“Our investment committee hasn’t reviewed our Investment Policy Statement in at least eight years,” said one nonprofit leader, expressing a common concern in endowment governance. Despite best intentions and knowledge of fiduciary duties, often more pressing challenges receive higher priority, especially when a thorough review process can require months of attention. Dealing with Covid-19 emergencies may have exacerbated this problem for many institutions.

Organizational priorities change. Committee members turn over. Investment best practices evolve. There are several reasons to review an institution’s governing documents with regularity. Many nonprofits review their Investment Policy Statement (IPS) every 1-2 years,1 but to do this well it is usually appropriate to step back and complete a full Enterprise Review that results in an informed revision of the IPS. The ultimate goal is to have confidence that the investment strategy is properly aligned with the needs of the organization so the nonprofit can focus on its mission.

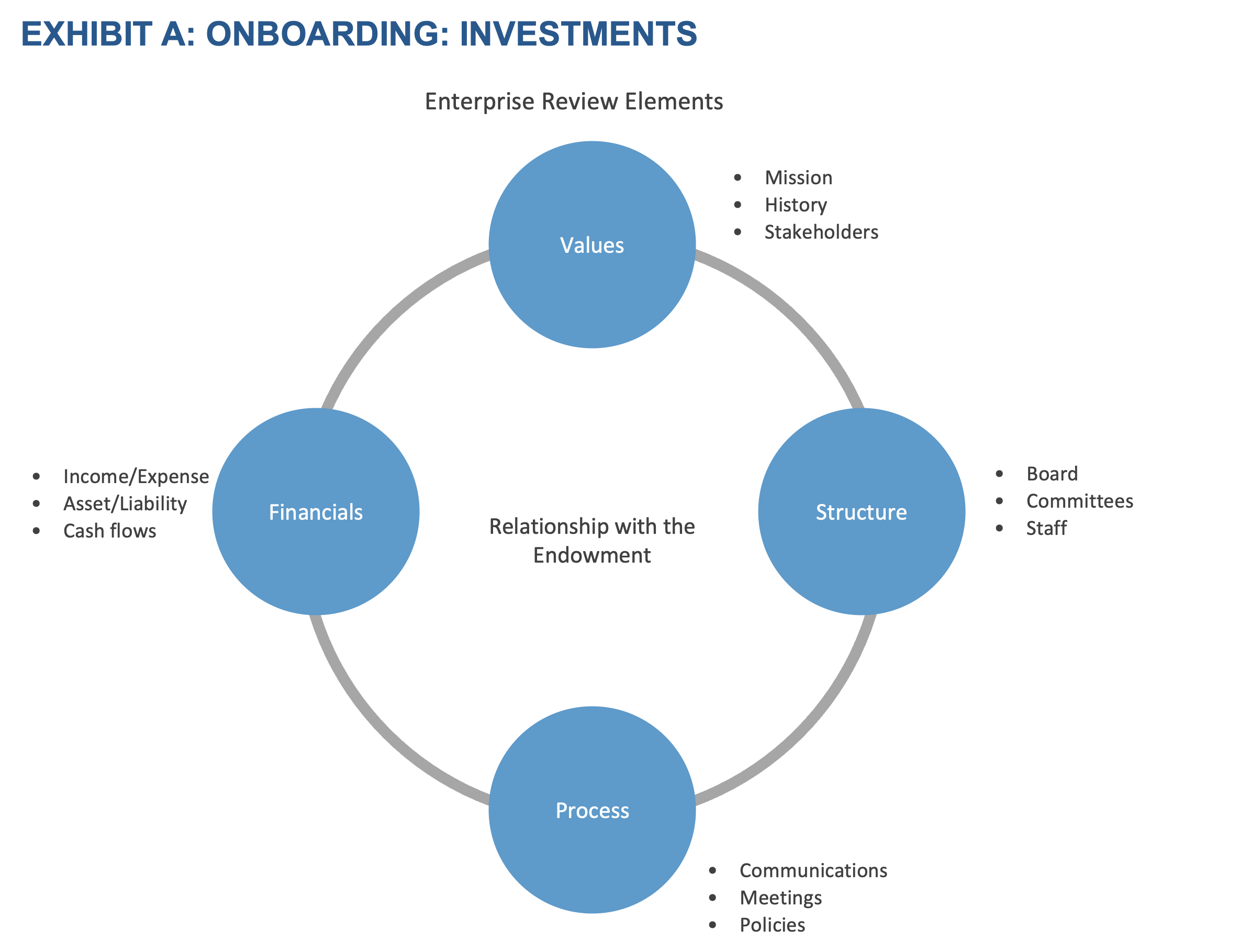

The Enterprise Review

The Enterprise Review looks beyond the investment portfolio in an effort to truly understand the organization holistically and determine what matters to the stakeholders. The exercise considers the values, structures, processes and financials of the institution, all within the context of the endowment and its importance. The Enterprise Review is analogous to a financial planner at the outset of a relationship asking a wealthy family a series of questions to fully understand their goals, concerns, assets and constraints. It is not just a numbers exercise but truly designed to help the advisor ascertain what is important to the client and recommend an appropriate investment program.

