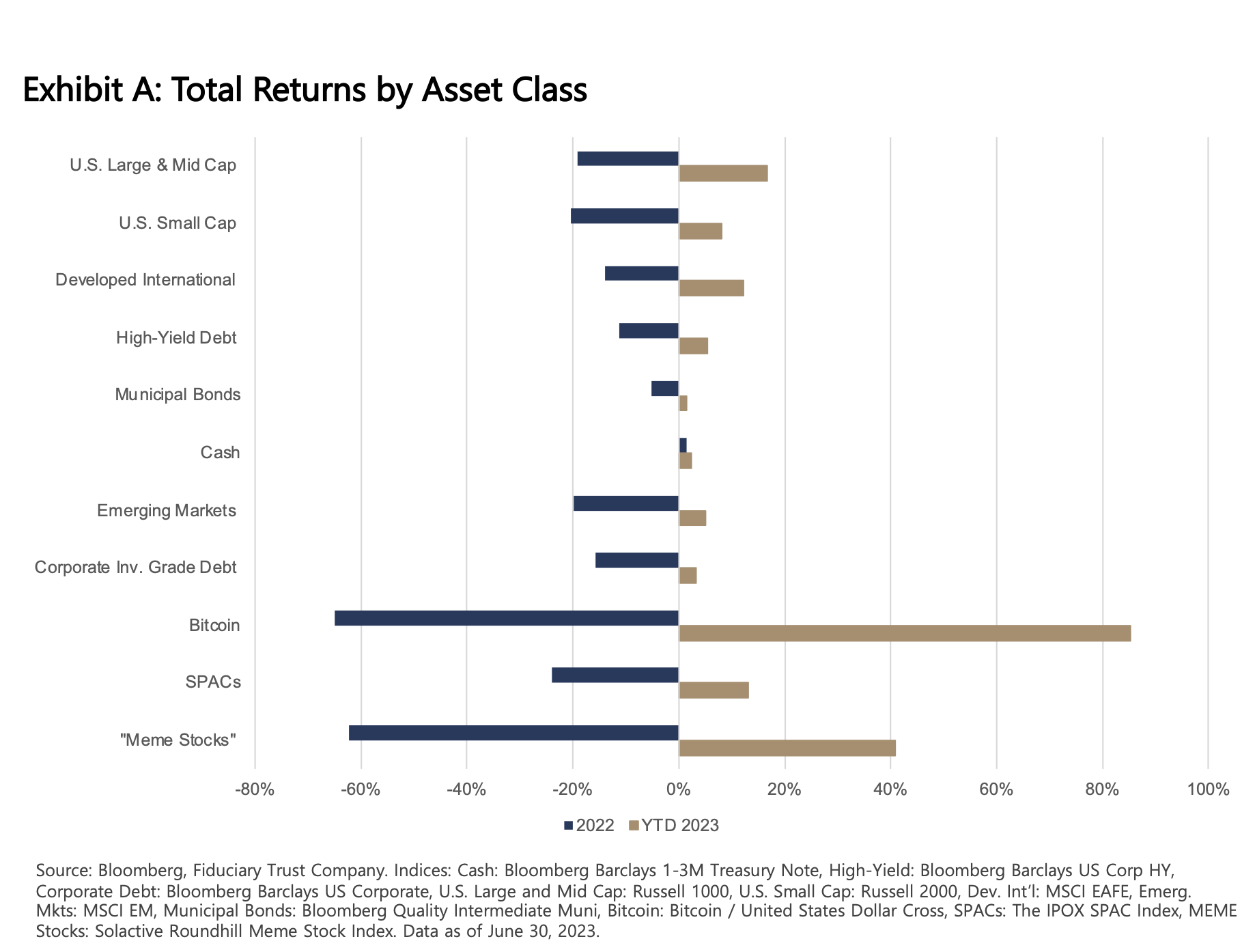

A solid run. Second quarter equity returns were impressive given the uncertainty that underpins the global economy and developed markets. Fixed income markets modestly participated in the run as questions about inflation and interest rates naturally dampened enthusiasm for the asset class. Remarkably, investors appear unperturbed by weakness in credit creation and political instability within Russia, the owner of the largest stockpile of nuclear weapons on the planet.1

We are facing the dichotomy of rising equity markets against the backdrop of high and rising interest rates with tightening credit and liquidity conditions, as the Federal Reserve attempts to bring inflation to heel. This has many amongst the financial smart set wondering whether the market is ignoring the traditional linkages between money and commerce or whether it has simply lost the plot. These questions are important as they are driven by a collection of trends that historically signaled recession and an accompanying fall in asset prices.

