July 1, 2025

The second quarter began with a challenging start for investors as President Trump’s “Liberation Day” tariff announcement caused equities to fall 10% over the next week, while bonds and the dollar also declined. On April 9, just as the tariffs were set to go into effect, Trump announced they would be delayed for 90 days (a deadline which is fast approaching). Since then, there has been a series of escalations and de-escalations on the trade front; Congress advanced legislation to extend the 2017 tax cuts, along with several new tax cuts; and a war broke out between Iran and Israel, which saw the US bomb Iranian nuclear sites before brokering a cease-fire two days later.

While much uncertainty remains across the tariffs, fiscal legislation, and geopolitical tensions, you wouldn’t know it looking at financial markets. Equities have rallied sharply off their April lows, with the S&P 500 staging a 25% rally since then, to finish the quarter up 11%. Non-US equities have fared even better, up 11%. Looking at year-to-date returns, non-US equities have been the clear winner, supported by several converging forces. Chief among them is the weakening dollar, but trade policy and local reforms are also playing a critical role. While these dynamics are complex and interrelated, they all suggest that the case for global diversification remains strong—and may be strengthening.

Exhibit A: Total Returns by Asset Class

Source: Bloomberg, Fiduciary Trust Company. Indices: Cash: Bloomberg Barclays 1-3M Treasury Note, High-Yield: Bloomberg Barclays US Corp HY, Corporate Debt: Bloomberg Barclays US Corporate, U.S. Large and Mid Cap: Russell 1000, U.S. Small Cap: Russell 2000, Dev. Int’l: MSCI EAFE, Emerg. Mkts: MSCI Mexico Index. Data as of July 1, 2025.

Why International Equities Are Gaining Ground

The resilience of international markets, particularly in Europe and Japan, stems from a mix of economic policy shifts and external conditions that are making their equities more attractive.

Tariffs May Hurt the US More Than Its Trading Partners

When President Trump made his first tariff announcements earlier this year, many on Wall Street believed the US to be in a position of strength in any trade negotiations because trade (total imports + exports) equates to a smaller percentage of US GDP than it does for most other developed countries. For example, the EU’s total trade balance is nearly equal to its total GDP while for the US, total trade is about 25% of GDP.

