2025 has been one of the more perplexing years in recent market history. On one hand, headlines have been dominated by concerns about tariffs, stagflation, rising fiscal deficits across developed markets, and political threats to central bank independence. On the other, every major asset class has delivered strong returns. Equity markets around the world are near record highs, and credit spreads remain among the tightest on record.

Amid this unusual market environment, investors may naturally ask what is driving these strong returns, and how long can the rally continue? To answer, we start with the Federal Reserve, whose actions and those surrounding it have been key drivers of markets.

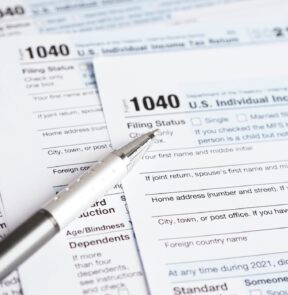

Exhibit A: Total Returns by Asset Class, 2025

Source: Bloomberg, Fiduciary Trust Company. Indices: Cash: Bloomberg Barclays 1-3M Treasury Note, High-Yield: Bloomberg Barclays US Corp HY, Corporate Debt: Bloomberg Barclays US Corporate, U.S. Large and Mid Cap: MSCI USA, U.S. Small Cap: MSCI USA Small Cap, Dev. Int’l: MSCI EAFE, Emerg. Mkts: MSCI EM, Municipal Bonds: Bloomberg Quality Intermediate Muni. Data as of September 30, 2025.

The Federal Reserve Under Pressure

While the Fed has long played an important role in financial markets due to its role in setting short-term interest rates, its influence has expanded significantly since the 2008 financial crisis. Policy tools like quantitative easing and emergency liquidity programs have directly impacted asset prices and fostered a belief in a “Fed put” (the idea that the Fed will always intervene in times of market stress) that has changed investor behavior and risk-taking.

One way to quantify the Fed’s importance to markets is by comparing the return of the S&P 500 over the last 20 years versus the return of the index excluding Fed meeting days (announcement dates and the prior day). Excluding Fed meeting dates, the index would be 44% lower today.1

There is a long history of U.S. presidents publicly or privately encouraging the Fed to lower interest rates. In April, President Trump escalated matters, calling for the Fed to lower rates and publicly questioning whether he should fire Federal Reserve Chairman Jerome Powell. By July, he intensified efforts to remove Powell, citing the $2.5B renovation of the Fed’s headquarters as excessive and grounds for firing. Despite this public pressure, Powell did not resign. Then, in the first week of August, Fed Governor Adriana Kugler unexpectedly resigned.

Three weeks later, President Trump announced his intention to fire Fed Governor Lisa Cook following mortgage fraud allegations, a case scheduled to be heard by the Supreme Court in December. The announcement fueled speculation that Governor Kugler may have been privately pressured to resign or face similar public accusations.

These actions have raised real concerns about the Fed’s independence. In our Q2 Outlook, we referenced a paper by Stephen Miran, then Head of the Council of Economic Advisers, on restructuring the global trading system.2 Miran’s paper primarily addressed tariff policy, and we noted that its analysis could provide insights into where tariff rates might ultimately settle.

