Have you considered selling the business you built? Robert did. He had built a successful, brand-name automotive business, and as his hair gradually turned white he decided to sell to a strategic buyer. Feeling like he had won the lottery and coming from a generation that saw age 65 as nearing the end of the road, Robert assumed he could spend whatever he wanted with his new liquidity. He bought an expensive home, hosted large galas and traveled extensively. He margined his investment portfolio to support this new lifestyle. When the market turned, Robert was forced to sell at depressed prices and ended up with less than he needed to enjoy his retirement. Within 18 months of his exit, he regretted selling and found himself in search of purpose. Unfortunately, his story is all too common and highlights the importance of planning properly for the sale of a business and life afterward.

Readiness

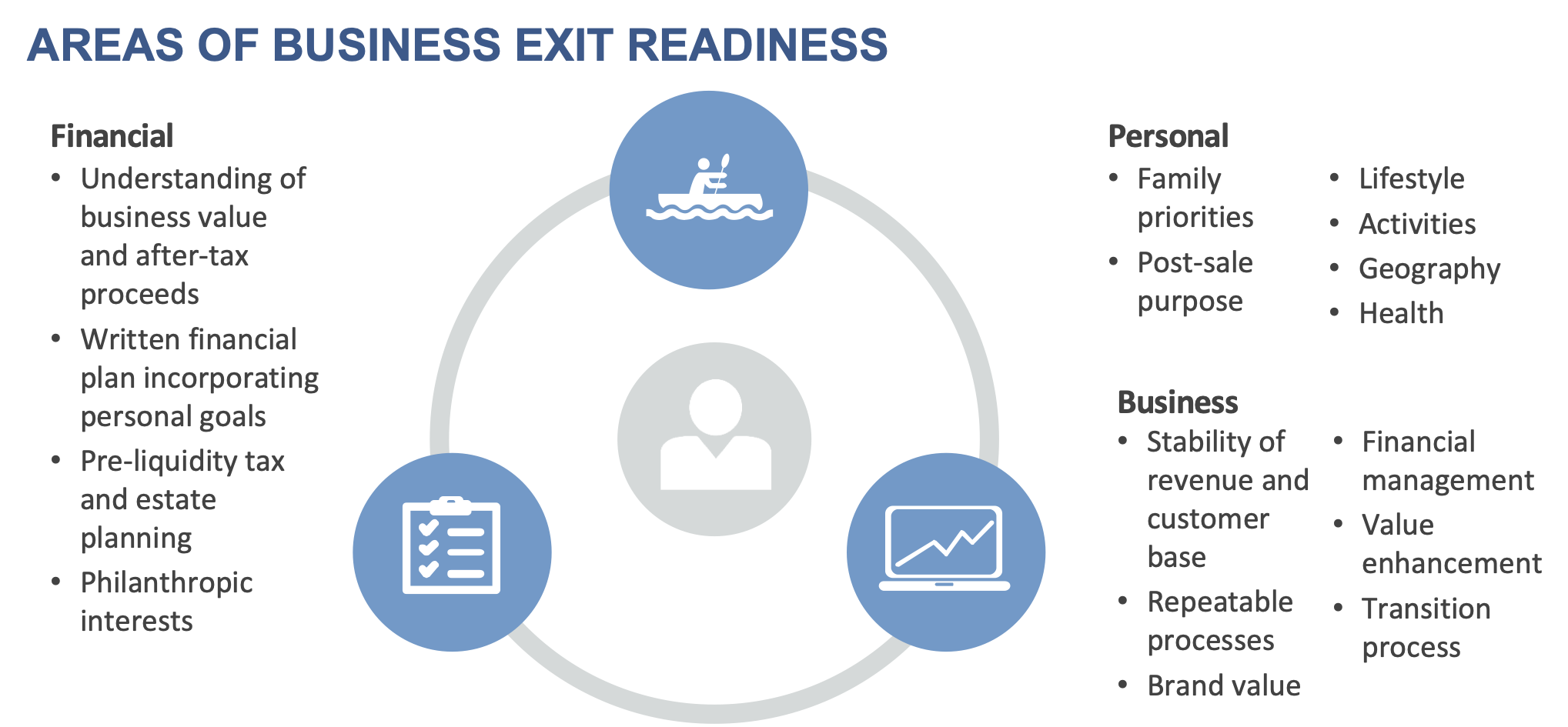

Many business owners reach a point where they say, “I am ready to sell,” when what they really mean is, “I don’t want to do this much longer.” Often they do not have a plan, and this can have unfortunate consequences. Approximately half of pending deals fall apart at the last minute, and nearly 75% of business owners regret selling within 12 months of the sale.1 To avoid this outcome, it helps to consider three equally important dimensions to readiness: personal, financial and business.

