January 3, 2023

Every age enjoys the optimism of a new set of rules, ideas, and ways of doing things. Historically, these periods are the result of a discovery or change in societal dynamics. In the late 1800s, scientific and technological advancement accelerated societal change and ushered in the Industrial Age. Indeed, scientific advancement has been the foundational catalyst for progress over the last 150 years. The Technological Age accelerated in the 1980s and met societal change with the end of the Cold War. This period brought a considerable peace dividend and the embrace of democratic forms of government. Furthermore, productivity boomed, markets ruled, and massive wealth creation unfolded across the globe.

The economic hyper-financialization that unfolded during this period created a new order where central bankers play a dominant role. Through the administration of interest rates and the printing press, these Lords of Money have become the guardians of prosperity, the guarantors of capital, and the mitigators of risk. This alacrity to print and price money, thereby smoothing business cycles and supporting asset values at scales never seen before, facilitates risk-taking and forms of “innovation” not seen in modern times. New narratives spun by visionaries unfettered by existing rules spur new businesses, markets, securities, and supporting philosophies, culminating in an “everything bubble.” Yet inevitably, old rules have the unfortunate habit of reasserting themselves like gravity, and the market/economic/societal cycle turns.

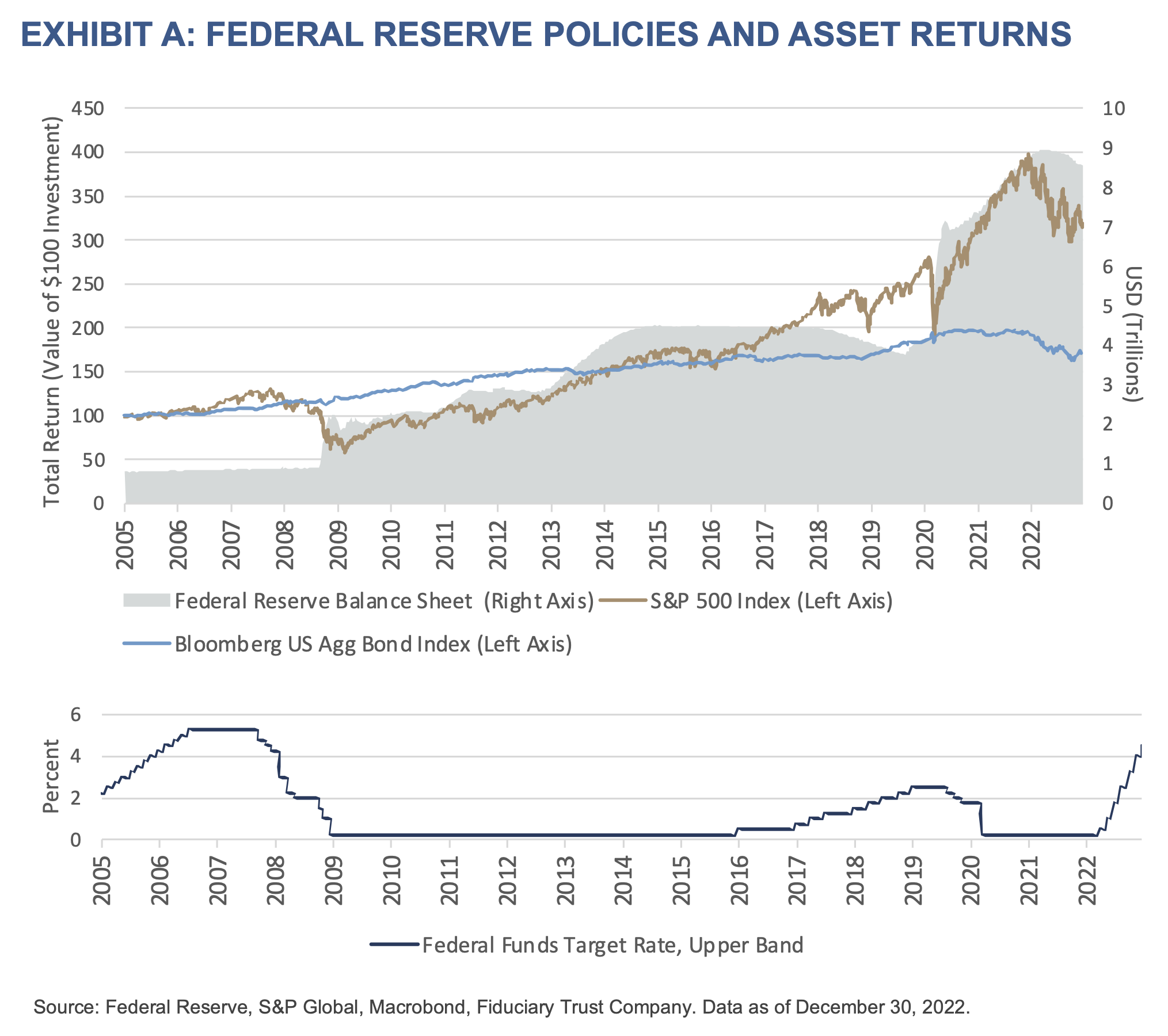

In surveying the financial and societal landscape of 2022, it is hard to overstate how the fashionable ideas of recent years have painfully collided with the reality of the old rules. Buoyed by a cost of capital so low that one needed a magnifying glass to detect it, new frontier ideas such as Modern Monetary Theory, meme stocks, Special Purpose Acquisition Companies (SPACs), China, crypto, central bank omnipotence, and high-expectation growth stocks bloomed. Easy money and easy returns fueled these confections. The synchronicity of money growth and asset inflation is hard to miss when comparing the Federal Reserve’s balance sheet and administered interest rates to stock prices. (Exhibit A)

The cycle of cheap money began unwinding in 2022. Short-term interest rates rose an eye-watering 18-fold over the course of the year.1 While the entire term structure of money rose, the quantity of money the Federal Reserve printed since the pandemic began to shrink. Monthly balance sheet runoff from the central bank increased to roughly $100 billion a month. This shrinkage in the Fed’s balance sheet will likely continue, as the oceans of liquidity injected into the economy during the pandemic were a source of the current inflation.

