One of the toughest and potentially scariest moves an investment professional can make in their career is to embark on the road to independence. From the logistics of navigating garden leaves and non-competes on the exit side to the basic blocking and tackling on the entry side, founding a firm of one’s own throws many simultaneous challenges at the new entrepreneur. Finding office space, hiring an operations staff, building a compliance structure, ensuring SEC registration, and discovering technology solutions are equally daunting. Of course, all of this must be completed before signing on a single client.

Many custodial providers are now paying particular attention to the “break-away” growth in the RIA space, focusing on these new firms with lures such as turnkey technology, practice management tools, and “RIA in a Box” compliance guides that are helpful in those first few tumultuous years. The proverbial shingle has been hung, and all who embark on the independent route hope to be successful. From this point forward, is success or failure simply up to you, or can it be enhanced – or possibly hindered – by your custodial provider?

What if, three to five years past its founding, your firm is quite successful in gaining not just clients and assets under management, but those coveted higher-net-worth clients? Along with higher-net-worth clients come more complex account structures and assets, life needs, and financial situations. These types of clients look to their financial provider to be more than just a stock picker – they need a trusted advisor who can help them establish and achieve a total financial plan.

The question is, now that you are “on your own” and trying to distinguish your firm from the others that surround you, has your custodial provider been able to grow with you in order to enable your firm to serve the needs of these desired, yet complex, clients?

Consider working with a custody partner, such as Fiduciary Trust, which cannot only meet the exceptional service and complexity needs of your clients, but can also provide your firm with access to additional services and expertise to help you deepen client relationships.

It’s Not All About M&A

It seems every week there is news of another RIA acquisition or merger, or a firm simply folding up shop. One would think that the number of independent RIA firms out there is shrinking. That could not be further from the truth. For every firm that is either acquired or dissolved, there are multiple new firms that spring up in its place.

