, it is a very different signal if they articulate a nuanced thesis for their positioning versus passively following consensus. Additionally, observed portfolio actions may lag behind actual inflections in manager sentiment.

Driving Portfolio Returns Beyond Manager Selection

We believe a manager’s value to an investor can extend beyond the fund’s reported return. Investing in quality managers can create a successful partnership beyond just the dollars invested in a fund. By gleaning valuable insights for asset allocation decisions, Fiduciary seeks to maximize the portfolio-level return of our investments.