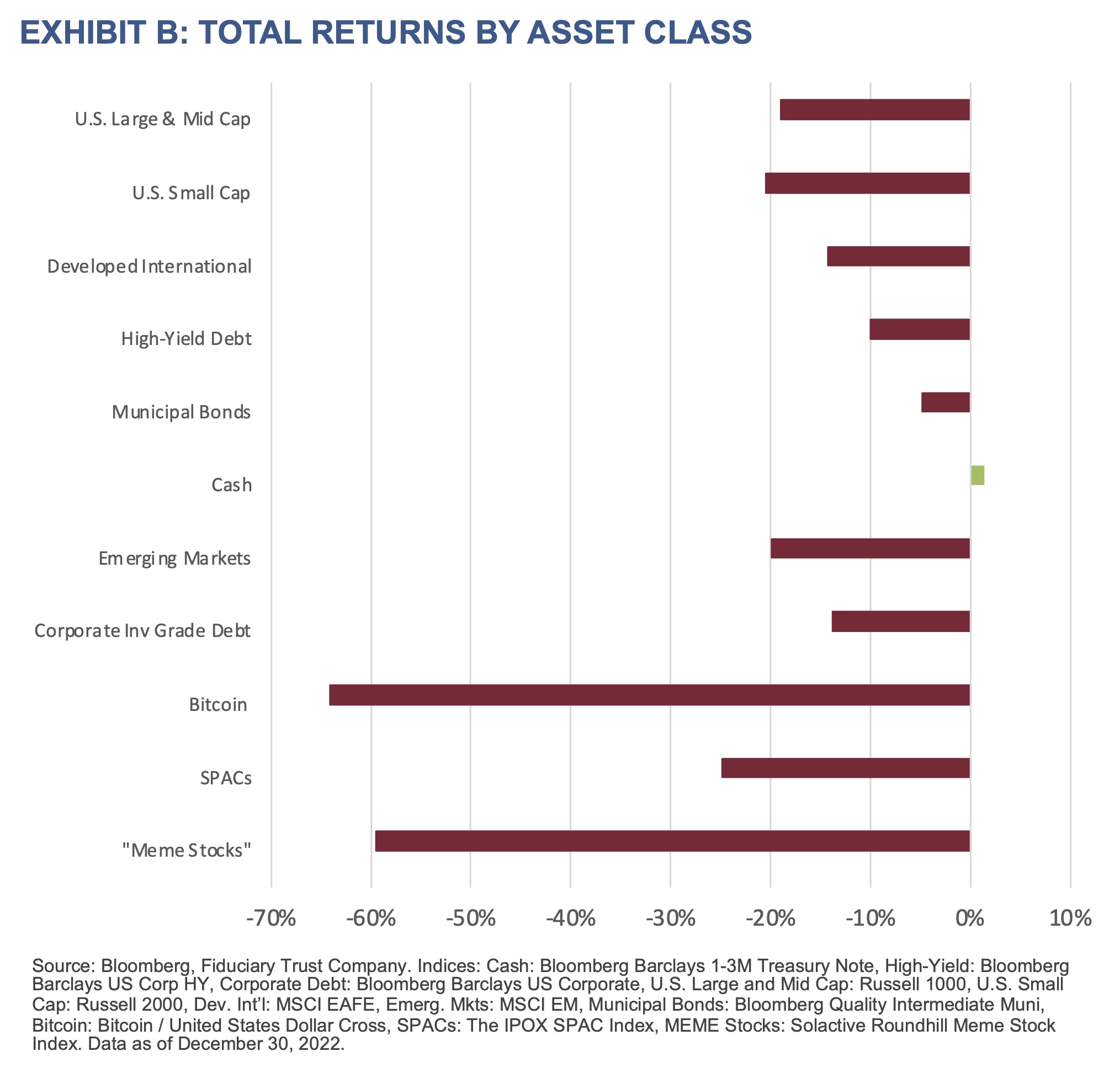

The resetting of asset prices in this new, unfolding money regime is a brutal affair. Surveying the landscape causes eyestrain as one attempts to find markets sporting gains for the year. (Exhibit B) Across markets, assets faltered, even those that conventional wisdom dictates should do well in adverse conditions. Consider the price of gold: accepted wisdom would have us believe that war and inflation are stressors that catapult gold prices higher. This “barbarous relic,” the thinking goes, is the bulwark against inflation and geopolitical uncertainty, both of which were abundant in 2022. Yet gold failed to follow the script, posting a 0.28% loss.2 Bitcoin, the “Johnny come lately” of financial assets and the digital equivalent to gold, turned in a dreadful performance. Not only did it plummet 64%, the entire “crypto-ecosystem” was called into question as exchanges, custodial structures, and financing mechanisms appear not fit for purpose.3 Investors have endured serial failures within the crypto architecture, some apparently fraud and theft.