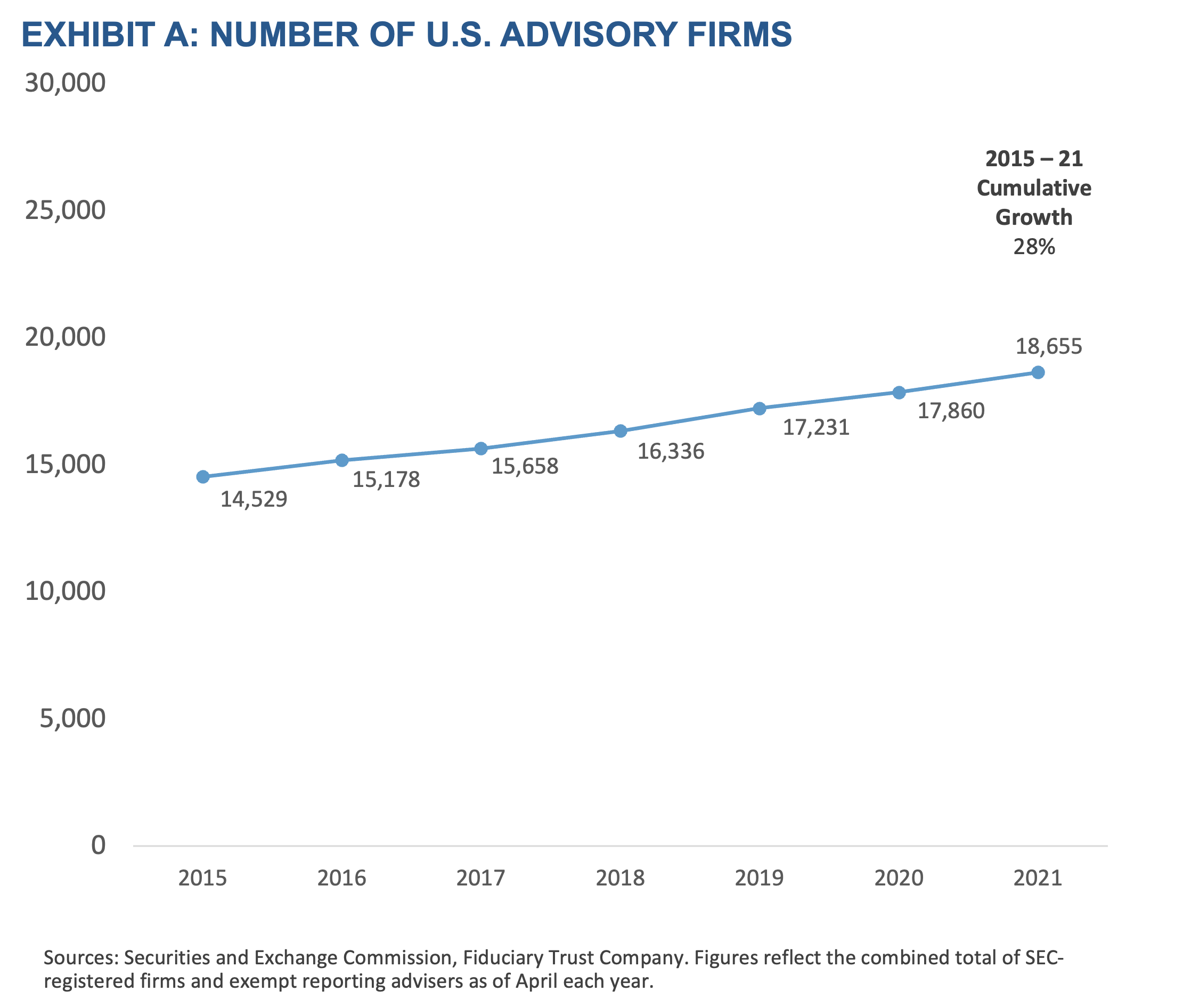

The industry has seen a 28% increase in advisory firms since 2015 as it has grown to nearly 19,000 firms.

Driven by this phenomenon, there is now an almost daily barrage of posts on LinkedIn and other social media outlets from the brokerage custodians advertising their services to this new and growing market. These providers are out there offering turnkey platform solutions that help the new and fledgling firm become established as an independent provider. At first, having a firm hand you a trading and portfolio management platform, compliance and practice management tools, and a default option for custody sounds alluring. The tradeoff is that what might have helped liberate you from your last scenario, now binds you to that custodial provider.

Outgrowing the “Box”