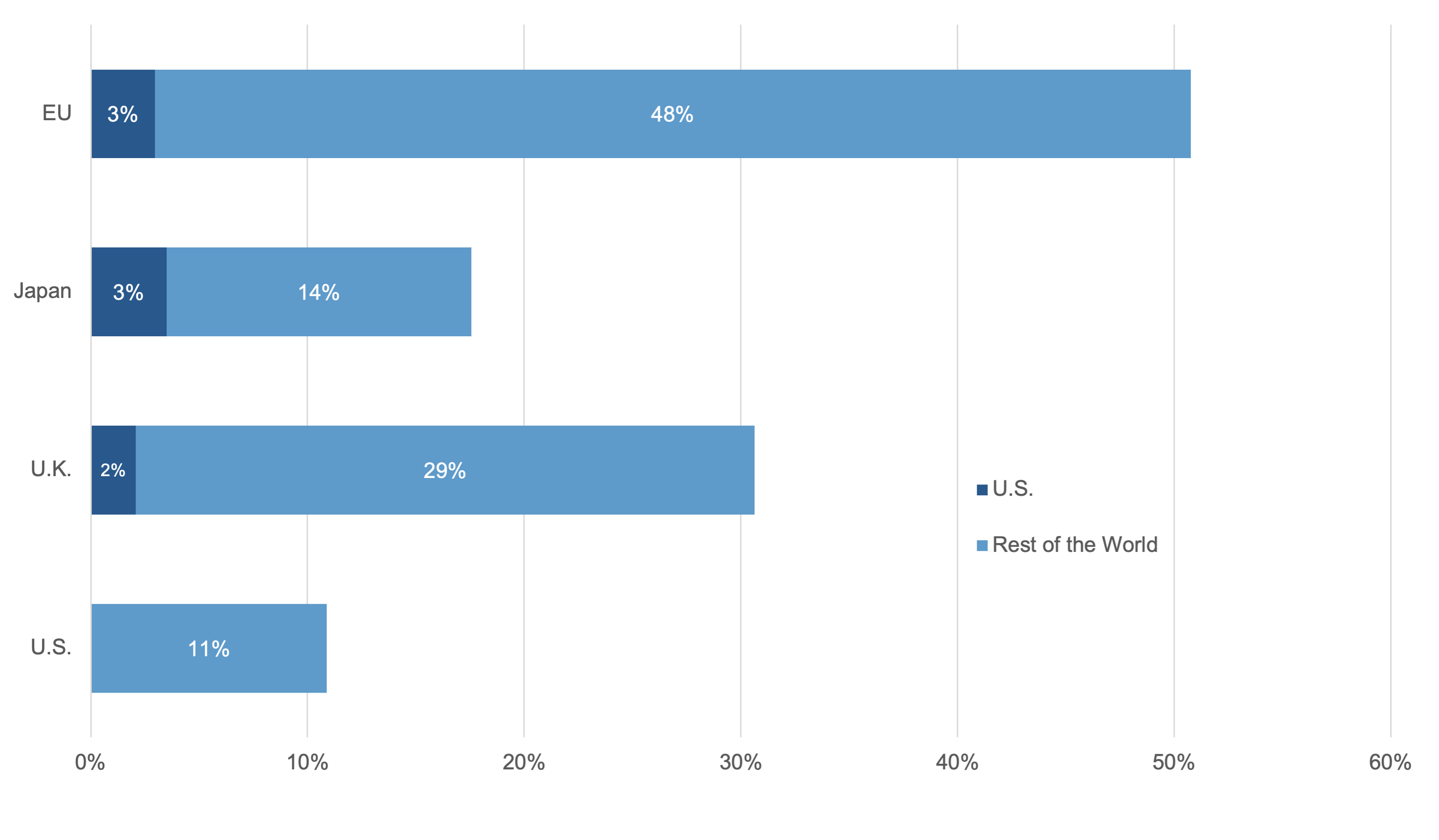

However, despite Europe’s reputation as an export-driven economy, the potential fallout from US-imposed tariffs on European goods is less severe than it may appear. When evaluating the impact of tariffs, investors should not consider the entirety of Europe’s exports, but only its exports to the US. The US exports are the only ones potentially subject to new tariffs, and they represent a relatively modest portion of the EU’s total exports and an even smaller share of GDP, at about 3%.

Exhibit B: Exports as a Percentage of Nominal GDP, 2024

Source: Bloomberg, Bureau of Economic Analysis, UK Office for National Statistics, Economic and Social Research Institute Japan, Eurostat, Fiduciary Trust Company. Data as of June 26, 2025.

Meanwhile, the US is either placing or threatening tariffs on all major trading partners, including the EU, China, Mexico, and Canada. Therefore, the tariffs apply to a much higher percentage of the US’ traded goods (all imports less any excluded items, and then also the possibility of retaliatory tariffs on US exports). Also, if US importers find the tariff rates high enough to deter US demand, Chinese producers may be forced to redirect their excess capacity to other regions—including Europe, Japan, and emerging markets—who could then benefit from an influx of lower-cost goods or inputs. This shift could help lower inflation and increase profit margins for foreign businesses, while offering consumers more affordable options.

Moreover, if retaliatory tariffs reduce demand for US exports, European and Japanese firms stand to gain market share. This asymmetric impact of global tariffs could serve as a tailwind for non-US companies.

Europe Embraces Fiscal Stimulus

In a noteworthy policy shift, Germany has amended its longstanding “debt brake” rule which limited fiscal deficits to 0.35% of GDP. Defense spending beyond 1% of GDP is now exempt from borrowing limits, and the government has announced a €500 billion infrastructure fund, equivalent to about 12% of German GDP. This sizable commitment to capital investment has the potential to spur long-term productivity and growth in Europe’s largest economy, supporting corporate earnings and investor confidence.