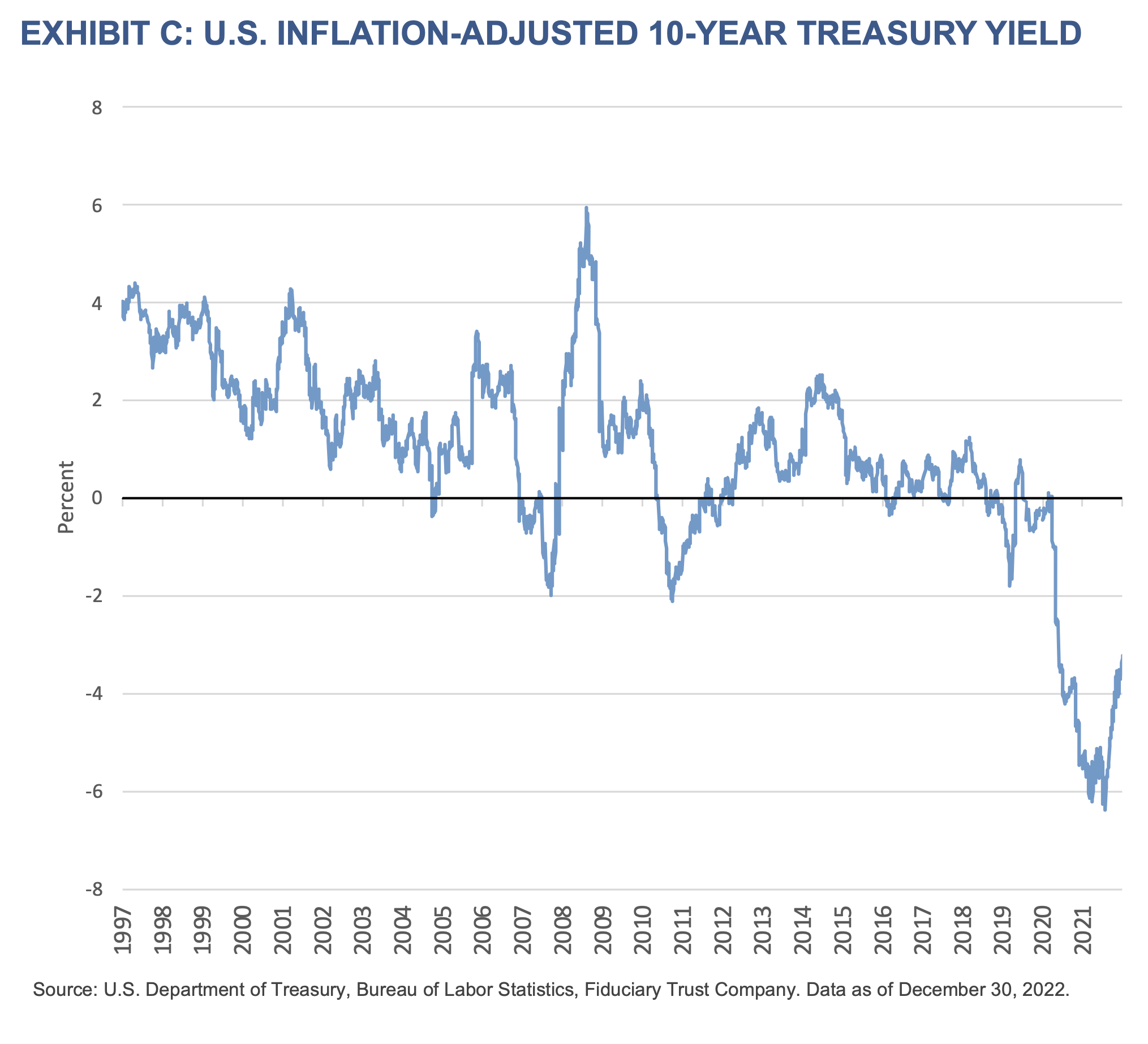

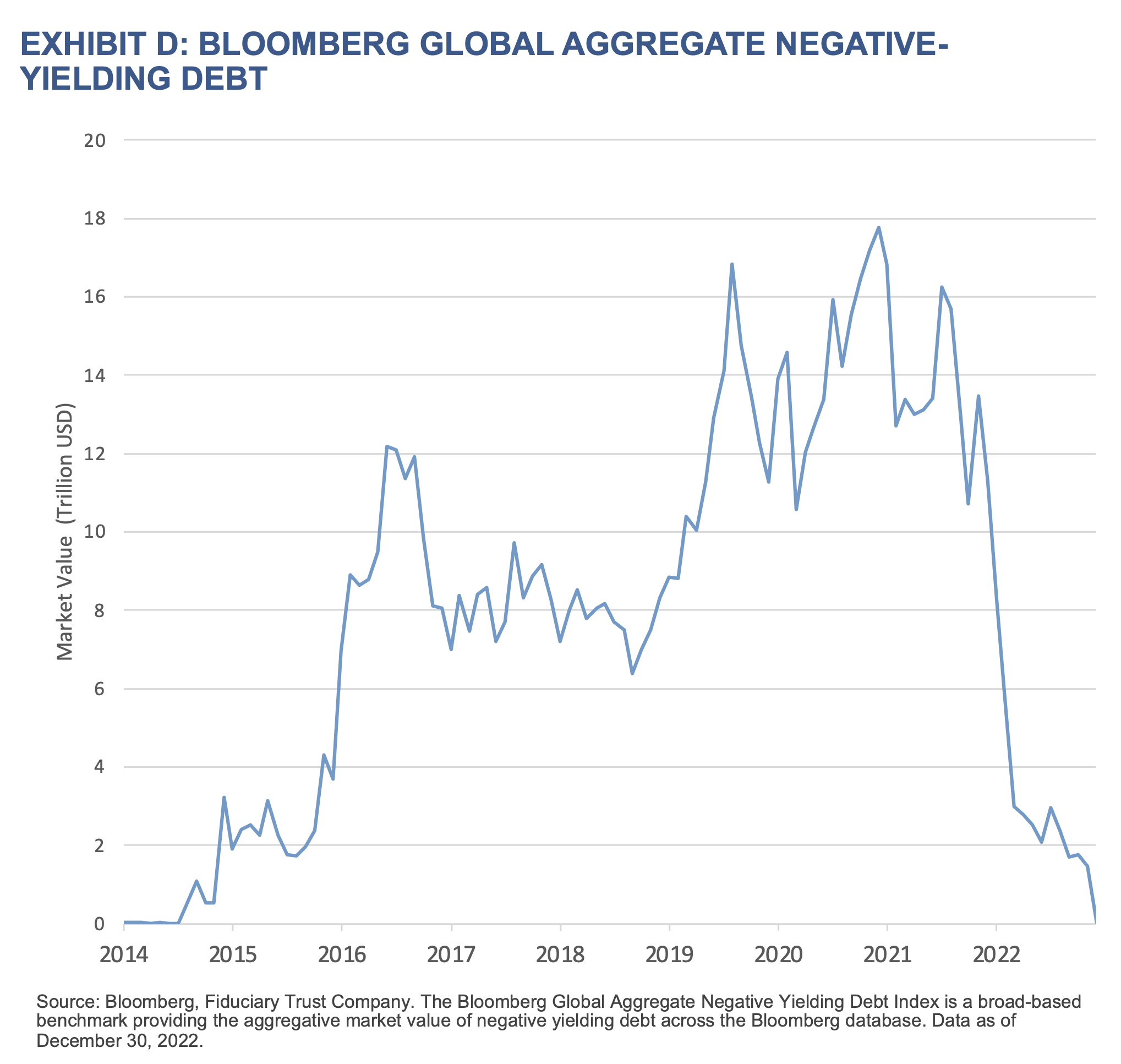

Portfolio diversification failed to offer much protection in 2022. The popular 60%/40% stock-bond portfolio posted a loss of 17%.4 In the United States, a fundamental repricing of financial assets is underway as the price and quantity of money normalizes, driven by inflation not seen in generations. Demonstrating this normalization is the rise in the inflation-adjusted yield on the benchmark 10-year Treasury bond. Negative for years, yields are rising. (Exhibit C) Investors who have been long accepting of negative interest rates are less so when inflation runs hot and central banks join the fight to arrest it. This pain process is not just a domestic phenomenon. The quantum of negatively yielding debt across the globe plummeted in 2022. (Exhibit D) Could the future new normal look like 2014?