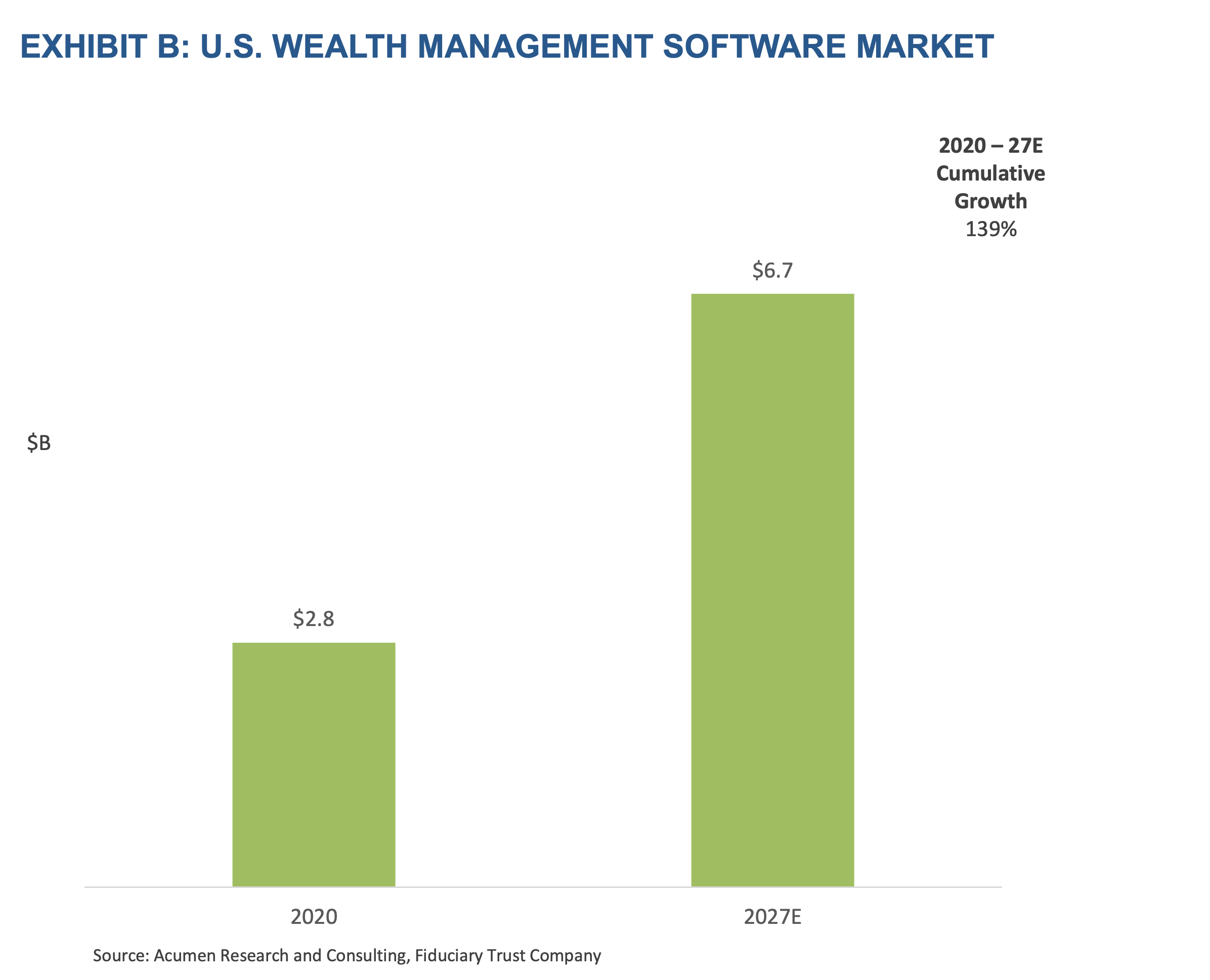

Many of the “big box store” custodial providers are a good fit for a firm that is just starting out, but three to five years in, as these new RIAs grow and achieve success, they find that they are outgrowing their custodial relationship. In the beginning, it was comforting to be provided with account management and trading tools; however, convenience comes at a cost. Lack of flexibility in the portfolio management and performance reporting engines drives firms to explore their own options. Reporting is critical to how you tell your story to your clients each quarter. Shortcomings in the out-of-the-box solutions are driving firms to consider additional providers, such as Advent, Orion, and Addepar to take client reporting and portfolio management and trading to the next level. As a result, the size of the overall global wealth management software market is expected to grow nearly 140% between 2020 and 2027, according to a report by Acumen Research and Consulting.

However, as a captive to the brokerage custodian’s platform, RIAs often find it difficult to integrate and find support for new systems that are purchased separately. Facing an inability to select the best of breed technology can hamstring a firm’s growth and their ability to relay their value proposition to their clients.

The other challenge that can become glaringly evident as your firm acquires higher-net-worth clients is something that previously seemed simple: trading. At first, having a one-stop-shop for custody and brokerage can seem like a good deal. However, a firm quickly learns that trading away from that custodian is not only costly to the client, but operationally difficult as it is not supported in the order management platform. So what if, in acquiring a sophisticated client, the issue of best execution is raised? It is not possible to guarantee best execution without the use of, and comparison of, multiple brokers. Another concern can be a cost item for the firm itself; with an ability to spread around commission dollars across a stable of brokers, valuable research can be obtained as a result of your business with that broker. The custodian may have research available, but your firm will have to pay for it out of pocket.

