For many families, few financial decisions carry the weight — or the price tag — of funding a college education. Over the past 25 years, the “rising cost of higher education” has drawn growing attention in headlines, dinner-table conversations, politicians’ platforms, and family wealth planning.

However, this narrative does not match the reality of how higher ed sticker prices have changed over the past decade, or more importantly, the actual amount families pay, once scholarships, grants, and tax benefits are factored in.

Understanding these dynamics is essential for all families with members who aspire to attend a higher education institution. High-net-worth families often find themselves in a unique position: too affluent to qualify for need-based aid, but still navigating six-figure tuition bills, sometimes for multiple children.

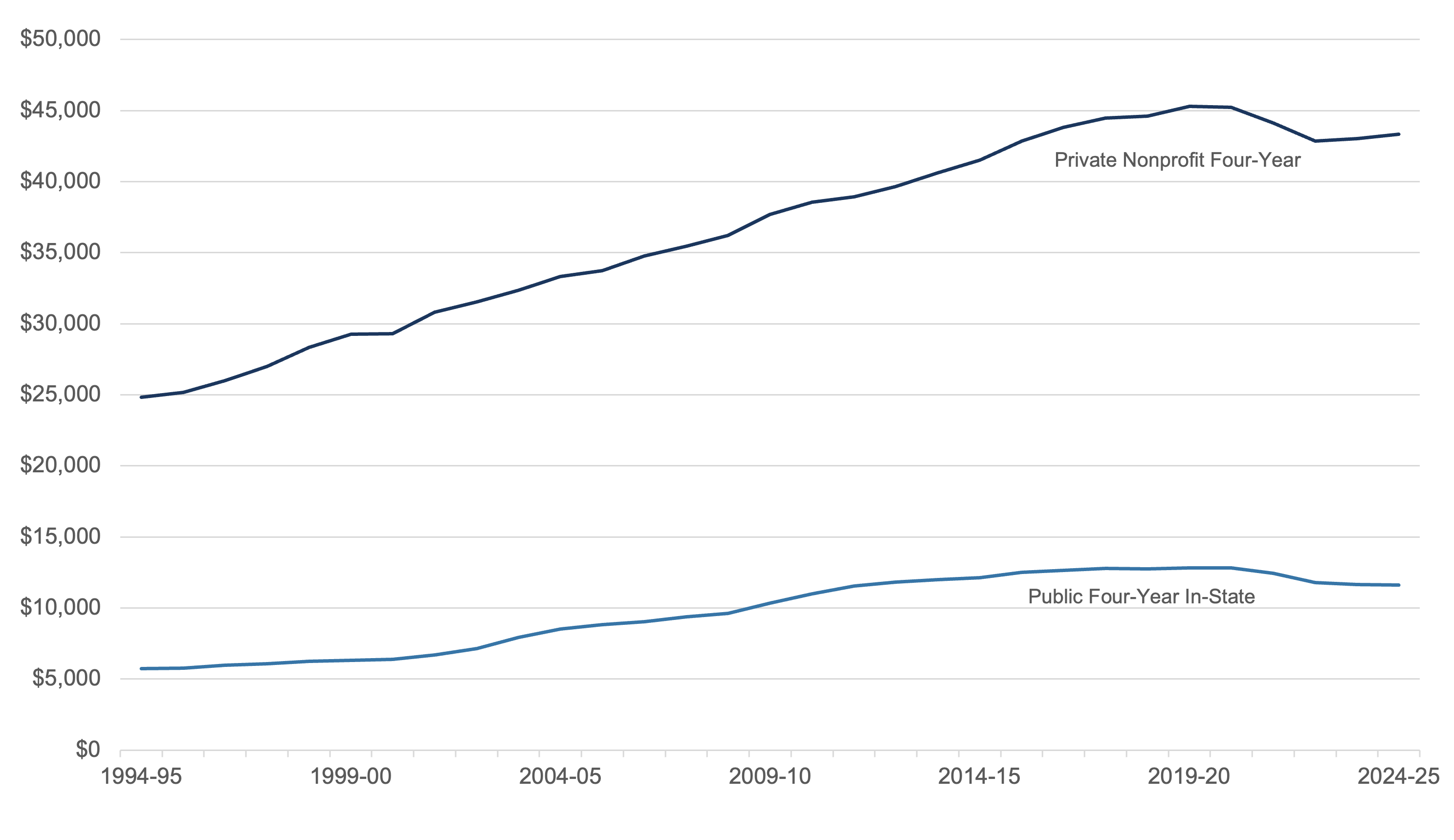

The Published Price

While the published price of higher ed is significant, over the past decade, in real (constant) dollars, Public Four-Year In-State tuition and fees have actually declined. Private Nonprofit Four-Year figures have exceeded inflation by only four percent cumulatively over the period. And, few families actually pay the stated price.

Exhibit A: Average Published Tuition and Fees in 2024 Dollars by Sector

Source: College Board, Fiduciary Trust Company. Figures are enrollment weighted.

Families are often most aware of these “sticker” numbers because they appear on admissions materials and in media reports. These headline figures can understandably create anxiety.

