Recent headlines have highlighted growing concern about the U.S. housing market, largely driven by high home prices and increased borrowing costs. Although home prices have remained relatively stable this year, there have been declines in some regions — raising questions about what lies ahead.

Housing plays a pivotal role in the U.S. economy, representing roughly 18% of GDP and nearly one-third of household spending.1 Its sensitivity to interest rates and consumer sentiment makes it both a reflection of broader economic conditions and a potential driver of future trends. Today, affordability pressures and signs of weakening demand suggest that the housing sector could be at a turning point.

Housing as an Economic Indicator

Historically, housing has been a leading economic indicator. Homebuilding activity, in particular, often slows ahead of recessions. Recent data show a possible repeat of that trend: housing starts declined 1.7% year-over-year in April 2025, while building permits fell 3.2%.2 One in seven U.S. home purchase agreements was canceled during the same month, suggesting rising buyer hesitation.3

In addition to its economic impact, housing also plays a significant role in inflation. Shelter costs account for about one-third of the Consumer Price Index (CPI).4 Despite easing headline inflation, shelter costs rose 4.3% over the past year—nearly double the overall CPI increase—putting continued pressure on household budgets.5

Home Ownership Increasingly Out of Reach

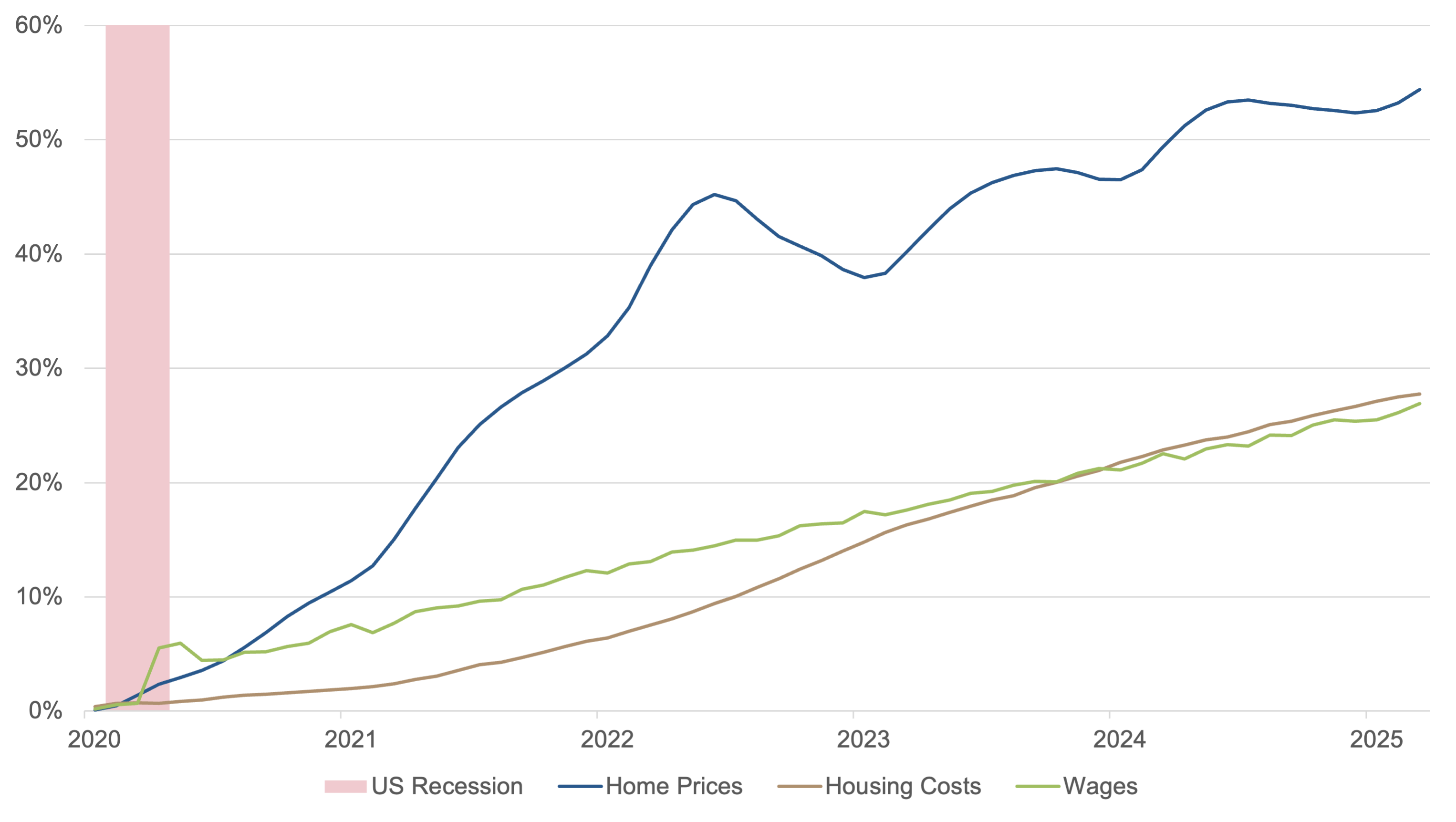

The sharp rise in home prices over the past five years is largely a result of pandemic-era dynamics: increased demand for space, historically low interest rates, and limited housing supply. As of early 2025, the median U.S. home sale price reached $416,900—a 27% increase from five years ago.6 This surge has made homeownership increasingly difficult for first-time buyers and reduced discretionary spending for those who recently purchased a home.