In the brokerage-custodian space, mega firms such as Fidelity, Schwab, TD Ameritrade, and Pershing often lack core key services required to manage assets for high-net-worth clients.

These missing services can include capabilities like true principal and income trust accounting, the ability to hold foreign assets, and the willingness to provide custody services for foreign clients or entities. The more assets a client has, the more complex their financial picture becomes, and the more they will require these services.

That’s just an account structure perspective. Along with the rise in the sophistication of the account structure, there is also an increase in the sophistication of the asset allocation beyond the traditional 60/40 equity/fixed income split. Again, the accounting for alternative assets, private placements, derivatives, or anything else considered outside of the box is often not supported by the big box providers.

Opportunities to Differentiate Your Business

To differentiate your firm from the thousands of others in the market, it is critical to find ways to ensure that your firm is positioned to be your client’s first call when wealth planning issues arise.

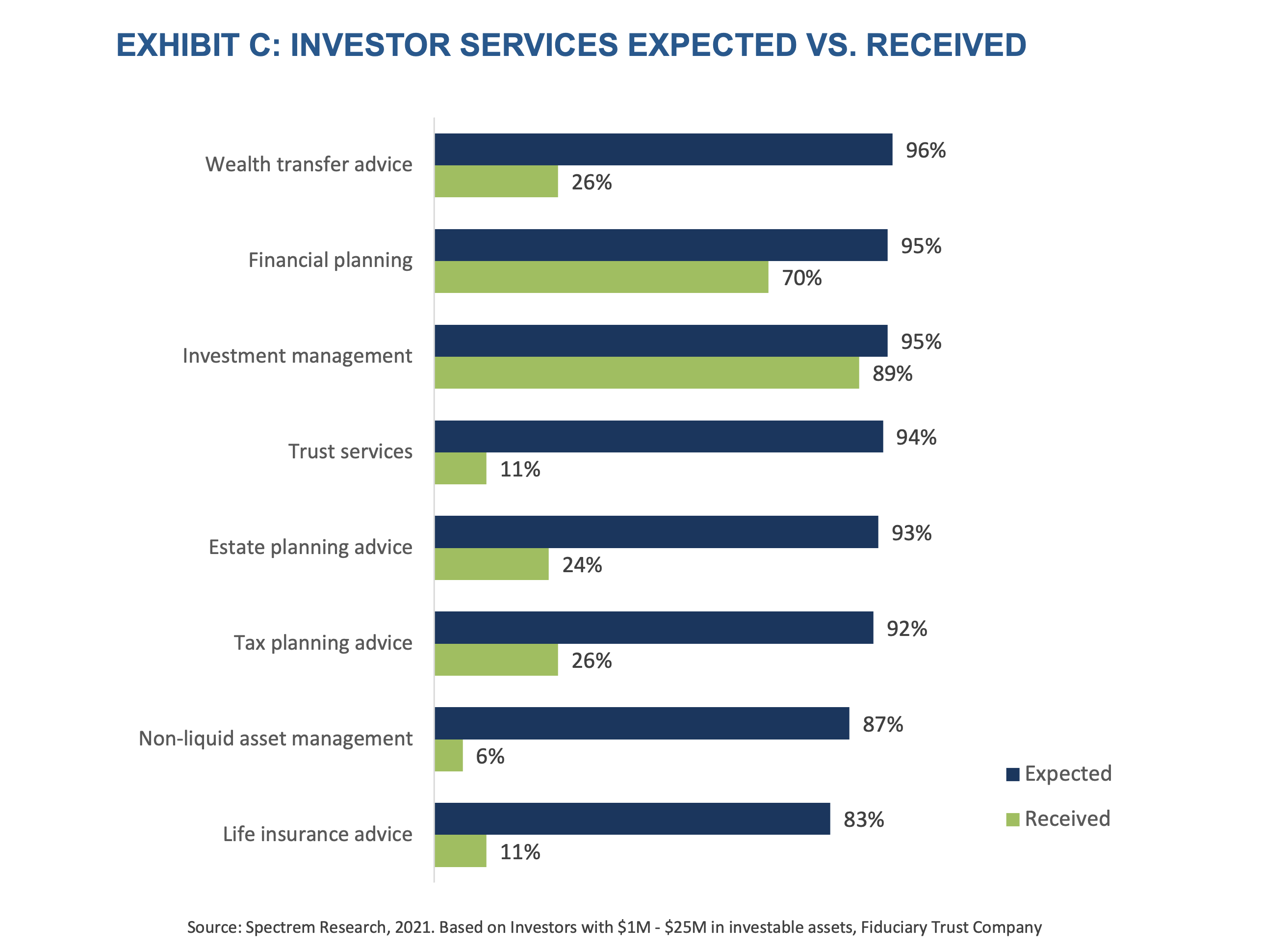

This requires providing the ancillary services that high-net-worth clientele need to support their financial and personal lives. According to a Spectrem Group study, most high-net-worth clients are not receiving all of the services they expect from their financial advisor, including wealth transfer advice, trust services, tax advice, and non-liquid asset management.1

One way to move beyond simply picking stocks and bonds for clients is to delve into the area of financial planning by providing trustee services. Choosing a corporate trustee is a prudent measure for any high-net-worth individual or family to ensure the permanence of their financial plan. However, this is an area that brokerage custodians truly struggle to offer. At best, a client may be handed a list of “preferred providers” or cobbled-together partnerships, but the overall process can be quite disjointed.

Given that a corporate trustee makes distribution and other decisions that can impact a beneficiary’s wellbeing, do you want your most highly valued clients calling an 800 number – the same number your firm calls for all other matters of business?

In the arena of fiduciary services, it is imperative that the wishes of the grantor are understood and respected, and that trust distributions, sometimes critical to the wellbeing of the beneficiary, are not caught in the months-long bureaucracy of a distant trust committee, or simply afforded a “case number” like all of the custodian’s other requests.