Japan’s NISA Reform: From Savings to Stocks

Japan is undergoing a quiet but potentially transformative financial shift. In January 2024, the country overhauled its Nippon Individual Savings Account (NISA) system to encourage household investment in equities.

Japanese households currently hold ¥1,100 trillion (about $7.4 trillion) in low-yielding cash deposits. Equities account for approximately 15% of household financial assets in Japan, versus over 50% in the US, where similar reforms (401(k) plans in 1978 and expanded IRAs in the 1980s) helped lead to an expansion of household equity ownership.

If even a modest portion of Japan’s household savings is redirected into equities, the inflow could meaningfully re-rate Japanese markets. Valuations remain compelling: Japanese equities are still trading at just 15x earnings, compared to 22x in the US.

The Dollar: Losing Strength and Losing Luster?

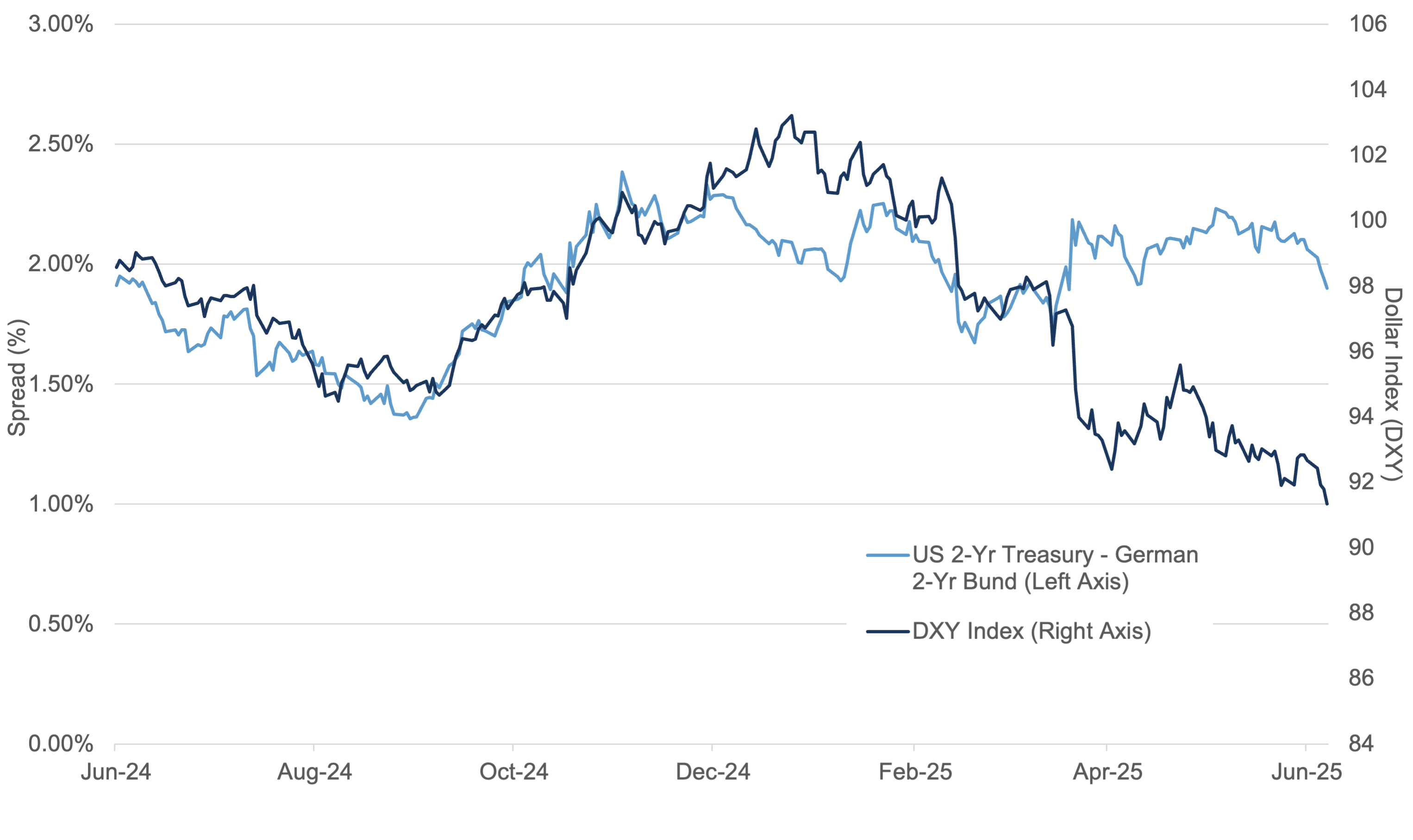

Currency has played a major role in return differentials across US and non-US equities this year. The dollar has weakened significantly, with the DXY Index (which measures the dollar relative to a basket of six major foreign currencies) down more than 10% from its January peak. Over the last few years, short-term interest rate differentials had served as a reliable guide for the dollar’s direction. That relationship broke down following Liberation Day despite diverging monetary policies across major central banks (the Federal Reserve on hold, the ECB cutting rates, and the Bank of Japan hiking).

Exhibit C: US Minus Germany 2-Year Gov’t Bond Yields vs. U.S. Dollar Index

Source: Bloomberg, U.S. Bureau of Labor Statistics (BLS), European Central Bank (ECB), Fiduciary Trust Company. Data as of June 26, 2025.

This decoupling suggests that broader geopolitical and structural concerns are now the primary drivers of currency markets. Trade tensions and shifting global capital flows may be exerting more influence than central banks.

Foreign Investors May Be Hedging, Not Selling

Despite concerns about a “Sell America” movement, data suggest that foreign investors may not be selling their US equities, but they are hedging them. Foreign investors hold nearly $30 trillion in US financial assets, including about $16 trillion in US equities—nearly 20% of the US stock market. At the start of the year, only about 20% of this exposure was currency-hedged.