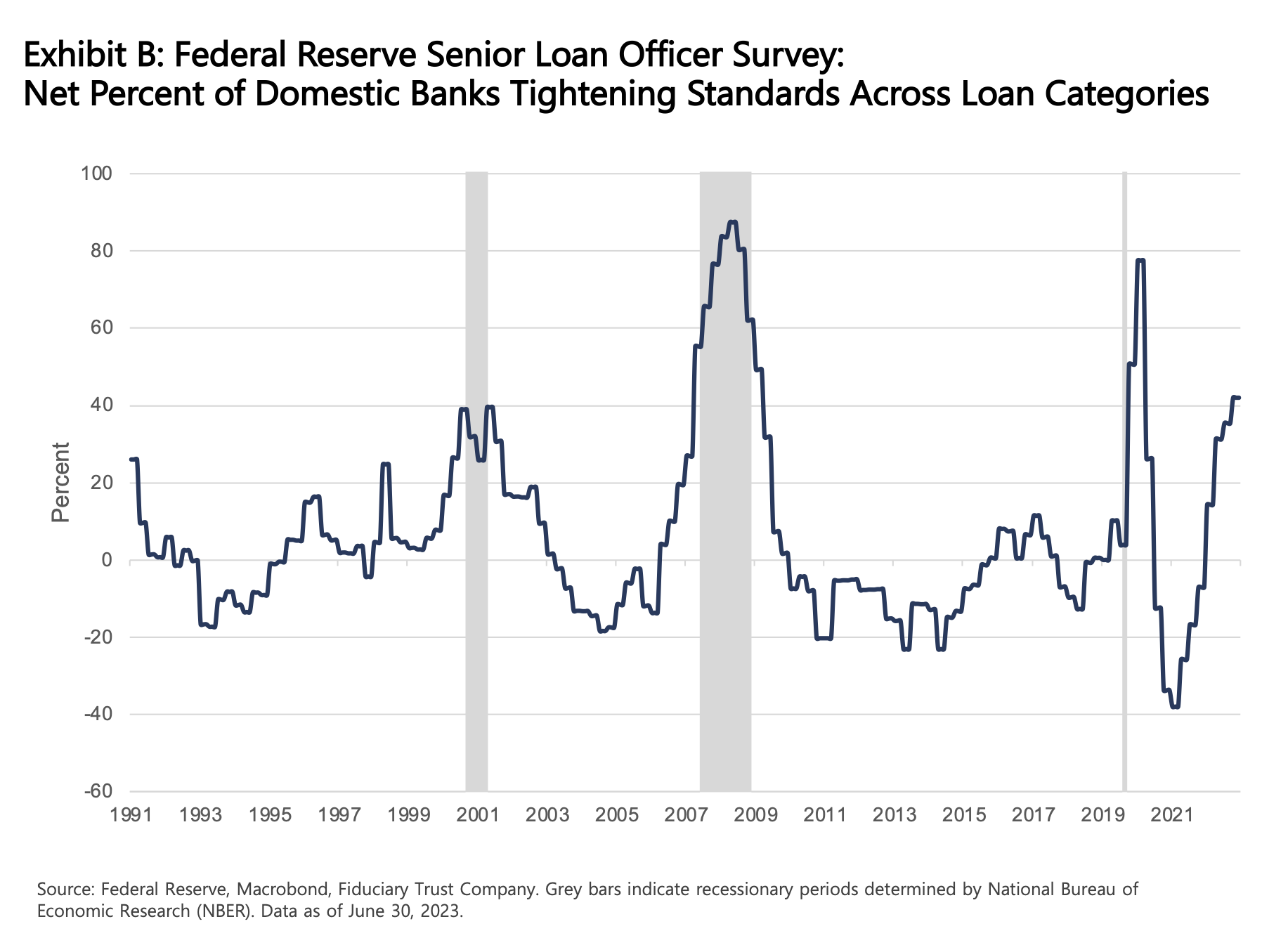

Credit is the wellspring of economic activity: everything flows from it. When making loans, banks create the money that businesses use to transact, turning the virtuous wheel of commerce forward. Similarly, when money creation slows it tends to cause a slowdown in economic activity. Slowing money creation is the goal of global central banks as they raise interest rates and tighten credit conditions to arrest inflation. In the United States, the policy rate has risen from essentially zero to more than 5%, changing credit conditions considerably.