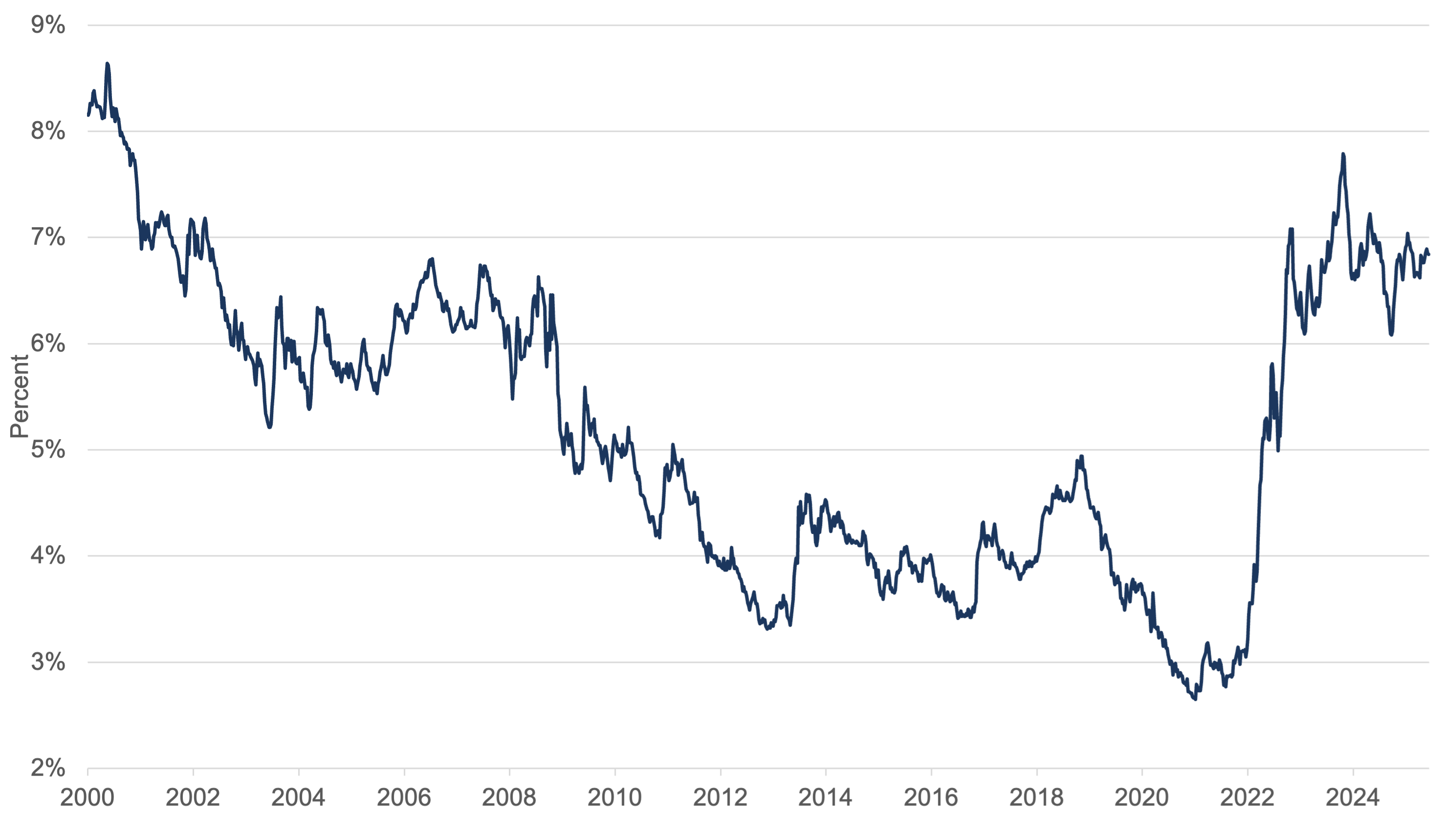

Mortgage rates have also climbed significantly, from 2.99% in June 2021 to 6.85% in June 2025.7 Monthly mortgage payments have far outpaced income growth, straining affordability and limiting new demand. In some markets, this pressure is beginning to push home prices down slightly.8

Unlike the lead-up to the 2008 financial crisis, today’s buyers face tighter lending standards. Risky mortgage products are far less common, and borrowers must meet more stringent qualifications. While affordability remains a challenge, these safeguards reduce the risk of a systemic collapse.

Can Prices Keep Rising?

A key question for homeowners and investors is whether current home price levels are sustainable. Historically, housing values tend to track with income growth, but that relationship has broken down in recent years. As a growing share of household income is diverted to mortgage payments, many potential buyers are being priced out of the market.

Exhibit A: Home Prices, Housing Costs, & Wages

Source: S&P Dow Jones Indices, Bureau of Labor Statistics (BLS), Bloomberg, Fiduciary Trust Company. Data as of June 18, 2025.

Another important factor is the “mortgage rate lock-in” effect.9 Millions of homeowners refinanced or purchased homes at ultra-low rates during 2020–2021. Now, with rates near 7%, these homeowners are reluctant to sell, as doing so would mean giving up their favorable terms. As of March 2024, the average mortgage rate held by borrowers was around 4%—well below prevailing rates.10

Exhibit B: 30-Year Fixed Rate Mortgage Average in the U.S.

Source: Freddie Mac, Bloomberg, Fiduciary Trust Company. Data as of June 16, 2025.

This lock-in effect has tightened inventory and contributed to continued price pressure. At the same time, it has led to a mismatch between homeowners’ evolving needs and their willingness to move. Many people are staying in homes that no longer suit them because moving would significantly increase their housing costs.