Values: A nonprofit’s values are essential to who it is and what it does. The Enterprise Review process delves into the mission of the organization, its history, and how the various stakeholders perceive the purpose of the endowment in order to create a better-informed view of how assets should be invested. Many nonprofits see a benefit to aligning the investment portfolio with the values of the organization, either in whole or in part. This may involve including or excluding certain investments which either promote a certain world view or run counter to it. A thorough Enterprise Review will consider that not all stakeholders will necessarily agree on how to express values in the portfolio, if at all, and will seek to find the best solution for the institution and its investments.

Structure: Each organization has a slightly different structure, and an experienced advisor can detect subtle nuances between them. Some institutions have a focused investment committee, while others consider investment matters in a finance committee with a broader mandate. This could impact what level of decision-making authority should be vested in the committee. Each nonprofit has different norms for how staff are involved with the various committees in handling investments, which can inform how the organization interacts with outside investment advisors. The Enterprise Review maps out these structural considerations, checks the roles and responsibilities, surfaces any suggested changes, and confirms everything is well documented for future reference.

Process: The next important element to study in the Enterprise Review is the process by which decisions that impact the management of the endowment are made. Finding the right governance structure is essential because each organization needs to know its strengths and weaknesses and place authority where it belongs. Some nonprofits can afford to hire in-house investment professionals, while others will hire an outside consultant to assist an investment committee. Still others choose to outsource the daily management of the endowment to an outsourced chief investment officer (OCIO), while maintaining strategic oversight. The choice of which process works best for the institution depends on several factors, from size of the endowment to experience of the staff and board members. The Enterprise Review can surface the need to reconsider the current arrangement.

Financials: Finally, the Enterprise Review looks at the financial performance of the nonprofit to understand the importance of the endowment to the organization and its operating budget. It is valuable to consider the size of the endowment relative to any debt and recurring outlays, such as grants or tuition assistance. The portion of an institution’s operating budget derived from the annual endowment draw can impact not only the required rate of return but also the ability to take on liquidity risk in search of higher returns. The revenue model will also dictate how much volatility risk an investment program can endure.

Once the advisor has consulted with the appropriate stakeholders and reviewed all relevant documents, the focus shifts to ensuring the Investment Policy Statement fully reflects what was discovered in the Enterprise Review.