Historically, the dollar has risen during equity market downturns, serving as a natural hedge for global investors. But in April, both US equities and the dollar fell simultaneously, which caused losses to compound in local currency terms. This breakdown in traditional correlations could prompt foreign investors to increase their currency hedging.

Even small shifts in hedging behavior can move currency markets: on $16 trillion in equities, every 1% increase in hedging demand translates to $160 billion of dollar selling pressure.

Is the World Ganging Up on the Dollar?

There’s also a growing debate about the benefits and burdens of the dollar’s role as the global reserve currency. In our April article we referenced a paper by Stephen Miran, Chairman of the Council of Economic Advisers, which argued that the dollar’s strength has hurt US manufacturing competitiveness and contributed to trade and fiscal imbalances. The paper floated strategies to weaken the dollar and boost exports.

In contrast, European Central Bank President Christine Lagarde has voiced frustration with the dollar’s “exorbitant privilege”—echoing French criticisms from the 1970s. In a speech in May, she argued that expanding the euro’s global role would help lower borrowing costs, stabilize trade flows, and shield the EU from dollar-driven volatility and geopolitical leverage.1

Though the two perspectives originate from different motives, they converge on a shared interest: a weaker dollar.

A depreciating dollar directly increases the returns of non-USD assets (including equities) for US investors. But a weaker dollar isn’t necessarily bad for US stocks, either, particularly for multinational firms with substantial overseas revenues.

Trade Policy: Moving in the Right Direction

The trade landscape remains unsettled, although it is clear that the final tariff rates will be much lower than initially feared. The pause in the latest round of tariffs (announced on “Liberation Day”) is set to expire on July 9. While the trade deal with the UK is the only one that has been finalized as of this writing, the US has announced a deal with China, the details of which are yet to be released. Treasury Secretary Scott Bessent has stated that he believes deals with all major trading partners could be signed by Labor Day.