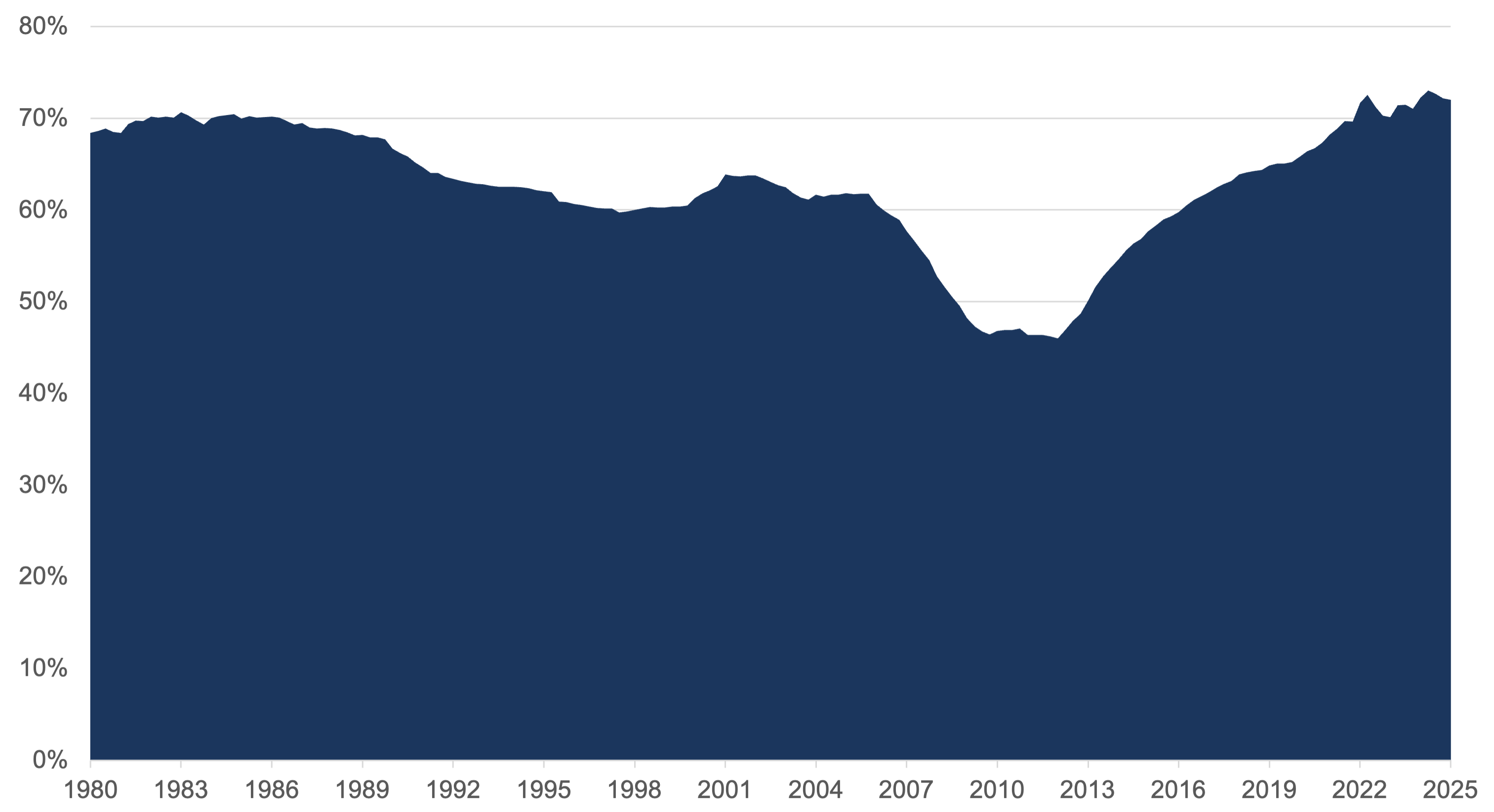

If the broader economy weakens, both demand and supply may decline. However, most homeowners are in a relatively strong financial position. Nearly 40% of U.S. homeowners have no mortgage, and many others hold substantial equity. In addition, strong stock market performance in recent years has bolstered household wealth and may provide a buffer against a housing slowdown.

Exhibit C: Households; Owner’s Equity in Real Estate as a % of Household Real Estate

Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis, Fiduciary Trust Company. Data as of June 16, 2025.

Why This Isn’t 2008

While current affordability issues and slowing demand may seem reminiscent of the 2008 housing crash, the underlying conditions today are significantly more stable. The earlier crisis was fueled by unsound lending practices and speculation, which left financial institutions highly exposed. When prices fell, the entire system unraveled.

Today, stricter mortgage standards and healthier borrower profiles mean that most homeowners have strong equity positions. The nationwide foreclosure rate remains under 1%, far below the nearly 5% rate during the 2008 crisis. Banks are better capitalized, and financial regulations implemented in the aftermath of the crisis have strengthened the system.11

The recent housing boom has been driven not by speculative excess or overbuilding, but by structural supply constraints and pandemic-related shifts in demand. As a result, while prices could face further downward pressure, the overall market is less vulnerable to a severe correction.

Conclusion

The housing market remains closely tied to the broader economy. A downturn in housing, while unlikely to trigger a crisis on its own, could exacerbate other economic stressors — especially if consumer debt rises or job growth slows. The market’s current challenges, including affordability constraints, softening demand, and tight inventory, warrant attention.

At the same time, the relative financial health of homeowners and the resilience of financial institutions suggest that the risks are manageable. Still, given housing’s central role in consumer spending, inflation, and economic sentiment, it remains an important area for investors to monitor.

At Fiduciary Trust Company, we view housing as a critical barometer of economic health. We believe that monitoring this sector can help inform portfolio strategy, liquidity planning, and long-term financial decision-making.

If you would like to discuss how the evolving housing market could impact your financial plans, please reach out to Sid Queler at queler@fiduciary-trust.com.