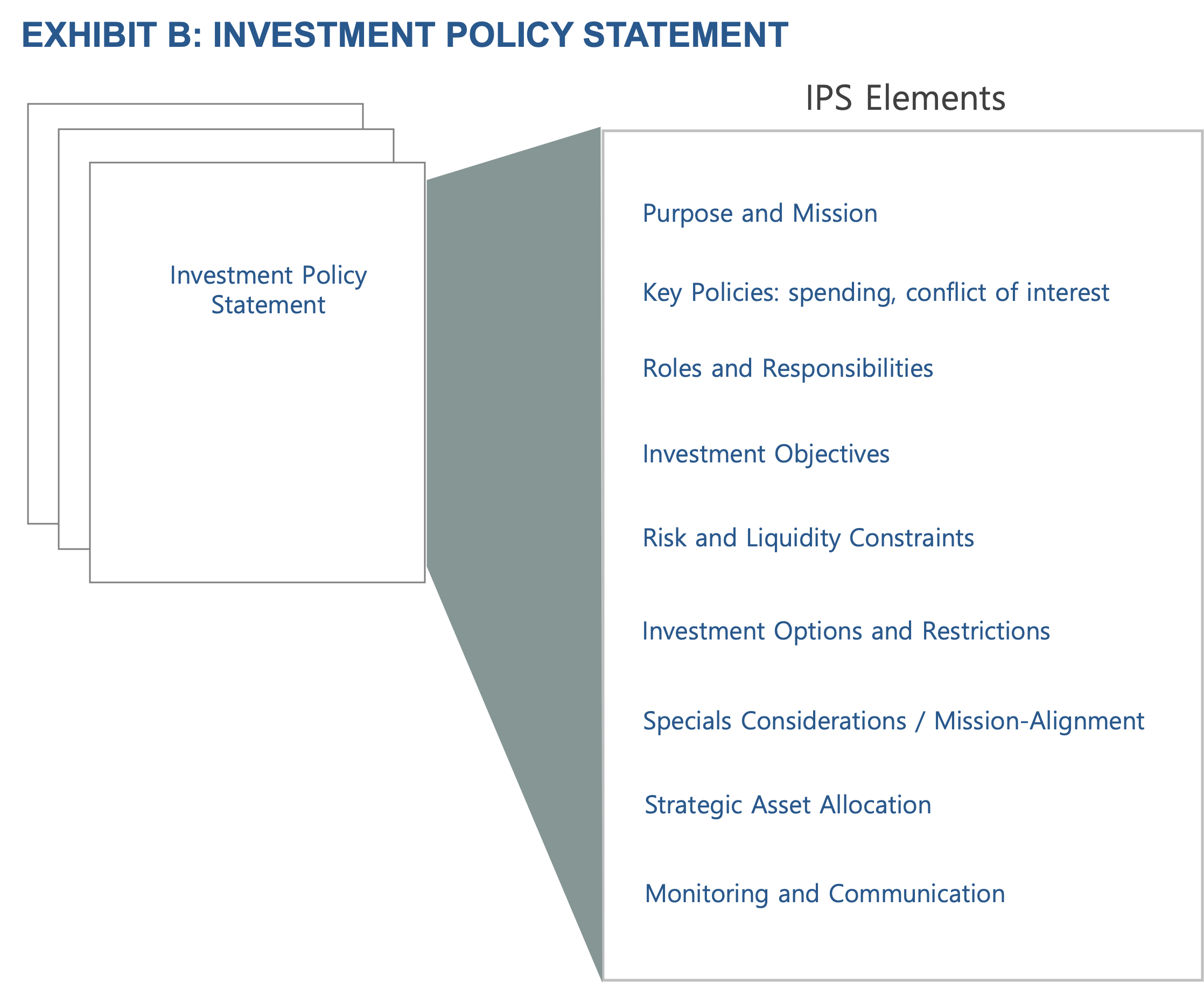

The Investment Policy Statement

The IPS is the key document defining the parameters for the endowment’s investment program, including who is responsible, how it is managed, and what kind of oversight is required. A sound IPS will not only preserve institutional memory for committees with regular turnover, it can be structured to guide committees with varying levels of investment sophistication. While there are many sample forms available online, each institution will have different objectives, structures, and tolerances. The IPS should be tailored to fit the unique needs of each organization.

The IPS will define the roles of the committee members, the advisor or OCIO hired to help manage the endowment, and the underlying asset managers entrusted to invest the funds. It will list the types of investments that are allowed or prohibited. This list will depend on the organization’s tolerance for illiquidity and lack of transparency. The IPS also documents the return target, spending policy, and approach to risk.

The element of the IPS that often requires the most analysis, but also carries significant importance, is the Strategic Asset Allocation (SAA). It can only be completed toward the end of the Enterprise Review process. The SAA is an expression of the endowment’s long-term target for how funds should be allocated to various asset classes, such as equities, fixed income, alternatives, and cash. Typically, the advisor will derive risk and return expectations for each of these asset classes and propose a mixture that achieves the organization’s required rate of return without taking excess risk. The investment committee will then consider how much leeway around those targets it should have, in order to allow for the necessary deviation from the exact values through time. The final and crucial step is to create a policy benchmark to measure performance, which is based on the strategic asset allocation.

As mentioned above, many investment committees seek to align the investment portfolio with the mission, vision, and values of the institution itself to create maximum impact with its resources. While defining and agreeing on exactly how to express organizational values can be a lengthy process, once complete it is often appropriate to codify the decision in the Investment Policy Statement. This way a committee and its advisor will have clear guideposts dictating to what extent the organization is prepared to modify its investment lineup to accommodate its mission.

Conclusion: Be Yourself

There are hundreds of charitable causes and thousands of organizations that support them in diverse areas such as health care, religion, animals, child care, food, shelter, education, and conservation.2 Each investment committee has a different flavor, and each community has its own expectation for the nonprofits in its view. Performing a full Enterprise Review with an experienced advisor can uncover and document all the unique aspects that make an institution special, leading to an Investment Policy Statement that lays the foundation for a tailored investment approach. If your organization is considering a review, contact Fiduciary Trust Company to begin a conversation.