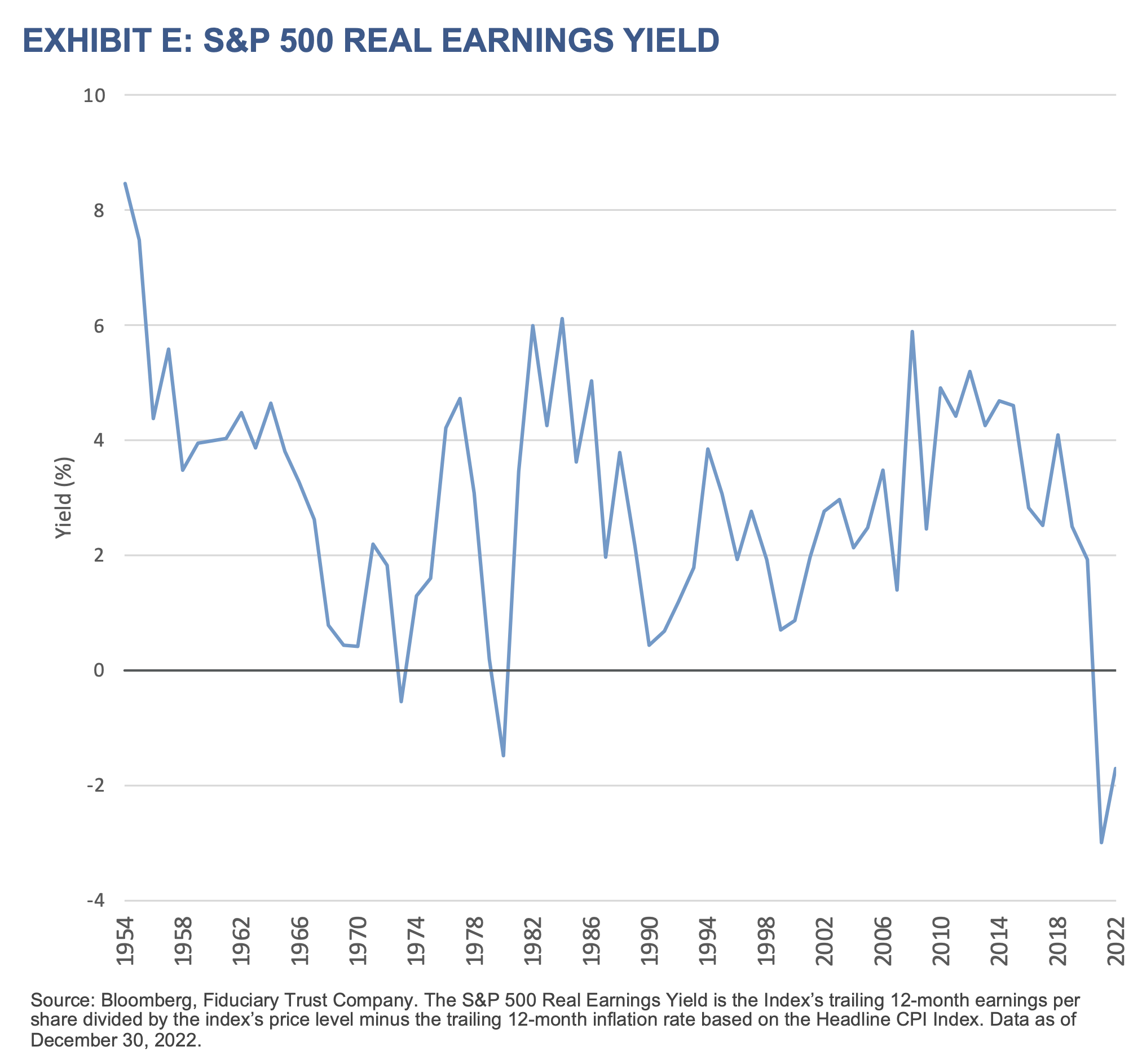

The reset unfolding in the American equity market is driven in large part by a decline in the multiple that investors are willing to pay for profits, rather than by a large drop in profits. Multiple contraction is a traveling companion with inflation and a closer look at the relationship between the two reveals a surprising and thoroughly unsustainable state of affairs. Calculating the real earnings yield on the S&P 500 Index, essentially the same measure as Exhibit C, shows the earnings yield to be significantly negative which is exceedingly rare. (Exhibit E) Data beginning in the 1950s shows only three episodes where it appeared, two briefly in the 1970s, and now. In statistical terms, this is a three standard deviation event.5 Considering the risks inherent in equity investing—the fact that equity investors have no senior claim on the earnings or assets of a company, they are residual players in the financial order—the inability to earn an inflation-adjusted profit fails to make the investing equation balance. In short, there is too much risk and not enough return. The only way for this imbalance to correct is for inflation and p/e multiples to contract.