These tightening conditions are causing a change of heart among commercial bankers. Surveys of senior loan officers by the Federal Reserve reveal a tightening of underwriting standards by banks across loan types and less willingness to make consumer loans. Particularly worrisome is the falling demand for commercial and industrial loans. Commercial real estate loan demand has collapsed, confirming the dreadful state of retail and office sectors. One bright spot remains as demand for household loans has turned sharply higher, no doubt supported by a strong labor market.

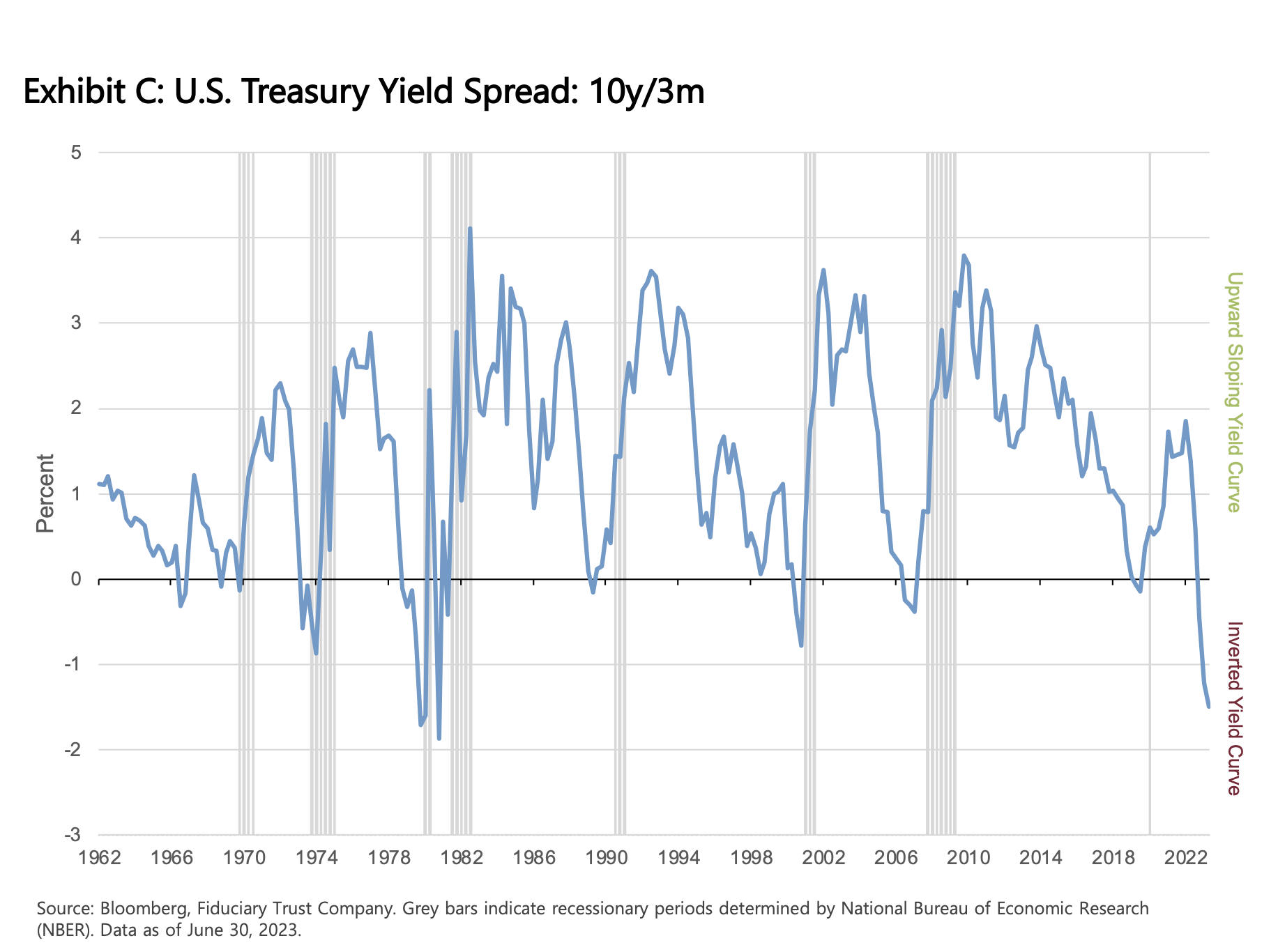

A deeply and durably inverted yield curve serves as a sort of menacing background music that warns of impending danger. Since 1969, the inversion of the 10-year/3-month section of the treasury yield curve has an unblemished track record of predicting recessions. This relationship between longer and shorter interest rates has now been negative for eight months and counting—a few months short of the 11 months of inversion that historically results in recession.2

Rounding out the bill of particulars against the economy is a set of purchasing manager surveys in the manufacturing and service sides of the economy. Readings below 50 suggest a contracting economy. By these measures, the manufacturing side of the economy is contracting and activity on the much larger service side appears close to sliding into contraction as well.