Sustainable Investing Overview

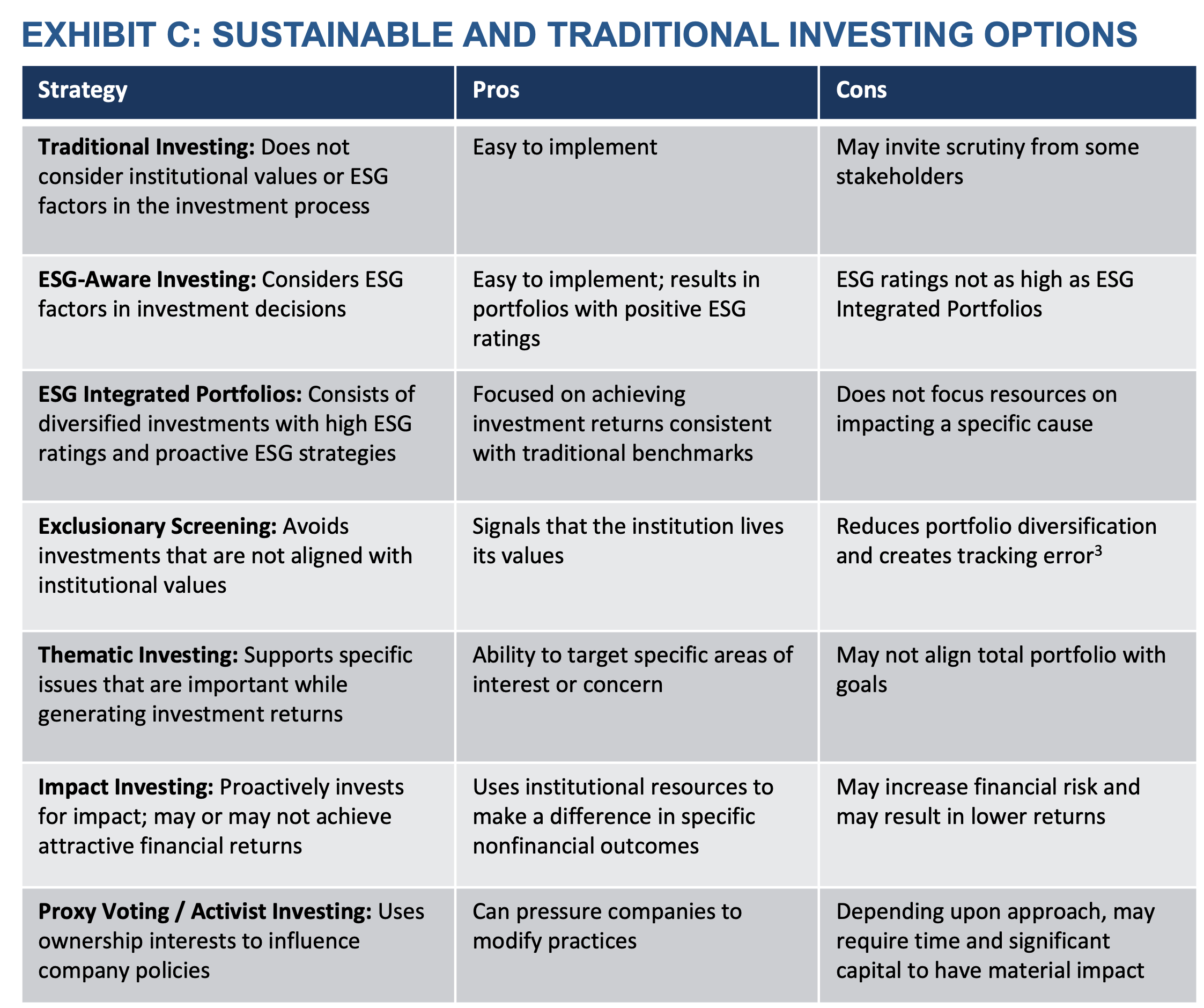

Traditionally, an investment committee would seek out the broadest opportunity set appropriate for the institution with the goal of maximizing risk-adjusted returns. This would typically result in owning a diversified portfolio of stocks and bonds across a full range of industries. But some organizations have come to recognize that certain investments appear to run counter to their stated mission, because investing in a business may signal approval and promote its success. Some of the more obvious examples are health care institutions owning tobacco stocks and religious institutions owning gambling stocks. Over time institutions have developed more sophisticated ways to express their mission, vision and values in the investment portfolio under a variety of names, including mission-related investing (MRI), socially responsible investing (SRI), environmental, social and governance investing (ESG), sustainable investing, impact investing, and more. Some of the more common approaches are shown in the table below:

There is an ongoing debate as to whether a trade-off exists between investing for profit and investing according to the organization’s values. There can also be significant disagreement between committee members over which values to express and how to express them, if at all. For this reason, it is valuable to conduct a thorough discovery process, often with assistance from an experienced advisor. At Fiduciary Trust, we offer a range of sustainable investment options, and consider ESG factors in all investment decisions.

Learn More: The Role of Sustainable Investing