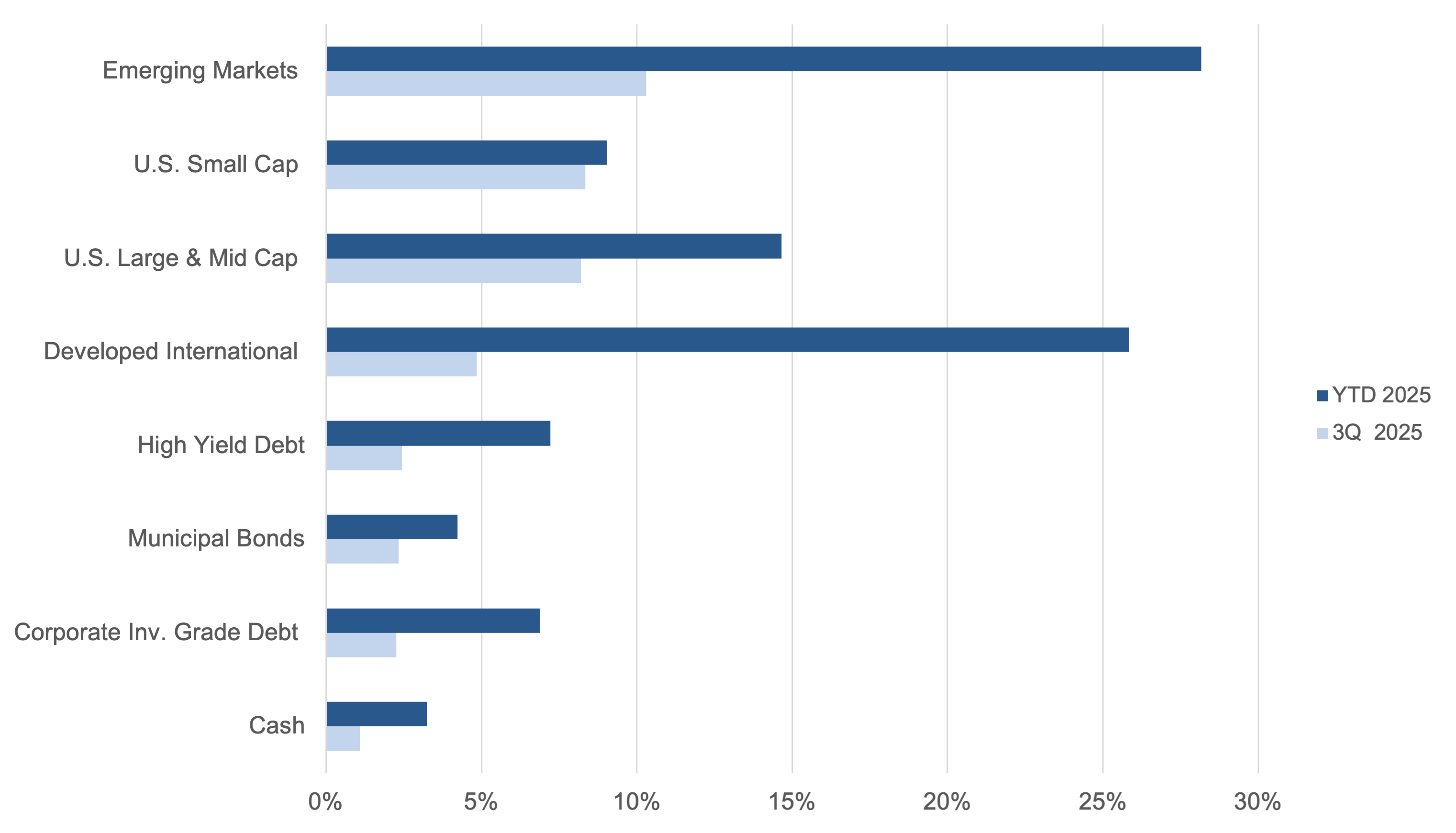

In recent weeks, Miran unexpectedly became central to the Fed narrative when he was appointed as a temporary Fed governor to fill the seat vacated by Governor Kugler. He was confirmed just in time to vote at the Fed’s September meeting, and his actions did little to ease worries over Fed independence. Miran was the lone dissent in the decision to cut rates by 25 basis points, calling instead for a 50-basis point reduction. He also projected five more cuts by year-end in the Fed’s “dot plot” forecasts, compared with a maximum of two from other members.

Exhibit B: Federal Funds Rate Dot Plot vs. Market Expectations

Source: Federal Reserve, Bloomberg, Fiduciary Trust Company. The Federal Reserve Dot Plot represents the Federal Funds Rate forecast from each member of the Federal Reserve’s policymaking committee. Chart represents year-end forecast rates. Data as of September 29, 2025.