Perhaps the most surprising development in 2022 was not the breathtaking rise in global interest rates, a 20th-century-style war in continental Europe, or a global bear market in financial assets but the return of the long-slumbering bond vigilantes. Their reappearance occurred not in the United States but in the United Kingdom. Their stirring was the result of a shambolic policy effort from the Kingdom’s shortest premiership in history. The country’s government bonds and currency collapsed with stomach-turning speed. An inchoate “mini-budget,” fueled by deficit spending, led to a collective “enough” from investors that quickly showed the door to the Prime Minister and her Chancellor of the Exchequer. The speed and severity of the market’s response serves as a cautionary tale for policymakers in the United States to tread carefully with spending when a country is battling inflation and the decline in living standards that it induces.

The Year Ahead

Forecasting is a tricky business and invariably misses the “big” events. Predictions of a WWII-style land war in Europe; cratering currencies in Japan, the UK, and Europe; and an 18-fold increase in the policy rate in the United States were most definitely not part of the prognostications at year-end 2021, yet here we are. More often than not it’s the things not mentioned in forecasts that are the most important and material. The unknown unknowns. Our crystal ball is as foggy as the next but we will try, nonetheless, to sketch out what to expect in 2023.

Inflation

Price data suggests inflation is slowing, but slowing to what remains unknown. If past is prologue, the process of working out the supply imbalances of goods and labor will take time. The labor part of the equation will be the tougher bit to resolve. As a population ages, older workers tend to be less engaged with the labor market than younger workers. An increasingly older Baby Boomer cohort is moving to a more tenuous relationship with work, therefore reducing an important source of labor. Labor-led service inflation is tougher to address than goods inflation. Since the U.S. economy is driven by services, the process of lowering inflation is likely to be messy and erratic. On the goods side, today’s reshoring, restocking, and rearming trends make inflation’s return to the pre-pandemic 2% level seem fanciful.

Is 4% the new 2%? Only time will tell.

Interest Rates

The eternal debate remains: “what will the Federal Reserve do?” In the short term, they will most likely raise interest rates because inflation remains too high. Market-based measures of the Federal Funds rate predict a top in the middle of 2023 of roughly 5% followed by a decline through the balance of the year.6 This decline assumes a recession will destroy demand and eliminate jobs, forcing inflation into a state of dormancy. From our perch, this is a tidy narrative, which is a bit too easy. What if a recession fails to materialize as expected? Does this failure mean more interest-rate hikes to slow the economy and achieve the desired result? Current data fails to follow the narrative, as the economy does not show signs of slipping into recession, though a deeply inverted yield curve suggests trouble ahead.

Bond Markets

Bond prices will likely follow expectations of inflation and policy. Globally, interest rates are rising and will continue to do so well into 2023. Consequently, bond markets will struggle but not likely to the same extent as they did in 2022. Investors will watch investment-grade, high-yield bonds, and syndicated loans in order to see if any stress develops in the ability to service and refinance outstanding debt. If credit events occur, it will likely be in 2023, the result of profit impairment that accompanies a recessing economy. Default rates, which are at a low 1.6%, will likely double in 2023. Some estimates suggest default climbing as high as 5% to 10% over the next couple of years.7

Equity Markets

Global equities have had a rough year. It is unusual for markets to post successive years of negative returns. Indeed, the surprise in the closing weeks of 2022 has been how well European markets have held up, despite the endless ructions in the trading bloc.