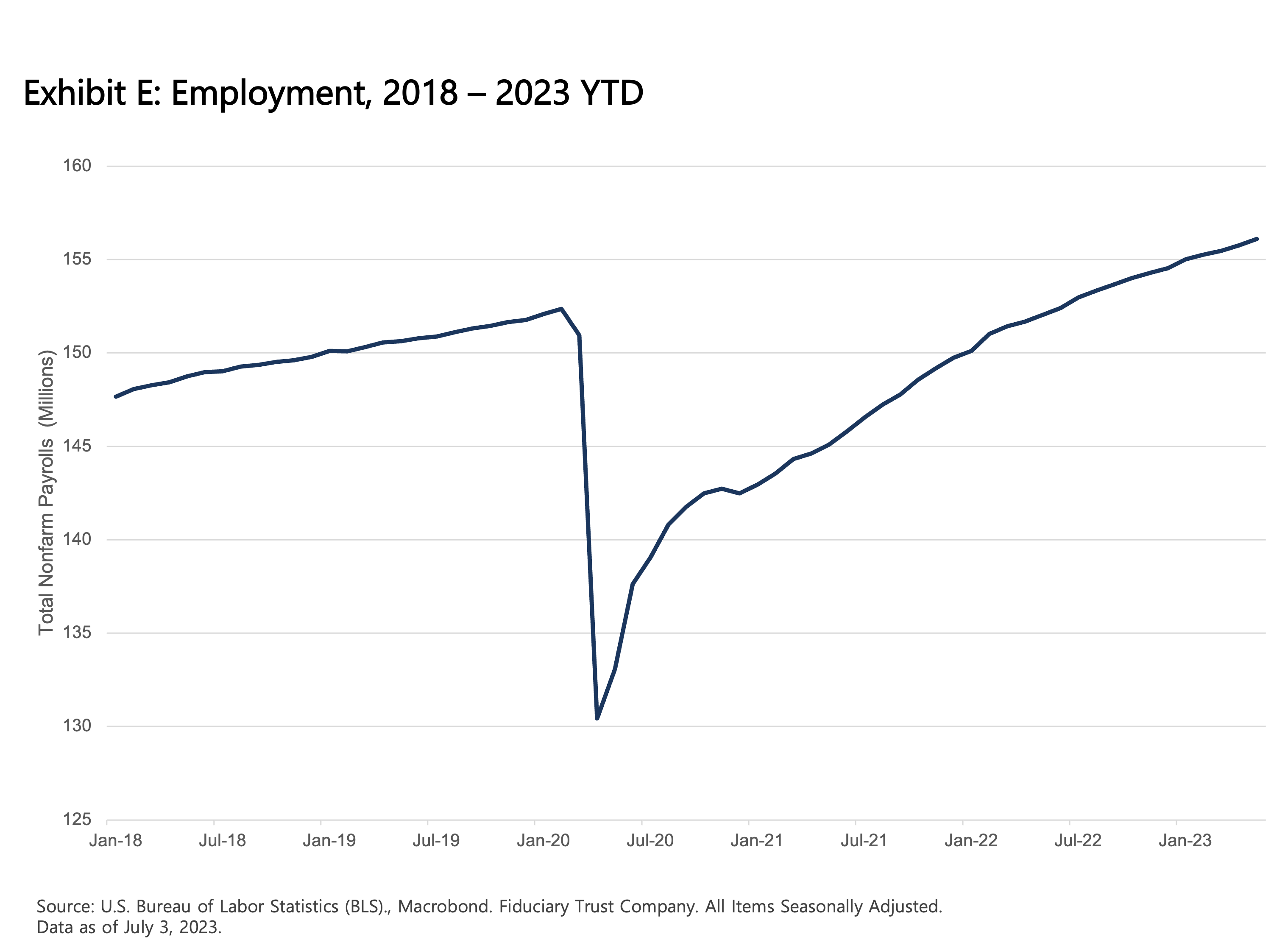

A durable silver lining remains with employment. The U.S. job market is in remarkably fine fettle. So far monthly employment gains this year are averaging 314,000.3 Indeed, the job losses caused by the pandemic have all been recovered and an additional 3.7 million jobs added to the economy. Yet, by some estimation, the economy is missing roughly 4 million workers now relative to the pre-pandemic trend. It is the labor shortage that muddies the forecasting waters as recessions do not occur without job losses. Unless and until there is a material increase in job losses, the feared and long-awaited recession will likely be postponed.