Even if finalized, the legality of these trade deals is uncertain. The Supreme Court is unlikely to weigh in before year-end, but even if they were to rule against the president’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs, the executive branch may find interim ways to maintain tariffs at comparable rates. Still, it would create significant uncertainty around the potential need to rebate all tariff revenue collected under that authority. Ultimately, our expectation is that we end up with an average effective tariff rate paid on total goods imported of 12-15%.

If that estimate is correct, it appears that the drag from tariffs should be mostly offset by the tax reforms included in the “One Big Beautiful Bill Act.” Provisions for accelerated expensing could save nonfinancial corporations an estimated $225 billion in the first year alone, providing a meaningful boost to after-tax earnings.

US Equities: the AI Era

The ongoing AI arms race continues to be the dominant theme in US markets. Views on AI’s long-term impact vary widely: some bullish observers foresee a world of superabundance, where automation displaces nearly all forms of labor, while skeptics argue that AI may fall short of expectations, constrained by hardware, energy, regulations, or societal friction.

We view AI as a powerful productivity enhancer: improving decision-making, reducing costs, and accelerating workflows across industries. The Magnificent 7 are a “first order” way to invest in AI and account for a large percentage of the S&P 500 index and client portfolios. We believe banks, utilities, and energy infrastructure are “second order,” AI-adjacent plays that either benefit from AI directly or are essential to enabling it, and also trade at reasonable valuations today.