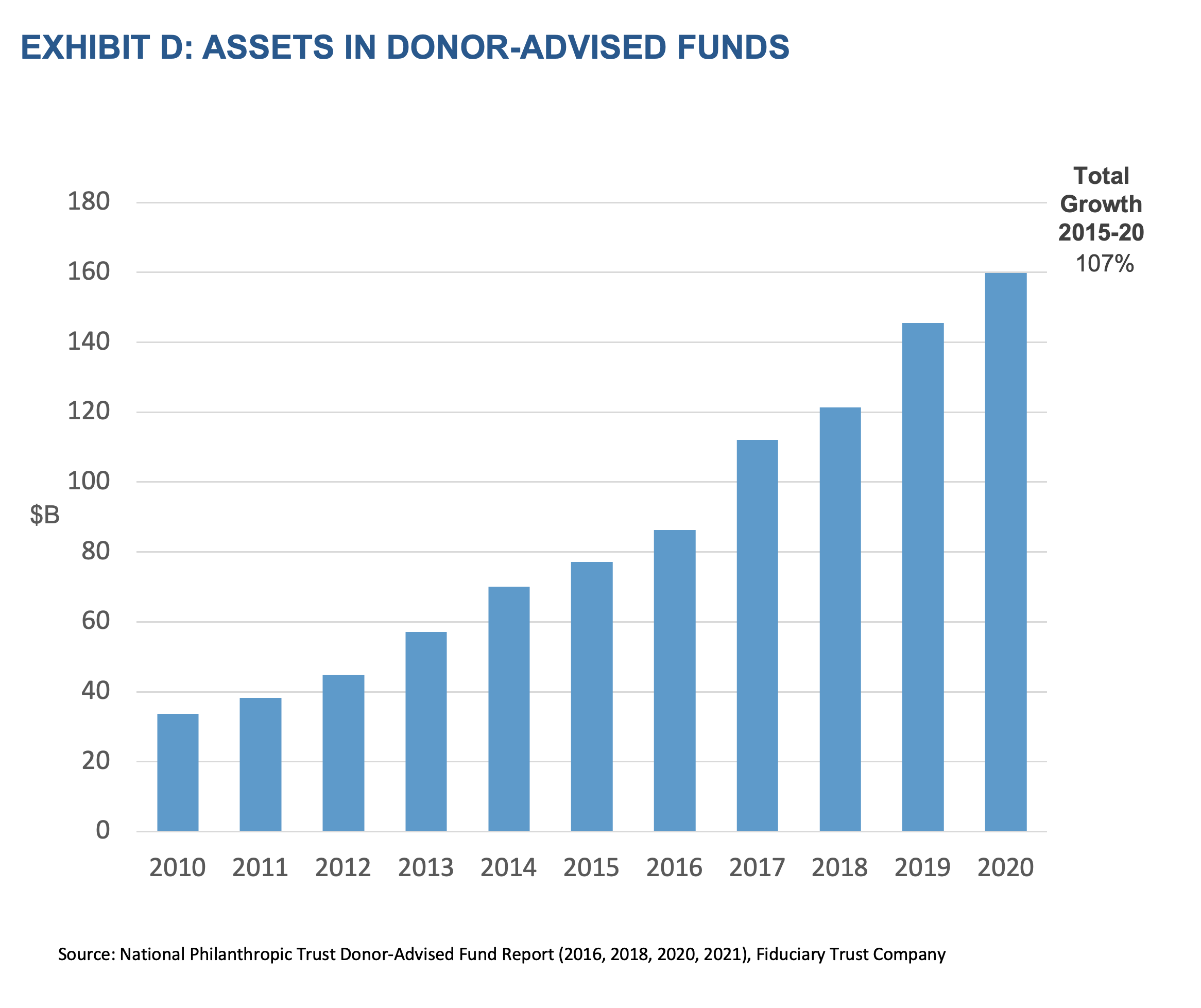

Another key characteristic of a high-net-worth individual or family may be the importance of their philanthropic pursuits. A popular avenue these days can be a donor-advised fund (DAF), which has seen near-exponential growth industry-wide over the last five years alone.

As one would expect, many brokerage custodians offer DAFs. However, their solutions can be inflexible in investment options, the types of contributions they will accept, and the channels through which donors can request grants. In addition, you and your client may not receive the level of personal service that you are expecting.

Finally, partnering with a custody provider that is a sound partner and source of advice can be a critical component to your firm becoming the trusted advisor of your high-net-worth clients. Tax planning, estate planning, and other complex matters require real-time expertise from a live person, not a website of “helpful” links and generic industry whitepapers.

Taking the Next Step

In contrast to these trends, Fiduciary Trust Company’s custody business has a long history of focusing on the superior client service that independent RIAs require. As a private and independent firm, Fiduciary offers both a boutique and an open-architecture custodial experience that is highly adaptable to the needs of each RIA and their clientele.

We leverage leading-edge technology to deliver a high-touch and personal client service that never tries to place clients in our “box.”

We seek to complement an RIA’s own relationships with the individuals and families it serves by providing timely, agile solutions.

We accomplish this by offering all the same services as a typical mega-custodian, but each is performed by Fiduciary employees who can collaborate in person and on a daily basis. Our streamlined and cohesive structure allows all tasks to be performed quickly, efficiently, and—most importantly—accurately, meeting the expectations of the high- and ultra-high-net-worth investor.

Fiduciary Trust provides so much more than custody: we offer the trust (including directed trusts and access to New Hampshire’s advantageous trust laws), fiduciary, tax, and donor-advised fund services that enable our RIA clients to transform themselves from a start-up firm to a next-level financial services provider.