Personal Readiness

Too often, owners overlook the personal and psychological elements of selling their business. An entrepreneur who has spent decades building a business and investing emotional capital in its success needs to have a clearly defined plan for the next chapter in life. Leaving behind a 50- to 70-hour workweek creates a large void that must be filled with something – and 36 holes per day is usually not a fulfilling or sustainable answer.

In the example above, Robert lacked purpose after the sale. His entire adult life he had a reason to get up each morning, but after the exit he filled the hole with an unsustainable lifestyle. Rather than treating a sale as the end of an era, a business owner needs to be prepared for the next chapter in advance. For some, this can include civic and charitable endeavors, travel to bucket-list locations, mastery of a new skill, starting a new business, or becoming a significant figure in the lives of grandchildren. Discovering this new purpose in advance takes time and effort, and ultimately provides a positive motivation to complete the sale.

Creating a personal plan involves family, friends, associates and advisors. It helps to envision what life will look like post-sale and consider the role of the people, things, experiences and values that will be important in the next chapter of life. After a comprehensive and iterative process, the end result should be a written plan with enough specificity to give the business owner confidence that he or she is truly ready to complete the exit and move on with excitement. Think of it as a “business plan” for retirement.

Financial Readiness

Financial readiness means that the business owner has sufficient resources for the next chapter of life, has established the appropriate structures to maximize after-tax proceeds, and has considered future wealth transfer. Many businesses provide healthy cash flow for the owner, and the question is whether the net sale proceeds and other existing personal assets will be sufficient to provide for the desired standard of living. An experienced wealth planner can help identify goals and needs for post-sale life, such as normal living expenses, medical costs, a second home purchase, tuition payments for younger family members, travel plans, wealth transfer and much more. The wealth planner will then incorporate those goals into a comprehensive plan. This plan is then stress-tested against a range of possible outcomes for the investment portfolio available to support the goals, to arrive at a confidence range for the ability of the plan to succeed.

In our example above, Robert assumed the sale proceeds would be more than he ever needed and neglected to create a financial plan. What he did do well, however, was create an estate plan. A well-orchestrated estate plan can not only save substantial amounts in transfer taxes, it can give a wealth creator more control over what happens to assets after passing. A good estate planner can work with a wealth planner to identify structures that will help meet goals, such as ensuring surviving family members have income for life, creating a philanthropic legacy, protecting assets from creditors and minimizing taxes by acting in advance of a liquidity event. The key is to plan early, because wealth and estate planners have many more tools available before the value of the business is fully realized.

Business Readiness

Business readiness is not as straightforward as it sounds. Does the business owner have a reliable understanding of what the business is worth today versus what it could be worth after enacting some value enhancement strategies? Has there been an honest assessment of the strengths and weaknesses that will impact value, and is there a written action plan to address them? Is there a core team of advisors who can help the business owner through this process?

The value of a business is made up two key pieces: the financial results that the business generates and a multiplier that buyers are willing to pay for access to those results. Common equations include a multiple on sales or on earnings before interest, taxes, depreciation and amortization (EBITDA). The business owner has the most control over the results and can work to enhance them before selling. While the market typically determines the multiple range for each industry, there are a host of levers that business owners can pull to produce a multiple at the upper end. Spending time and energy on a few key metrics can unlock substantial value.

