This material highlights a number of key IRS and other planning amounts for 2024. It is designed to be a reference tool for clients and advisors to inform this year’s planning. Individuals should consult their tax and other advisors before taking action on this information.

Estate and Gift Tax

Annual Gift Exclusion: Increased to $18,000 from $17,000, or $36,000 for married couples who gift split. This amount is $185,000 for a spouse gifting to a non-US citizen spouse.

Federal Estate and Gift Tax Exemption Amount: Increased to $13,610,000 from $12,920,000 per person. This is a combined $27,220,000 for a married couple. This higher exemption amount is scheduled to sunset on 12/31/2025 to effectively one-half of the inflation-indexed amount. Massachusetts estate exemption has increased to $2,000,000.

Generation Skipping Transfer (GST) Exemption Amount:Also increased to $13,610,000 per person.

Retirement Savings and HSAs

401(k) (and similar) Plan Contribution Limit: Increased in 2024 by $500 to $23,000 for those under age 50, and to $30,500 ($23,000 + $7,500 catch up) for those over age 50. Total 401(k) contributions, including employer contributions, cannot exceed $69,000 or $76,500 for those over age 50. Elective deferrals into SIMPLE plans is $16,000 in 2024, plus up to $3,500 catch up contributions for those over age 50.

Traditional IRA/Roth IRA Contribution Limits: Increased to $7,000 for those under age 50 and $8,000 ($7,000+ $1,000 catch up) for those over age 50. Contributions for a given year can be made during that year or until April 15th of the following year, but cannot exceed the limit even if contributions are split between a traditional and Roth IRA. There is no longer an age limit for making IRA contributions, but contributions cannot exceed earned income, including the earned income of a Married Filing Jointly (MFJ) spouse. Backdoor Roth IRA conversions are allowed under current law.

- Roth IRA Contribution Income Limits: In order to make a full direct contribution to a Roth IRA, incomes must be below a certain level, with the ability to make contributions phasing out quickly once that level is reached. The income phase-out ranges are: Single and Head of Household (HOH) – $146,000 to $161,000, MFJ – $230,000 to $240,000, and Married Filing Separately (MFS) – as low as $0 to $10,000.

- Traditional IRA Contribution Income Limits: Contributions to a traditional IRA can be tax deductible or after-tax. If neither a person nor their spouse is covered by a retirement plan at work, then their traditional IRA contribution will be tax deductible. If either a person or their spouse is covered by a retirement plan at work, then their contribution is only fully deductible if their Modified Adjusted Gross Income (MAGI) falls into one the following: Single or HOH – below $77,000 or MFJ – below $123,000. (MAGI is basically Adjusted Gross Income (AGI) with non-taxable items, like muni-bond interest, added back.)

Required Minimum Distributions (RMDs): Now begin at age 73 for those born after 1950. Changes to the life expectancy tables lowered RMD amounts beginning in 2022. Beginning in 2033, RMDs will be required beginning at age 75 for those born after 1959 (and maybe during 1959, depending on a needed technical correction to the legislation.)

Inherited IRAs: As a general rule for any IRA inherited where the owner passed after 2019, all assets must be distributed by December 31st of the 10th year following the year of the decedent’s death unless the beneficiary is a member of a special class, such as being a surviving spouse. For those subject to the 10-year distribution, whether there are RMDs before the ultimate distribution date is generally dependent on whether the participant died before or after their required beginning date (RBD), with the RBD being April 1st of the year following the RMD age they are subject to based on their year of birth. If the IRA owner died before their RBD, RMDs are generally not required during the 10-year window, but if they died after their RBD then RMDs are required during the 10-year window. Distributions can generally be taken earlier if desired.

Learn More: “Naming a Trust as an IRA Beneficiary”

Learn More: “SECURE 2.0 Encourages Retirement Savings”

Health Savings Account (HSA) Contribution Limits: $4,150 for a person and $8,300 for a family, with an additional $1,000 allowed for those over age 55. The High Deductible Health Plan (HDHP) minimum deductibles are $1,600 for a person and $3,200 for a family, with maximum out-of-pocket costs of $8,050 for a person and $16,100 for a family.

Income Taxes

Federal Standard Deduction Amounts: MFJ – $29,200 (up $1,500), HOH – $21,900 (up $1,100), Single and MFS – $14,600 (up $750)

Top Ordinary Income Tax Rate: Remains at 37% and applies to a HOH’s and single taxpayer’s ordinary income over $609,350, MFJ ordinary income over $731,200, and trusts and estates ordinary income over $15,200.