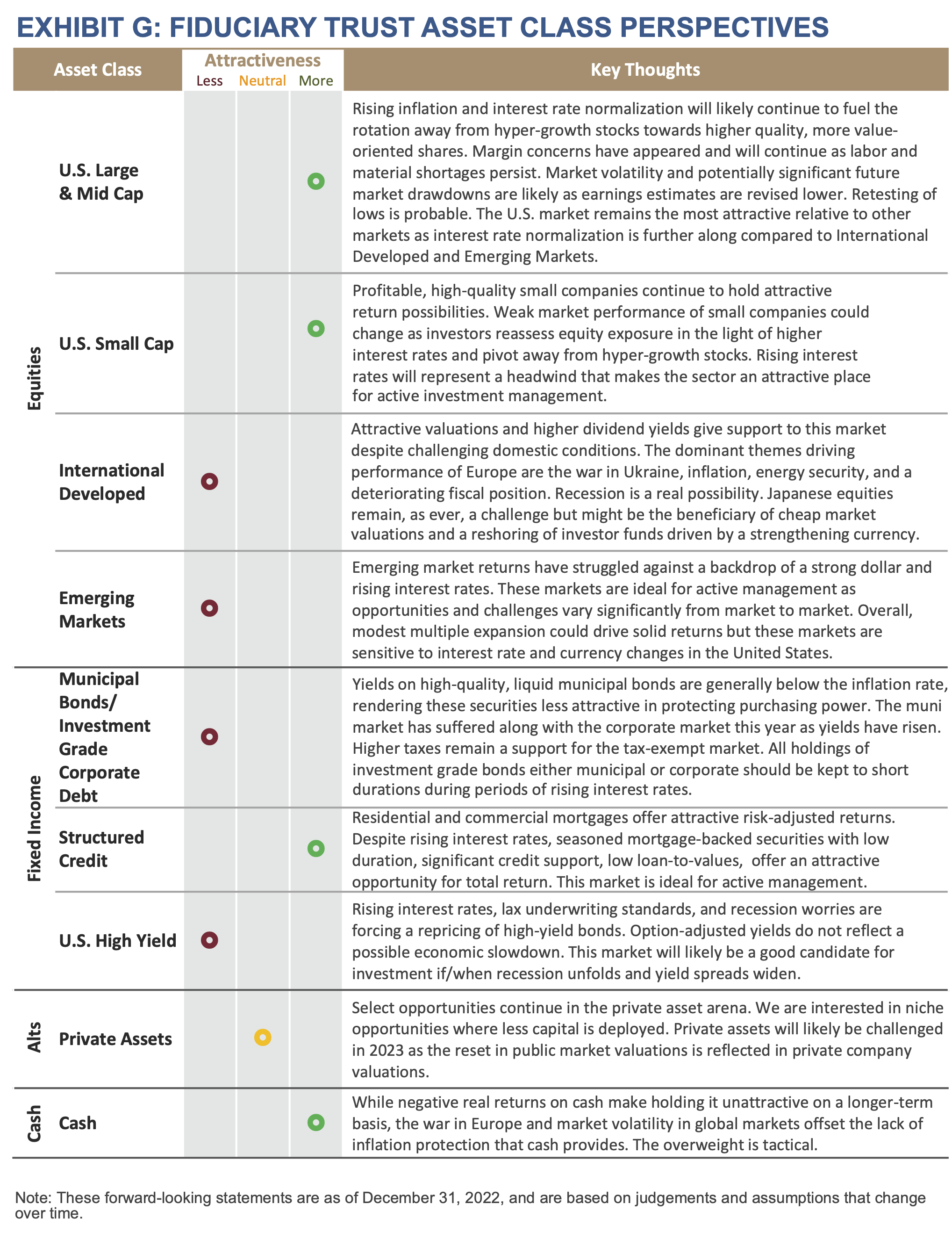

Low single-digit returns led by the United States are likely to be the result. How that unfolds remains an open question. The surprise in 2023 could very well be international developed markets, not because they have sorted their respective issues, but because the companies in those markets trade with the rest of the world.

In the United States, equities will likely remain in a metronomic swing driven by perceptions and expectations of the battle to control inflation. Earnings in the U.S. will likely be lower as inflation’s deleterious impact on profit margins manifests itself. If a recession does occur, we expect a peak-to-trough profit decline of roughly 20%-30%, which is consistent with a mild recession.

If the anticipated normalization of interest rates continues, the high multiple darlings of the pandemic will likely struggle while quality- and value-leaning sectors will continue to do well. Materials and energy should do well as the capital spending cycle and end demand works in their favor. High interest rates will likely bring with them a more discriminating attitude from investors, which will differentiate returns across sectors. This is welcome, as it gives more attention to the elements of good capital husbandry rather than to the siren call of story stocks that are long on narrative but short on business fundamentals.