The President’s objectives related to the Fed may go beyond just a desire to lower short-term rates. Returning to Miran’s paper in light of his new position, there are several sections relating to the Fed’s role in achieving certain policy objectives, such as capping interest rates. Most investors are familiar with the Fed’s “dual mandate” of maximum employment and price stability; Miran highlights a third mandate of “moderate long-term interest rates.” In practice, this could mean using policy tools to cap yields even if inflationary pressures rise.

The President’s actions seem to indicate that he is trying to ensure there is enough support on the Federal Open Market Committee to approve Vice Chair Bowman’s deregulatory agenda, which aims to unlock excess bank capital for lending. It seems increasingly likely that we are entering a new era of explicit coordination between the Fed and Treasury.

Investment Implications of Fed Policy — and Inflation

The market is pricing a short-term Federal Funds rate near 3% by the end of 2026. Given the political dynamics, rates may fall more quickly than expected. While President Trump was unsuccessful in his efforts to oust Powell this year, Powell’s term ends in May of 2026, and the President will be able to appoint a new Fed Chair. It is possible that he will name Powell’s successor later this year, and that person could exert some influence on market pricing of short-term rates before their official confirmation.

Lower long-term rates may be achieved through a combination of the Treasury issuing shorter-term bills and the Fed buying longer-dated bonds. The recently enacted GENIUS Act, which regulates stablecoins, may also serve to channel new demand into Treasury bills, freeing the Fed to focus purchases further out the yield curve.

The Trump tariffs are expected to place some upward pressure on import prices, adding to near-term inflation risks. While the broader economic impact may take time to unfold, the Federal Reserve is likely to keep a close watch on whether these trade measures complicate its path toward price stability.