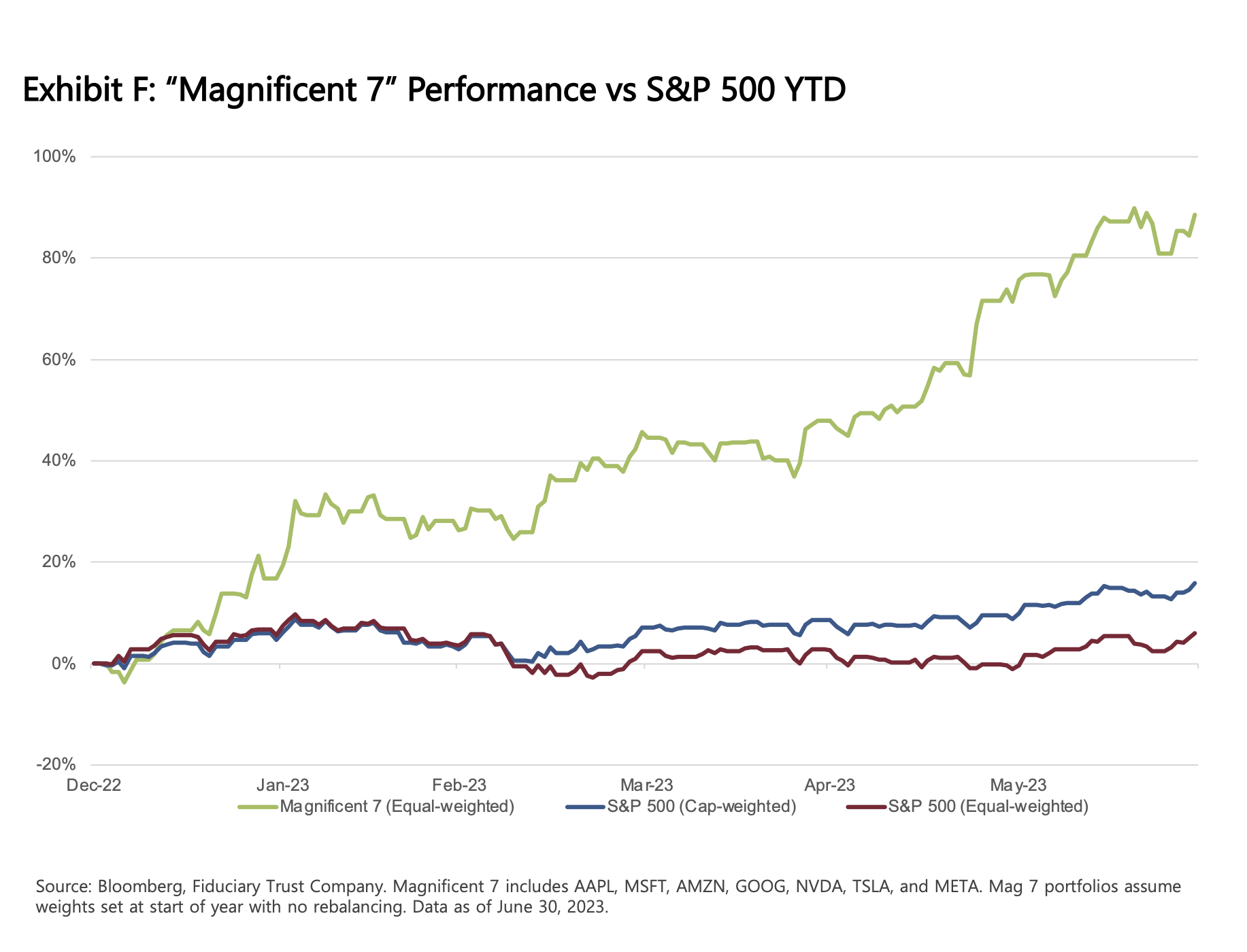

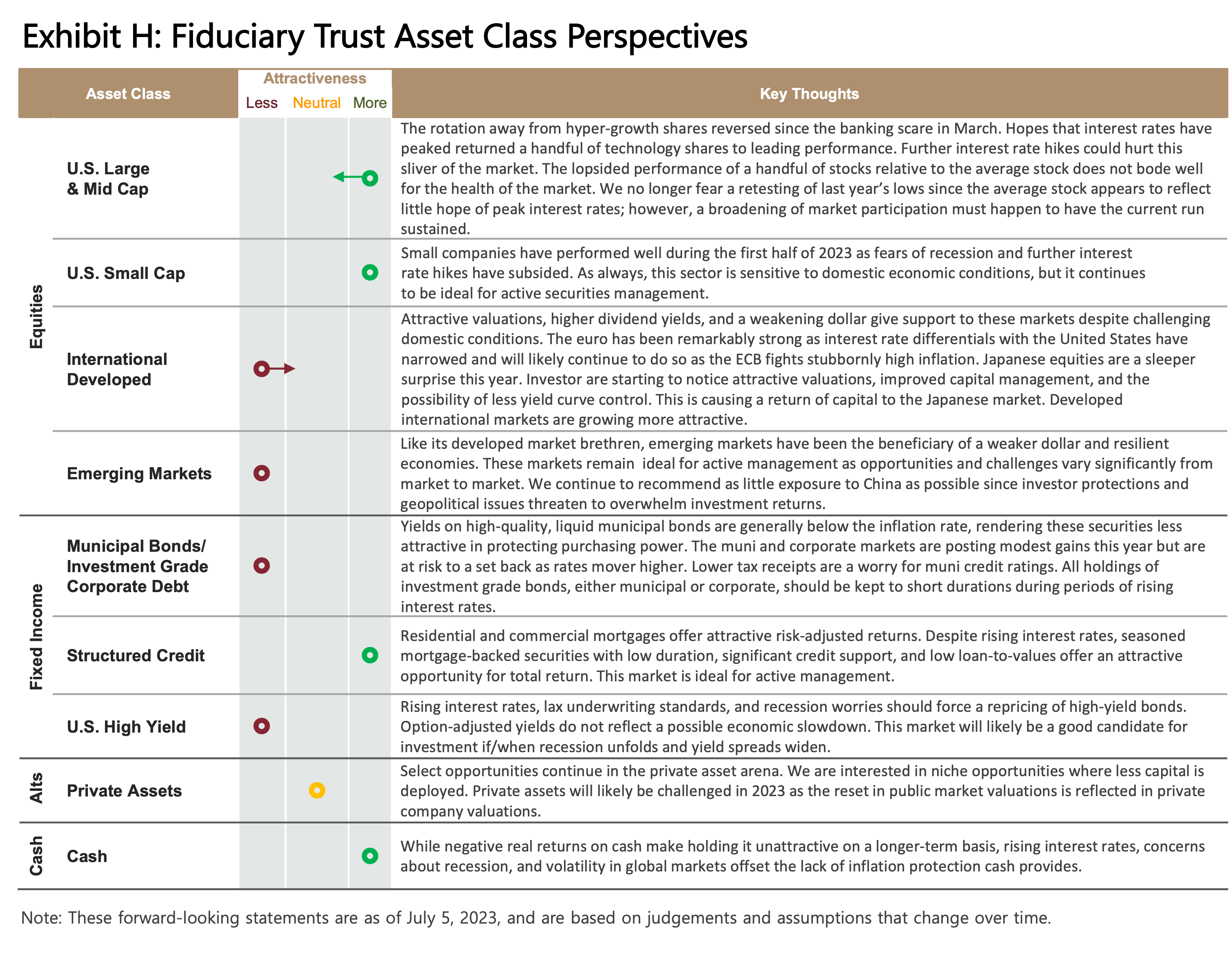

All does not appear as it is when looking at the performance of the U.S. equity market. The headline return for the ubiquitous S&P 500 Index blares good news: posting a second quarter gain of 8.3% and year-to-date rise of 15.9%. However, looking at the same index from an equal-weighted perspective to estimate the performance of the average stock reveals significantly less impressive gains of 3.5% for the quarter and 6.0% for the year.4

The difference between the performance of these two versions of the same collection of companies is the result of an impressively top-heavy market. The oft-quoted market capitalization version of the S&P 500 Index exhibits a bobble-head quality, stemming from the disproportionate weight a handful of stocks has on the index’s overall return. To wit, the weight of the top five companies (aka: the Fab Five) tally to 22%; and the weight of the top seven companies (the Magnificent Seven) account for 26% of the index.5 Building diversified portfolios benchmarked to concentrated indexes is a challenge in the best of times and fraught with risk all the time.