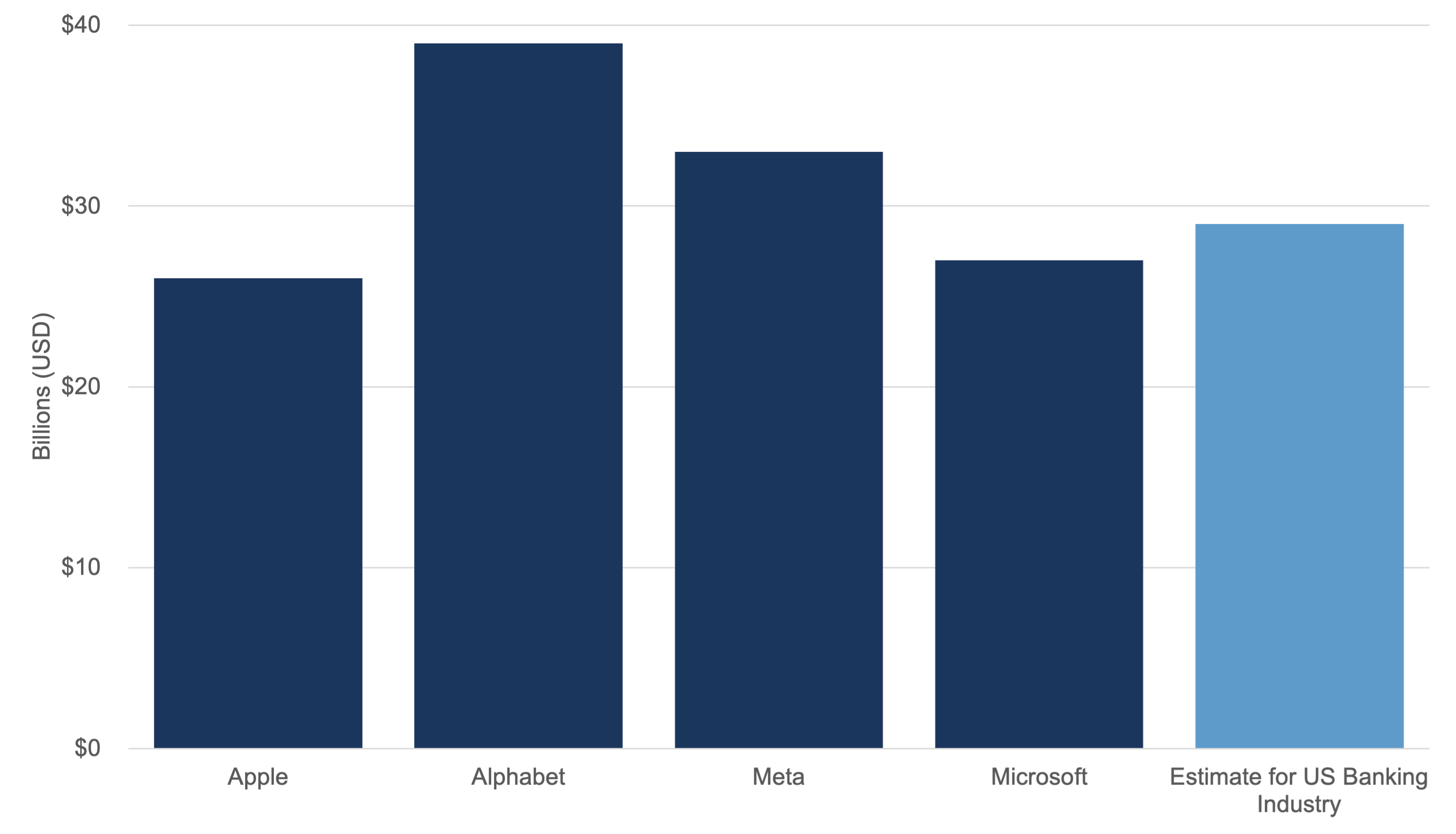

Banks are among the most aggressive adopters of AI, applying it to fraud detection, risk modeling, and operations, which could help meaningfully reduce non-interest expenses and boost returns on equity over time. We first noticed an attractive investment opportunity with large banks prior to the election on the expectation of a more deregulatory stance under President Trump. That thesis is playing out: the Fed is currently reviewing changes to the Supplementary Leverage Ratio (SLR) that would give banks more flexibility to deploy capital, and the administration is reportedly exploring ways to ease bank merger guidelines and simplify capital planning rules, making it easier for regional and super-regional banks to scale.

Exhibit D: U.S. Big Tech & Banks R&D Spend (Avg. last 3 fiscal years)

Source: Morningstar, Fiduciary Trust Company. Data as of June 26, 2025.

Meanwhile, utilities and energy infrastructure companies have become increasingly attractive as enablers of AI. Recent Congressional testimony from Sam Altman (CEO of OpenAI, the creator of ChatGPT) and Eric Schmidt (former CEO of Google) emphasized that energy, not computing power, is the ultimate constraint on AI’s growth. With AI data centers requiring vast and steady power supplies, the demand for reliable baseload generation and transmission infrastructure is growing rapidly. Natural gas pipelines are well positioned to meet the energy density and reliability needs of AI workloads. Natural gas also plays an essential role in backstopping wind and solar generation, which are constrained by intermittency and regional variability. As renewable capacity expands, so too does the need for dispatchable, fast-ramping energy sources, and natural gas remains the most scalable solution today.

Conclusion: Recalibrating Global Exposure

Investors today face a dynamic and evolving landscape. Trade policy, monetary divergence, foreign capital shifts, geopolitical uncertainty, and AI are all influencing asset prices in ways that defy past patterns.

Yet amid this complexity, some themes stand out clearly. The weakening dollar, coupled with rising structural support for non-US markets—especially in Europe and Japan—suggests that global equities could continue to offer compelling opportunities.

In our view, the coming quarters may reward those who maintain a globally diversified perspective and remain attentive to policy-driven tailwinds across borders. While US equity valuations are relatively high, we believe the long-term prospects for this region remain solid and banking and certain energy sectors represent attractive opportunities.

If we can be of assistance in helping you navigate this changing environment, please don’t hesitate to reach out to your Fiduciary Trust Company officer or contact Sid Queler queler@fiduciary-trust.com.

