Services for Financial Advisors

We’re committed to helping financial advisors enhance their value to clients and grow their businesses.

Expertise and flexibility

-

A Breadth of Services

We’re proud to partner with more than 100 financial advisors. Deepen your client relationships with trustee services, including access to New Hampshire’s advantageous trust laws, custody services, a donor-advised fund program, and tax and lending services.

-

Personal Service

Our advisor-clients have direct relationships with our knowledgeable professionals to enable exceptional responsiveness and flexibility. This has helped us earn a 98% average annual client retention rate over the past decade.

-

Flexible Approach

As a private firm with $30 billion in assets under supervision, we are small enough to be nimble, yet large enough to have substantial resources for our clients. We offer a flexible operating model capable of handling complex and traditional assets, and our services can be unbundled to meet client needs.

-

Expertise

Our trustee services are supported by our 12-member highly-experienced trust & estates legal team, and you also have access to philanthropic specialists, our tax team, and marketing support.

Enhancing your value to clients

Our services can provide you a competitive advantage in serving your high-net-worth clients. You, the financial advisor, manage the client relationship and assets, while we provide key services to help you meet broader client needs.

We can provide your clients with access to the tax and other advantages of New Hampshire trusts through Fiduciary Trust of New England.

Learn MoreTrustee services from a firm you can depend on and backed by a highly experienced trust & estates legal team.

Learn MoreHigh-touch client service combined with expertise handling special assets and trust accounting.

Learn MorePersonal service and our unique DAF program make us the innovative partner to help maximize the impact of giving.

Learn MoreTrust, individual, and other tax return preparation integrated with other services from Fiduciary.

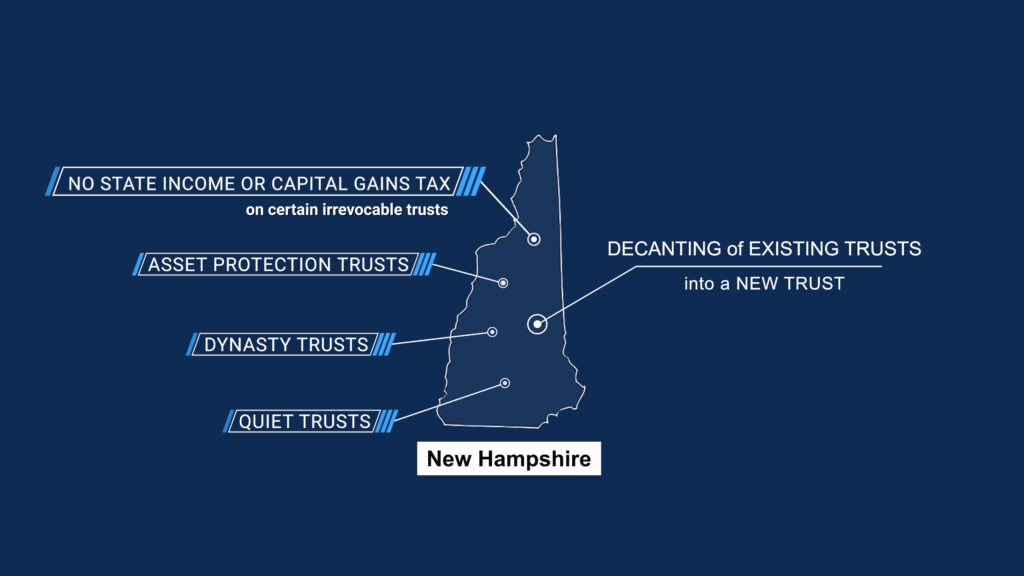

Learn MoreNew Hampshire's Trust Advantages

Today, trustees and beneficiaries have choices when deciding where to administer their trusts. We believe New Hampshire is the best state for this, with laws that allow for no state income tax on certain trusts, perpetual trusts, trust modification by decanting and statutory modification along with many other benefits. And these advantages are often available for trusts established outside of New Hampshire and with beneficiaries residing in other states.

Awards & Recognition

A Most Advisor-Friendly Trust Company

Best Trustee / Fiduciary Services Award

Best Philanthropic Offering Award

Best Wealth Manager Over $5B – Client Service Award

Best Custodian Award

Custody Thought Leadership Award