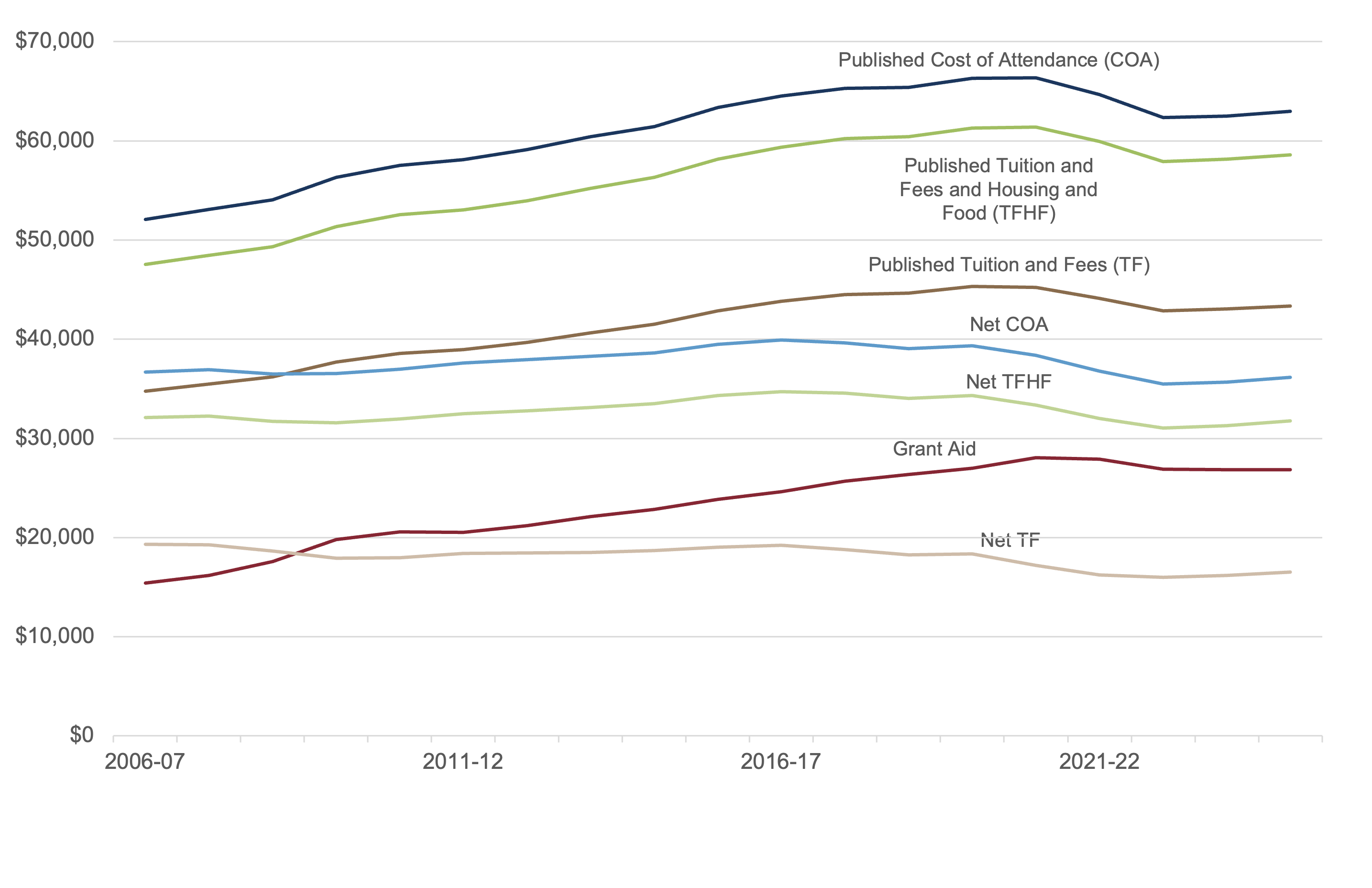

Net Price: What Families Actually Pay

The more relevant measure is the net price: tuition and fees after subtracting grants, scholarships, and education tax benefits. This figure sometimes paints a different picture.

Since 2000, colleges and universities have substantially expanded their use of “tuition discounting.” Today, the average private college student receives institutional grants that reduce published tuition by more than half.1 Public universities, while less generous on average, also distribute need-based and merit-based aid, particularly to attract high-achieving students from out of state.

As a result, the growth in net prices has been slower than the published prices suggest.

Exhibit B: Average Published and Net Prices in 2024 Dollars – Private, Nonprofit Four-Year Undergraduate Students

Source: The College Board, Fiduciary Trust Company. Grant aid and net prices for 2022-23 and after are projected.