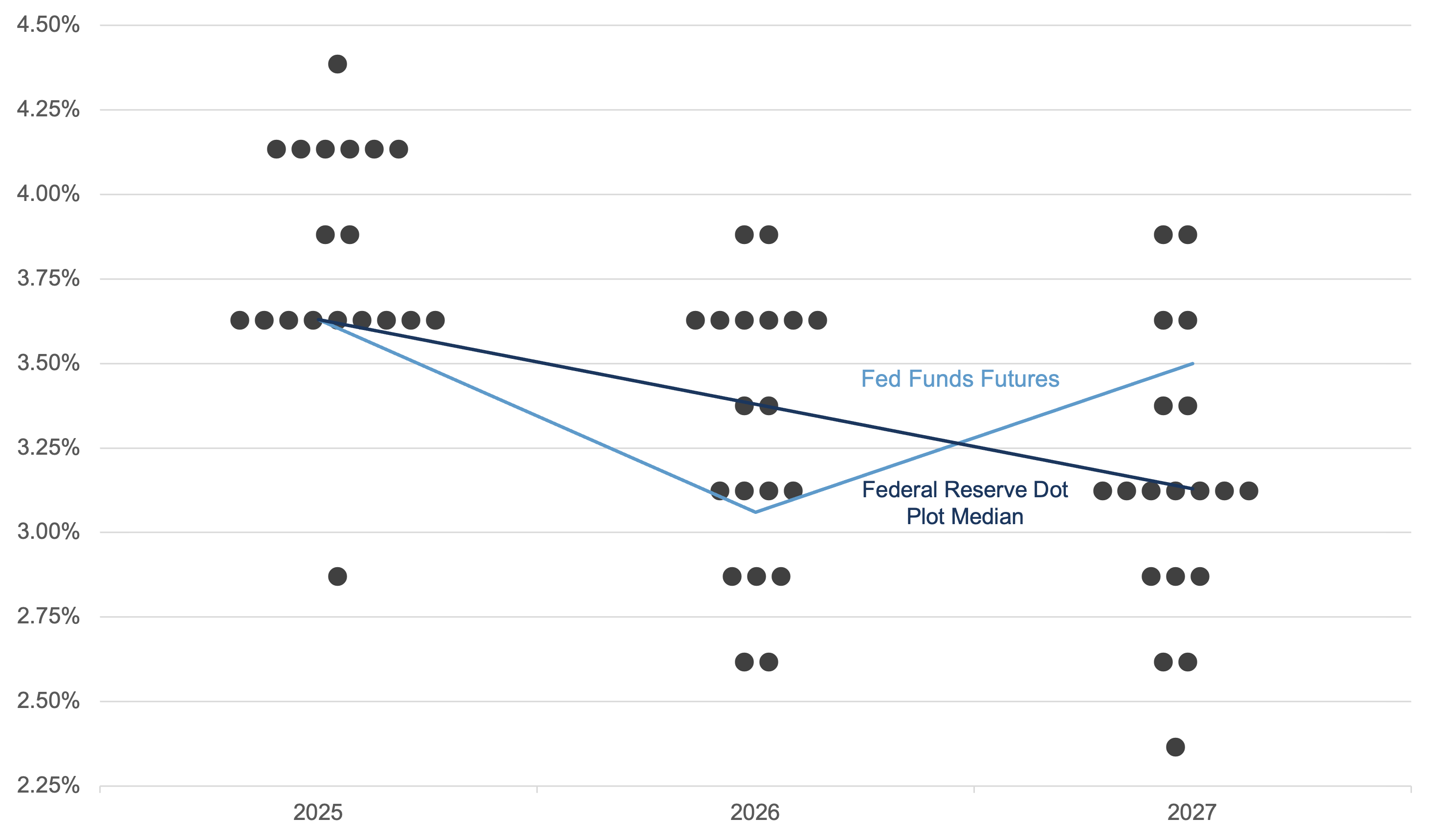

The key outcomes of the Fed effectively participating in fiscal policy include higher inflation, lower real interest rates, and potential currency depreciation. In such an environment, real assets would likely perform well, while equities could also benefit. Normally, higher inflation would weigh on equity multiples, but if the central bank is capping yields, that should provide support to valuations. We have actually seen these conditions play out this year, as real yields have fallen and the dollar has weakened significantly. As discussed earlier, this dynamic has contributed to strong returns across all major asset classes.

Exhibit C: The US Dollar Index vs. Real 10-Year US Treasury Yields

Source: Bloomberg, Fiduciary Trust Company. Real US 10-Year Treasury yield is based on the US 10-Year Treasury Inflation Protected Security (TIPS). TIPS are calculated by adjusting the bond’s principal based on the Consumer Price Index (CPI). The specific adjustment is made using a reference CPI that uses interpolated data based on CPI figures from three months prior. Data as of September 29, 2025.