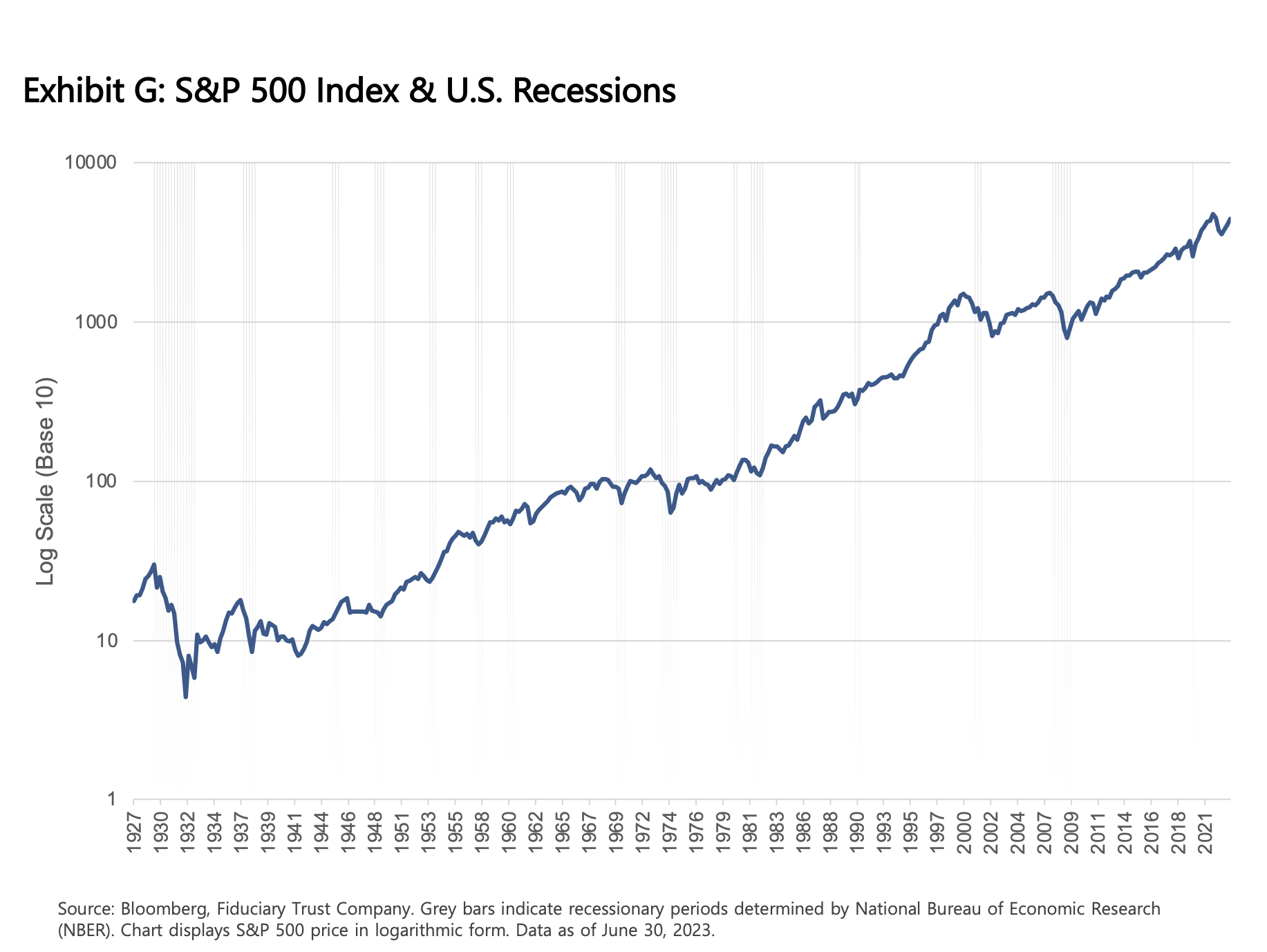

Over the last two decades, the S&P has never been more top heavy than it is today. The bank scare covered in our Q2 Market Outlook gave hope to a policy pivot from the Federal Reserve that fueled a strong rally in technology company shares. It appears that investors, looking through an economic slowdown, are pricing the recovery that typically follows. There is a flaw in this reasoning as our examination of nearly 100 years of stock market returns shows that markets almost never bottom before recession. The one instance where this pattern failed was during the immediate aftermath of the Second World War, a period fraught with global structural change.

Going Forward

Following the arc of history, it would be exceedingly rare for impairment of credit creation, an inverted yield curve, and wobbling business surveys to not result in a growth pause. Markets have historically reacted negatively to dark economic backdrops, often with substantial lags. Reports from one of our private credit managers, focused on companies in the lower middle market of the U.S., drive home the reality of how banks are acting on their rising reluctance to lend. During the eleventh hour of a recent debt underwriting, the bank involved with the transaction dropped out. The reason we were given centered on concerns about the economic environment. Yet, with adversity comes opportunity. The deal closed—thanks to the private debt fund taking on the bank’s share of the deal—but on terms that are quite favorable to the fund’s shareholders. Reports across the private equity landscape of slowing asset realizations through sales or public floatation are indicative of the caution and concerns evinced by the yield curve and banker surveys.