Portfolio Implications

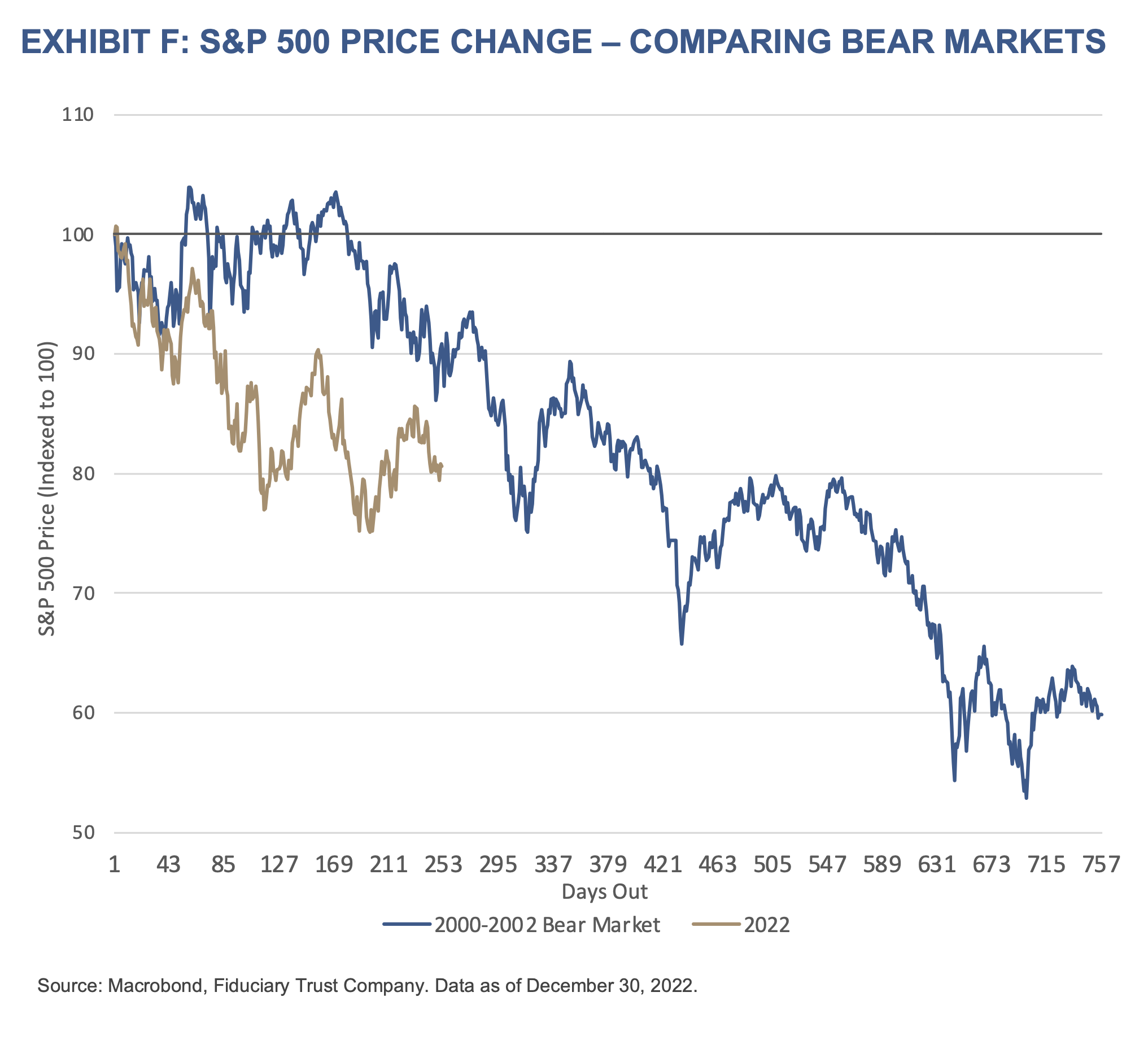

Our recommended portfolio posture ended 2022 with significantly more cash than we began the year. This additional cash came from significantly cutting our exposure to developed international and emerging market equities. We also slightly trimmed our structured credit exposure. These changes stem from our belief that the path to normalization will affect markets broadly and in waves. History demonstrates that bear markets have powerful rallies that are eventually overwhelmed by the larger downward trend. This phenomenon occurred in 2022 and we expect it to continue into 2023 as well. (Exhibit F)

Looking for Opportunities

Bear markets are great opportunities for investment, whether private or public market investing. When sellers need bidders, the bidders generally win. While the valuation reset will likely continue, we are looking at opportunities in both public and private markets. Real estate valuations are falling as capitalization rates rise.8 Similarly, if the expected rise in default rates in credit markets occurs, opportunities across the fixed income complex will materialize. Distressed credit might be a term that investors hear more of in 2023. Finally, we recently recommended adding to the natural resource space given the lack of capital invested in recent years, better capital management exhibited by the overall sector, and global structural imbalances. These are longer trends that will take time to pay off. Judging by the results of the natural resource sector in 2022, the trend is off to a profitable start.

Transitioning to What Is Next

If the epoch of the Great Moderation has ended, a new epoch has begun, one which brings with it fundamental structural changes and challenges that have been absent for 40 years. In this new epoch, a modicum of skepticism becomes an important component of investor compensation as the bar for profitable investing rises with the rise in interest rates.

Think about it as the cost of capital: the higher it goes, the higher the return on investment must be. The thematic silliness of the decade following the Great Financial Crisis seems to be drawing to a close. I hope we can say a goodbye to all that accompanied this time: billion-dollar valuation companies without revenue, crypto thingamabobs, Modern Monetary Theory, meme stocks, negative interest rates, and nosebleed stock and bond valuations. It will make for a more sustainable and profitable future.

May you and yours have a healthy, happy, and prosperous new year.

1 Federal Funds Target Rate Upper Bound from December 31, 2021, through December 31, 2022.

2 Data via Bloomberg.

3 Data via Bloomberg.

4 A generic portfolio that is constructed using 60% MSCI All Country World Index and 40% Bloomberg Barclays Aggregate Bond Index. Data via Bloomberg.

5 Bloomberg. Fiduciary Trust Company. S&P 500 Real Earnings Yield is the Index’s trailing 12-month earnings per share divided by the index’s price level minus the trailing 12-month inflation rate based on the Headline CPI Index. Statistics are based on daily data from January 1, 1954 through December 27, 2022.

6 Federal Funds via Bloomberg.

7 Defaults on U.S. Junk loans expected to climb as rate rises squeeze earnings, Financial Times, December 13, 2022.

8 Capitalization rate refers to the net income a property is expected to generate divided by the property value.