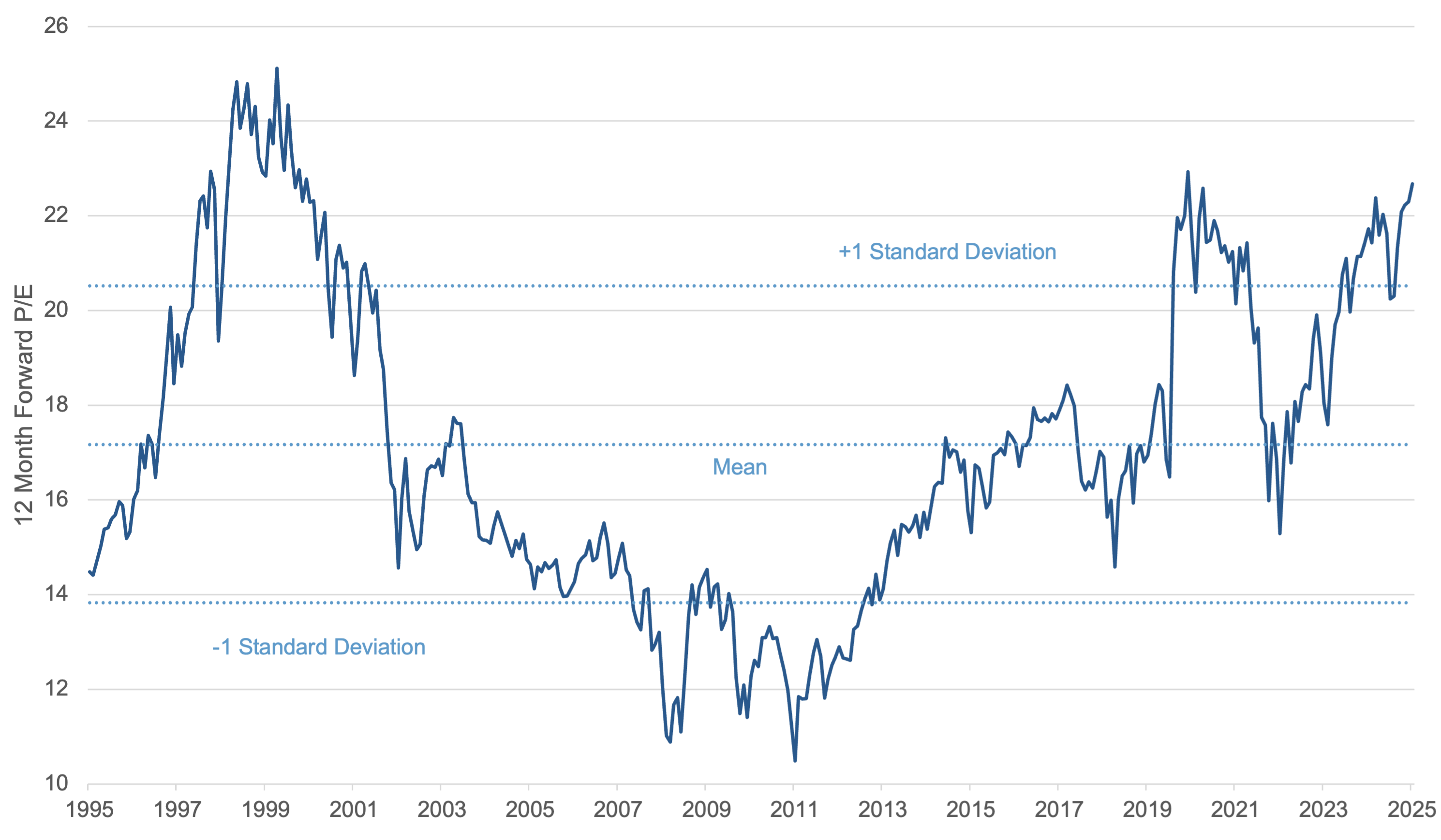

Valuations: High, but With Context

The key question is whether the market has already priced in this scenario, or if the rally can continue despite historically high valuations. The S&P 500’s forward P/E is at levels only exceeded during the dot-com bubble, so it is only natural to draw comparisons to that period. Today’s rapid expansion of AI datacenters bears a striking resemblance to the fiber-optic buildout of the early 2000s, when overcapacity ultimately led to severe losses for equity investors.

Exhibit D: 30-Year S&P 500 Forward 12 Month Price-to-Earnings Ratio

Source: Bloomberg, Fiduciary Trust Company. Data as of September 29, 2025.

There are some key differences between then and now. Today’s high multiple has been driven by the increasing weight of the Magnificent 7 stocks. Unlike the dot-com era high-flyers, today’s hyper scalers, like Alphabet, Microsoft, Amazon, and Meta, have thus far funded their capital expenditures primarily out of their substantial free cash flow. If expected returns on AI investments fall short, these firms can redeploy capital into other areas.