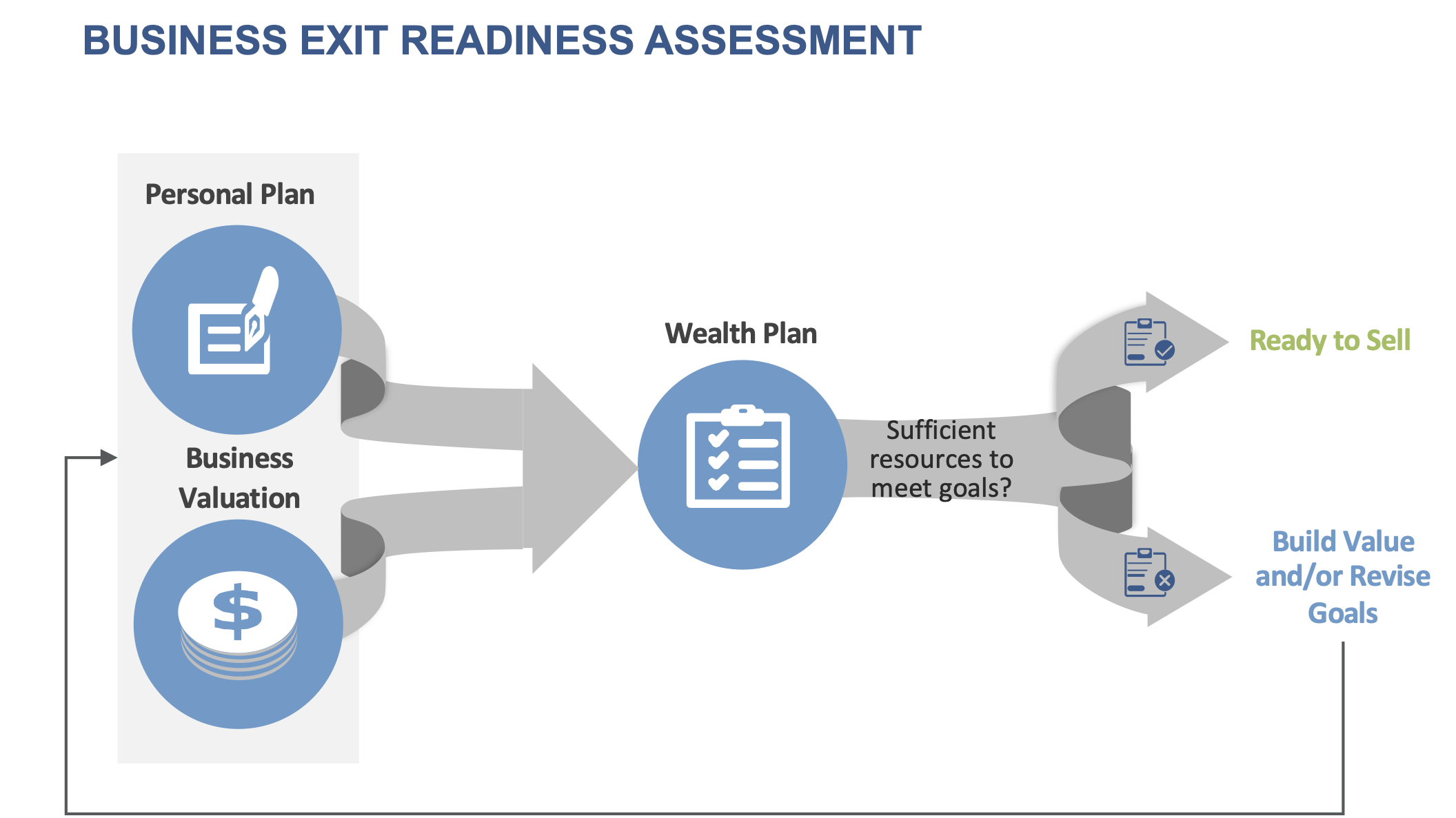

Taking the First Step

Sequencing and timing are critical to the sale process. An owner contemplating an exit first must have a personal plan and a bona fide valuation of the business before being able to complete a comprehensive wealth plan. Only then will the seller know whether the proceeds will be sufficient to fund retirement and other life and wealth transfer goals. If the proceeds are not projected to be sufficient, it may be worth stepping back to focus on enhancing the value of the business before selling. Either way, setting up the proper structures in consultation with a wealth and estate planning team before the liquidity event is essential to maximizing the after-tax proceeds of a sale and transfer of assets.

Conclusion

Robert’s story did not end 18 months after his business exit. With his remaining assets, he started a new business in a similar industry, relying upon his strength as an entrepreneur and his solid personal brand. Robert succeeded in building an operation that supported his needs, kept him happily employed, and was valuable enough to be sold at the right time. In the process, he learned the importance of having a “life after” plan, meeting with his wealth advisor well in advance of the liquidity event and having a team of experts to guide the process.

Exit planning is a high-stakes, emotional, and financially rewarding process. If you are considering the sale of a business within the next three years, contact Fiduciary Trust Company to speak with a Certified Exit Planning Advisor and our planning team about taking the right steps now, so you can move toward your exciting new future with confidence.