- The Massachusetts Millionaires Tax of an additional 4% applies to taxable income over $1,000,000. Beginning in 2024, the filing status for a Massachusetts personal income tax return must match the federal filing status used by that individual.

Medicare Surtax: The 0.9% tax applies to wages and self-employment income over the following thresholds: Single and HOH – $200,000, MFJ – $250,000, and MFS – $125,000.

Long-term Capital Gains (LTCG) Tax Rates: The 15% and 20% LTCG tax rates apply above the following thresholds: Single – $47,025 and $518,900; MFJ – $94,050 and $583,750; HOH – $63,000 and $551,350; Trusts and Estates – $3,150 and $15,450. When LTCG is below the 15% minimum, the tax rate is 0%.

Net Investment Income Tax (NIIT): The 3.8% NIIT applies when MAGI exceeds a threshold, with the tax calculated on the lesser of net investment income or the amount by which MAGI exceeds the threshold. The thresholds are: MFJ – $250,000, single or HOH – $200,000, and MFS – $125,000. Under current law this does not apply to trade or business income. Note that the NIIT applies to a trust or estate’s undistributed net investment income with a threshold of $15,200.

Safe Harbor Estimated Tax Percentage: 90% of 2024 tax liability, or 110% of prior year tax liability for those with AGI over $150,000 and 100% of prior year tax for those with AGI up to $150,000. The Massachusetts safe harbor is 100% of prior year tax or 80% of current year tax.

Charitable Giving

Qualified Charitable Distributions (QCDs): Any traditional IRA owner over age 70½ can distribute up to $105,000 per year to qualified charities, which is an increase from $100,000 and still does not include donor-advised funds or private foundations. Amounts distributed count towards any RMD, can exceed the RMD amount, and are not included in ordinary income. To avoid taxation, the IRA owner must be over age 70½ on the date of the QCD. If you make IRA contributions after age 70½, those amounts are the first paid out and do not qualify for QCD treatment.

Deductions: Gifts to non-private foundations (such as public charities and donor-advised funds) can be deducted at up to 60% of AGI for cash gifts, including up to 30% of AGI for gifts of appreciated securities. These limits are 30% and 20%, respectively, for gifts to private foundations. Gifts in excess of the deduction limits can be carried forward for up to 5 years, using what is essentially a last in, first out (LIFO) method in future years for carryover calculation purposes. This is addition to QCDs noted above.

Social Security & Medicare

Social Security Wage Base: For 2024 is $168,600 with a 6.2% tax rate for both employers and employees. The Medicare tax rate of 1.45% applies to all wages for both employers and employees. The 0.9% Medicare Surtax noted above is in addition to this.

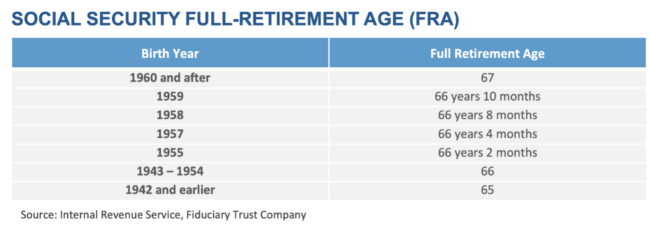

Social Security Full-Retirement Age (FRA): FRAs are based on year of birth as follows:

- Once an individual reaches FRA there is no earnings limit. The maximum Social Security benefit at FRA for 2024 is $3,822 per month, but waiting to claim until age 70 will result in a higher benefit if claiming on your own record. Regardless of FRA or when Social Security is claimed, Medicare should begin at age 65, or earlier if disabled, unless an individual has other creditable coverage or special circumstances.

Social Security Benefits COLA Adjustment: Was 3.2% for 2024, which is more normalized compared to the 8.7% COLA for 2023.

Medicare Premiums: Are based on MAGI, with an individual’s 2024 Medicare premium based on their 2022 tax return. If someone’s income has materially changed due to a “life-changing event,” such as retirement, divorce, or marriage, Form SSA-44 can be filed to request a reconsideration of the Income-Related Monthly Adjustment (IRMA) amount. For 2024, IRMA is relevant for single taxpayers with 2022 MAGI over $103,000 and for MFJ with MAGI over $206,000. Part B premiums escalate from $174.70 per month to as high as $594.00 per month, per person. IRMA also applies to Part D premiums, with monthly costs ranging from zero to $81.00 per person in addition to plan premiums.

If you have any questions about how these items could impact you or what steps you should consider, please reach out to your tax or planning advisor. Your Fiduciary Trust Officer is also available to discuss these concepts with you.

Release date: 11/29/2023