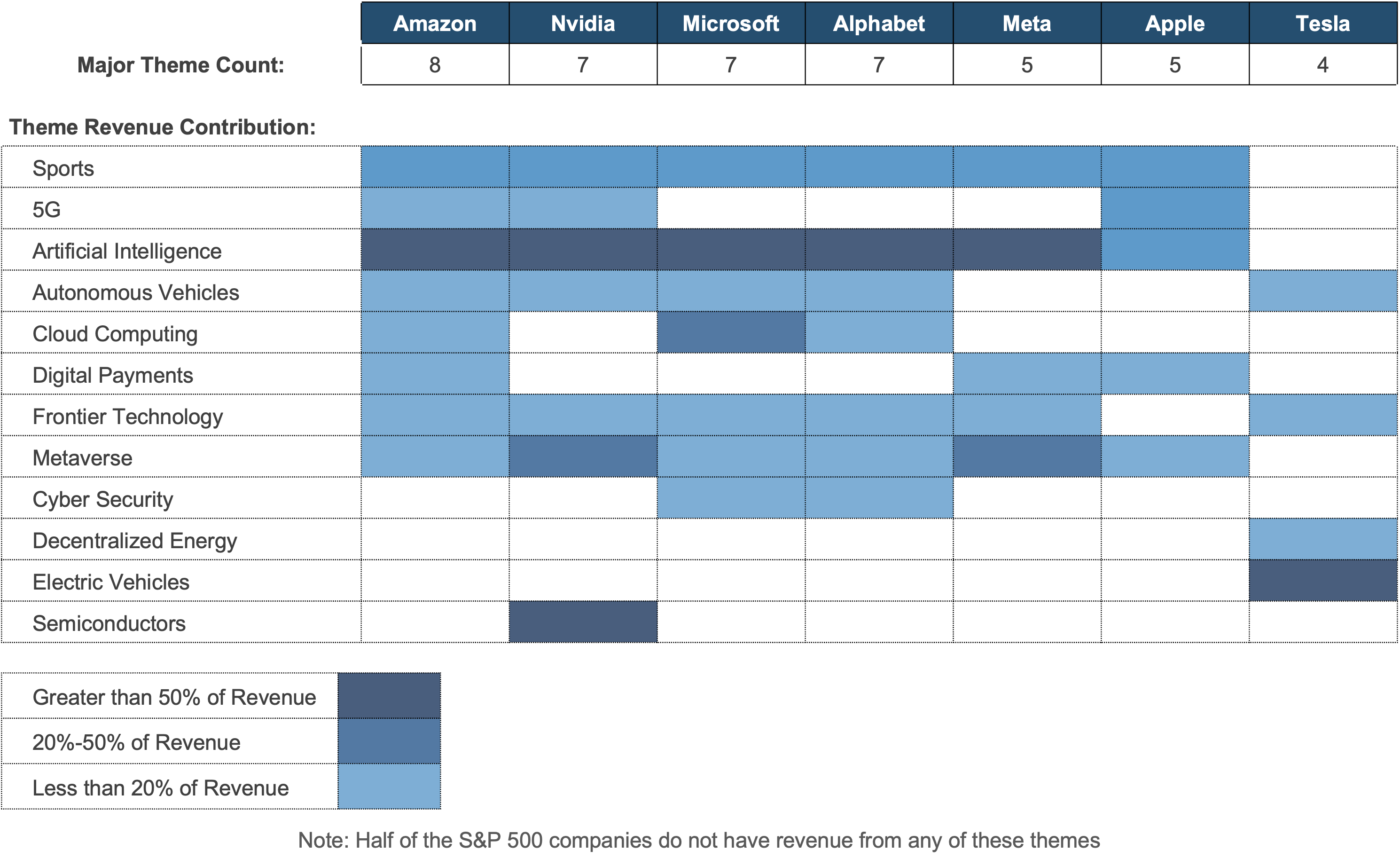

The surge of the Mag 7 has not only driven higher index valuations but also increased index concentration, with the top ten stocks in the S&P 500 now representing an unprecedented share of the market. While it is undeniable that these largest companies exert significant influence on market direction, there is reason for optimism: their business exposures are more diverse than many realize.