The inflation fight is an international effort. Recent rate hikes and commentary by the Bank of England and the European Central Bank suggest that more hikes are in the pipeline as inflation remains increasingly intractable in those economies. This will likely place greater pressure on the dollar as interest rate differentials between the United States and other economies narrow. A retesting of the dollar’s lows earlier this year is probable. Dollar weakness has helped to light a fire under international shares. Despite fears of recession and war on the European continent, European stocks, as represented by the Euro Stoxx 50 Index, are up 18.2% in dollar terms this year, handily beating the impressive and top-heavy gains of the S&P 500. Japan’s Nikkei Index has also enjoyed a return to favor, gaining 27.2% in local currency terms and 15.5% in dollar terms.6 Undoubtedly, the Japanese market is this year’s sleeper surprise, hitting levels not seen since February of 1990.7 We expect the tailwinds pushing developed international markets prices higher to persist, as undemanding valuations and a weaker dollar make these markets worthy of investment.

It is likely the dichotomous relationship between the economy and the market will be clarified during the second half of the year. The muted performance of the average stock is in concord with the economic state of play we observe. This leads us to worry less about a retesting of the lows reached in 2022. For the favored few in the Magnificent Seven, it is worth recalling what happened to the characters in that film. Most of them died. This part of the plot should not be lost.

1 International Campaign to Abolish Nuclear Weapons, www.icanw.org.

2 “Waiting for the Godot Recession,” John Authers, Bloomberg. June 28, 2023.

3 U.S. Employees on Nonfarm Payrolls Total Month-over-Month SA, January through May 2023, BLS via Bloomberg.

4 Returns are price only for the second quarter and year-to-date through June 30, 2023, via Bloomberg.

5 Data from S&P 500 Index ETFs via Bloomberg

6 Total return for the year through the end of June 2023 via Bloomberg

7 Nikkei 225 Index via Bloomberg

Disclosure related to Bloomberg indices: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.