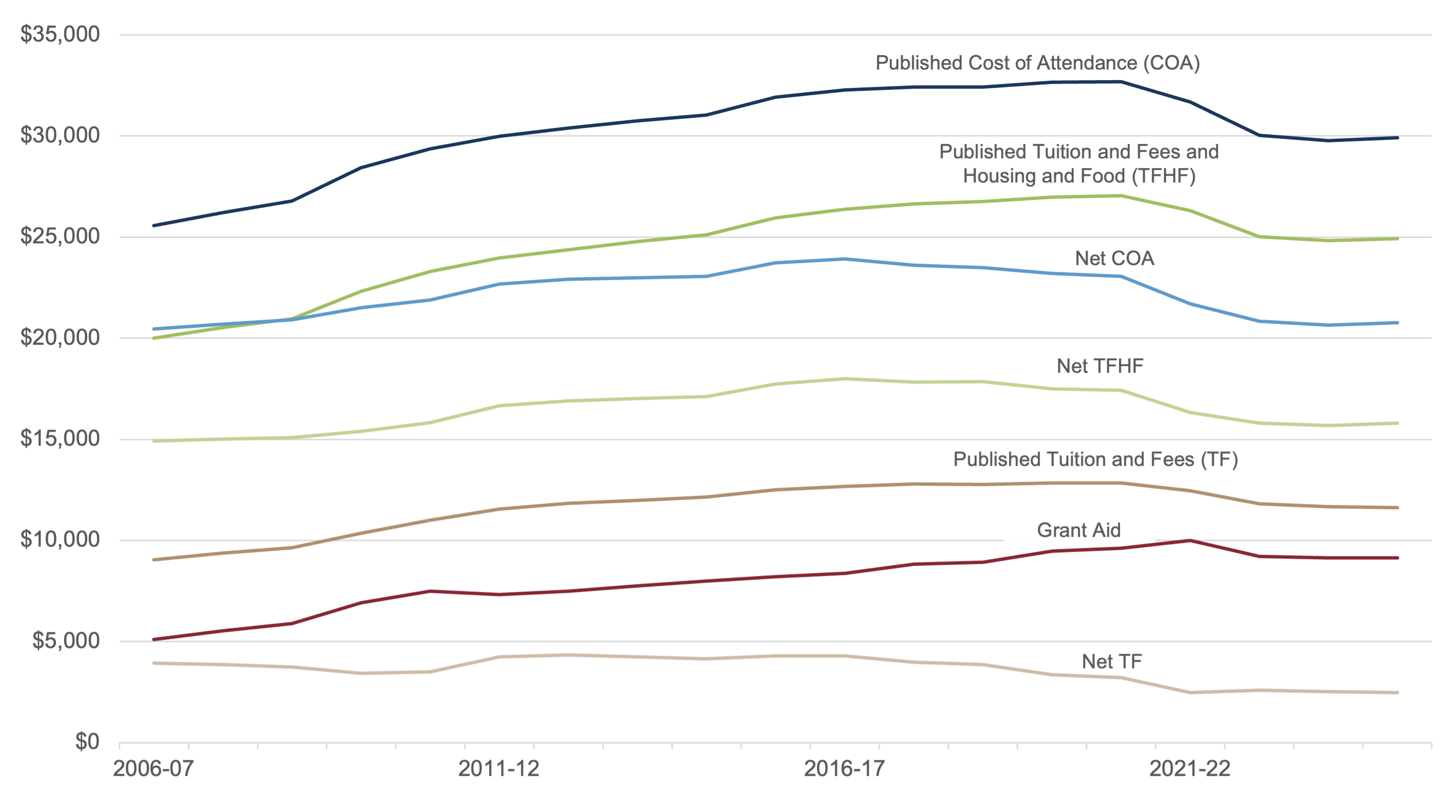

Exhibit C: Average Published and Net Prices in 2024 Dollars – Public, Four-Year Undergraduate Students

Source: The College Board, Fiduciary Trust Company. Grant aid and net prices for 2022-23 and after are projected.

How Income Shapes the Net Cost

The gap between the published price and net cost is most pronounced for lower- and middle-income families. Highly resourced institutions, especially the most selective private colleges, have committed to meeting the full financial need of admitted students. In practice, this means that a family earning $70,000 per year may contribute little or nothing toward tuition at an Ivy League school, while the same family could face steep bills at a less well-funded private or public university.2

By contrast, high-income families rarely qualify for need-based aid, though merit scholarships are sometimes available. For these families, the stated price and the net price converge, particularly at elite institutions where merit aid is limited or non-existent. This reality means that affluent households often shoulder close to the full published price. It is important to note that there is no set definition of “high income” for need-based aid purposes, as a variety of factors come into play, such as the size of the family, family assets, and the financial aid program at a particular school.

Impact of the One Big Beautiful Bill Act (OBBBA)

Borrowing is an important component of education financing for many families. The OBBBA of 2025 has reshaped several elements of the federal student loan programs. Some of the key changes include borrowing limits for students and parents and the elimination of graduate and professional plus student loan programs.3 For parents or students who anticipate borrowing to finance higher ed expenses, it is important to understand the details of the various programs and recent changes.

Learn More: “The One Big Beautiful Bill: Things You Should Know”

Looking Ahead

While the future trajectory of college costs is uncertain, several forces suggest continued pressure on published tuition: high labor costs in education, the demand for student services, and limited political appetite for large-scale subsidies at the state level. The practical reality is unlikely to change: financing higher education will remain a major expenditure requiring thoughtful, proactive planning.

At Fiduciary, we take the time to understand the educational aspirations you have for your children, and in many cases, grandchildren. Our comprehensive wealth planning process helps determine the most tax efficient and effective options for financing education for your family members, while maintaining considerations for other personal and financial goals.

To learn more about how we can help you achieve your goals, please contact Sid Queler at queler@fiduciary-trust.com.