Take Alphabet, for example, which generates revenue not only from search and advertising but also from YouTube, Google Cloud, Waymo, and hardware. This diversification is in part a result of the Mag 7 collectively executing more than 800 acquisitions since going public. Bloomberg offers an interesting perspective, identifying roughly a dozen major investable themes in the technology sector, including AI, autonomous vehicles, cloud computing, digital payments, and cybersecurity. They note that each of the Mag 7 participates in at least four of these key themes. Viewed this way, today’s concentration reflects diversified exposure through a few large platforms, rather than fragile dependence on a single sector.

Exhibit E: Technology Sector Investable Themes for the Magnificent Seven

Source: Bloomberg, Fiduciary Trust Company. Data as of August 12, 2025.

Nvidia is somewhat unique among the Mag 7 in that a large portion of its revenue comes from the other Mag 7 companies. Recent developments suggest we may be entering the later stages of Nvidia’s remarkable run. For example, they recently announced a $100B investment in OpenAI (the creator of ChatGPT) which OpenAI will use to purchase Nvidia GPUs. This arrangement bears resemblance to vendor financing practices seen at Lucent and Cisco in the early 2000s, which ultimately led to significant losses.

Additionally, it appears the Street has begun to fully price in Nvidia’s growth: over the past eight quarters, sequential upward revisions to the following quarter’s earnings estimates have grown progressively smaller, and Nvidia has beaten expectations by diminishing margins. For the time being, demand for Nvidia’s GPUs still outpaces supply, and the company’s largest buyers have very strong balance sheets and are investing aggressively in what they see as a critical AI arms race, both against each other and against China. The question is whether momentum can be sustained as market expectations become increasingly priced in.

Gold and Currencies: Watching the Endgame

Gold has been a top-performing asset this year, reaching new all-time highs. Interestingly, bitcoin, often referred to as “digital gold,” has not fared as well, up just 12% year-to-date. Because it does not generate cash flows, gold has always been difficult to value, and its recent surge has rendered traditional ratios to other commodities or metals like silver or platinum largely meaningless. Looking ahead, gold’s appeal remains supported by the macro backdrop. Central bank demand, particularly from China, India, and Japan, where gold remains a small share of reserves, could also provide further support for prices.

Gold’s strong returns this year have been supported in part by dollar weakness. While we expect the dollar’s slide may continue, we have preferred to express that view through non-U.S. equities rather than gold. Historically, foreign stocks have been more sensitive to moves in the U.S. dollar than gold, tending to move more sharply and in closer alignment with changes in the currency.

We expect to reassess our views on the dollar once the Fed approaches the end of its cutting cycle or if the dollar index (DXY) revisits its early-2000s levels in the mid-80s. Both could mark inflection points where the trend of dollar weakness may start to wane and the case for a currency-sensitive tilt would diminish.

Conclusion: Opportunity in Uncertainty

2025’s mix of strong market performance and rising political-economic uncertainty highlights a central paradox: risks are mounting, yet returns remain robust. We see three key takeaways:

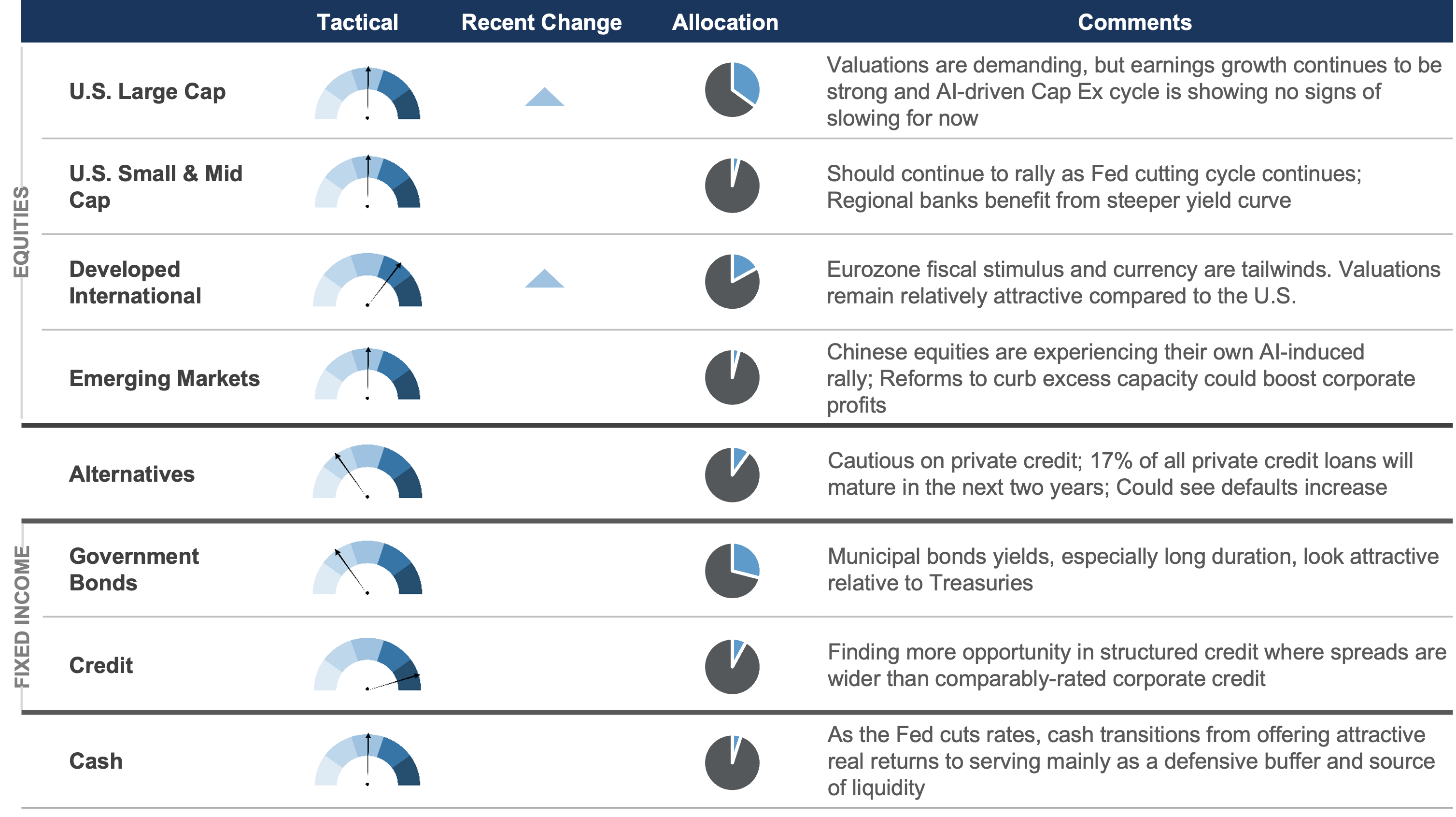

- Rates are likely to trend lower, creating opportunities in equities, credit, and especially municipal bonds. While most asset classes are at all-time highs, municipal bonds offer some of the highest yields in the last two decades.

- Inflation risks are real but manageable with AI-driven productivity offering some offset.

- The dollar may weaken, enhancing opportunities in international developed markets.

While today’s environment presents plenty of challenges, it also offers fertile ground for careful, selective investing.

If you have questions, please reach out to a Fiduciary investment officer or Sid Queler at queler@fiduciary-trust.com.

Exhibit F: Fiduciary Trust Asset Class Perspectives

Note: These forward-looking statements are as of 10/1/2025 and based on judgments and assumptions that change over time. Tactical allocation denotes positioning relative to a strategic benchmark. Recent Change column signals whether the recommended allocation to the asset class increased, decreased, or was unchanged in the last calendar quarter. Allocation denotes the percentage weight in a portfolio assuming a 60% equity, 35% fixed income, 5% cash benchmark.