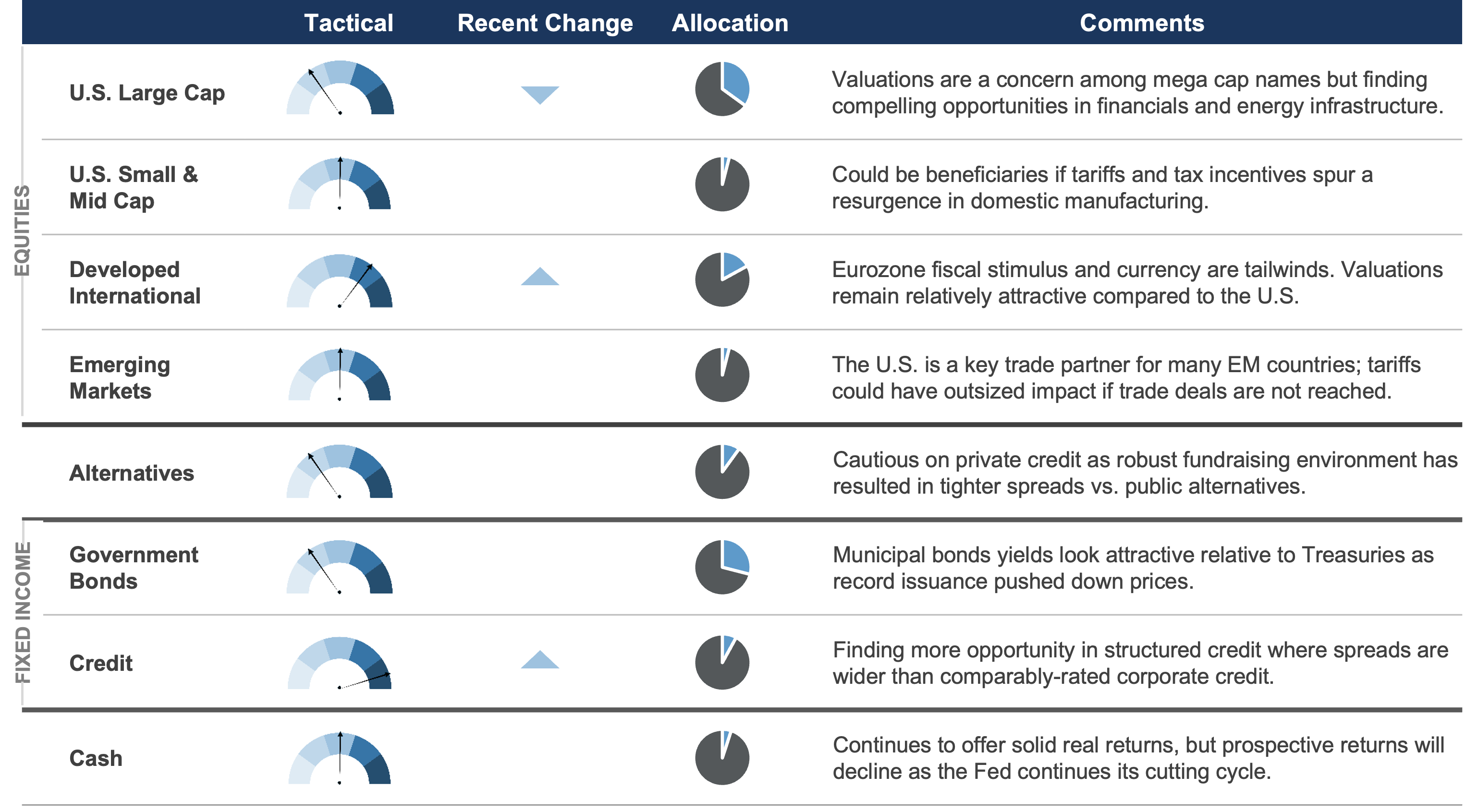

Exhibit E: Asset Class Perspectives

Note: These forward-looking statements are as of 7/1/2025 and based on judgements and assumptions that change over time. Tactical allocation denotes positioning relative to a strategic benchmark. Recent Change column signals whether the recommended allocation to the asset class increased, decreased, or was unchanged in the last calendar quarter. Allocation denotes the percentage weight in a portfolio assuming a 60% equity, 35% fixed income, 5% cash benchmark.