October 2, 2023

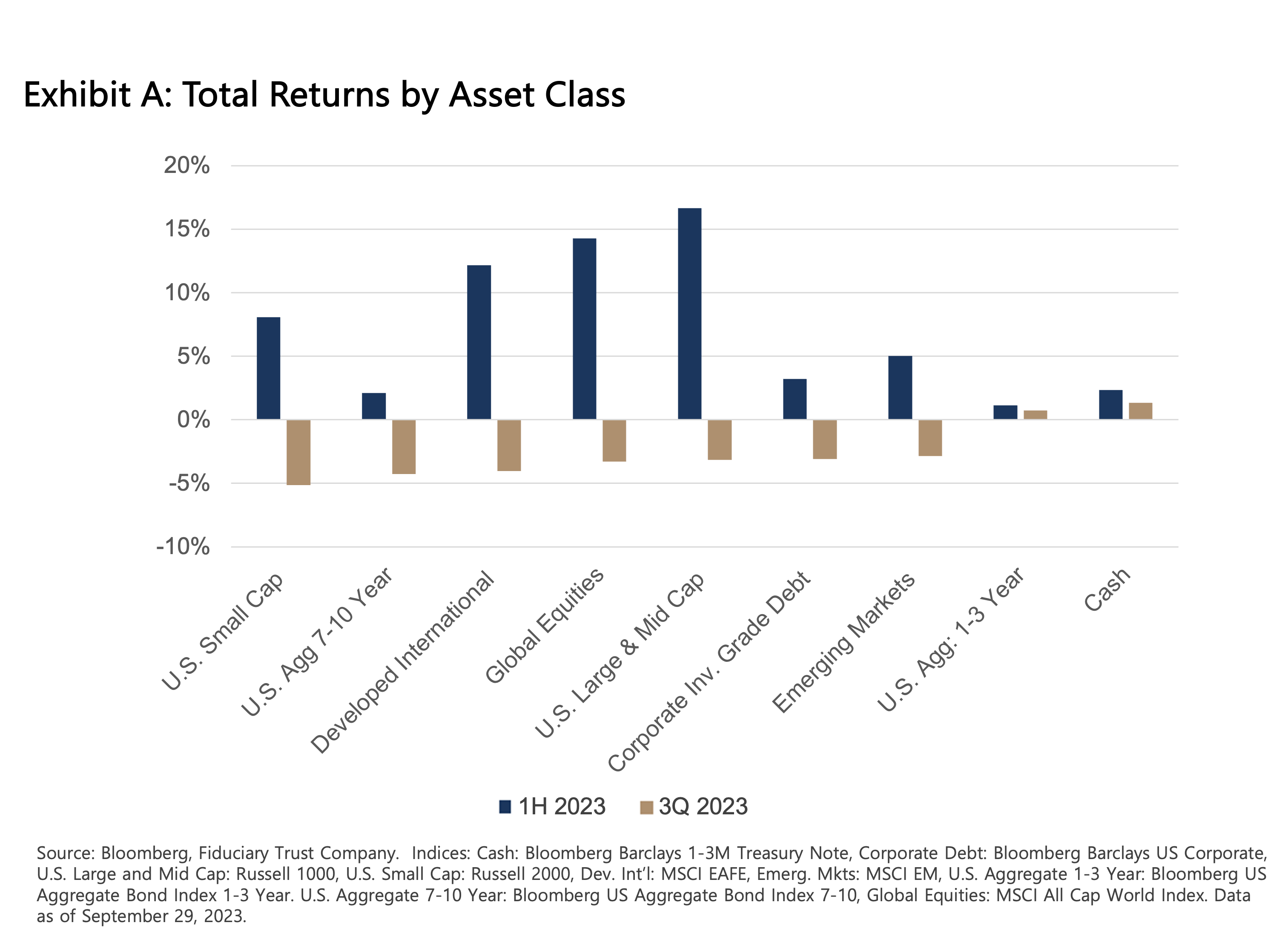

The market run of the first two quarters failed to repeat during the third. Global equities declined 3.3% with U.S. stocks both large and small falling 3.3% and 5.1%, respectively.1 International developed and emerging markets slid by similar amounts as well.2 Fixed income markets also struggled as investment grade issues fell across the quality and duration spectrum. The bond market sweet spot during the quarter resided in the short end (1-3 year) section of the curve. Perhaps a pause in the bullish sentiment was inevitable after the equity market’s exceptionally strong showing during the first half of the year.

Exhibit A

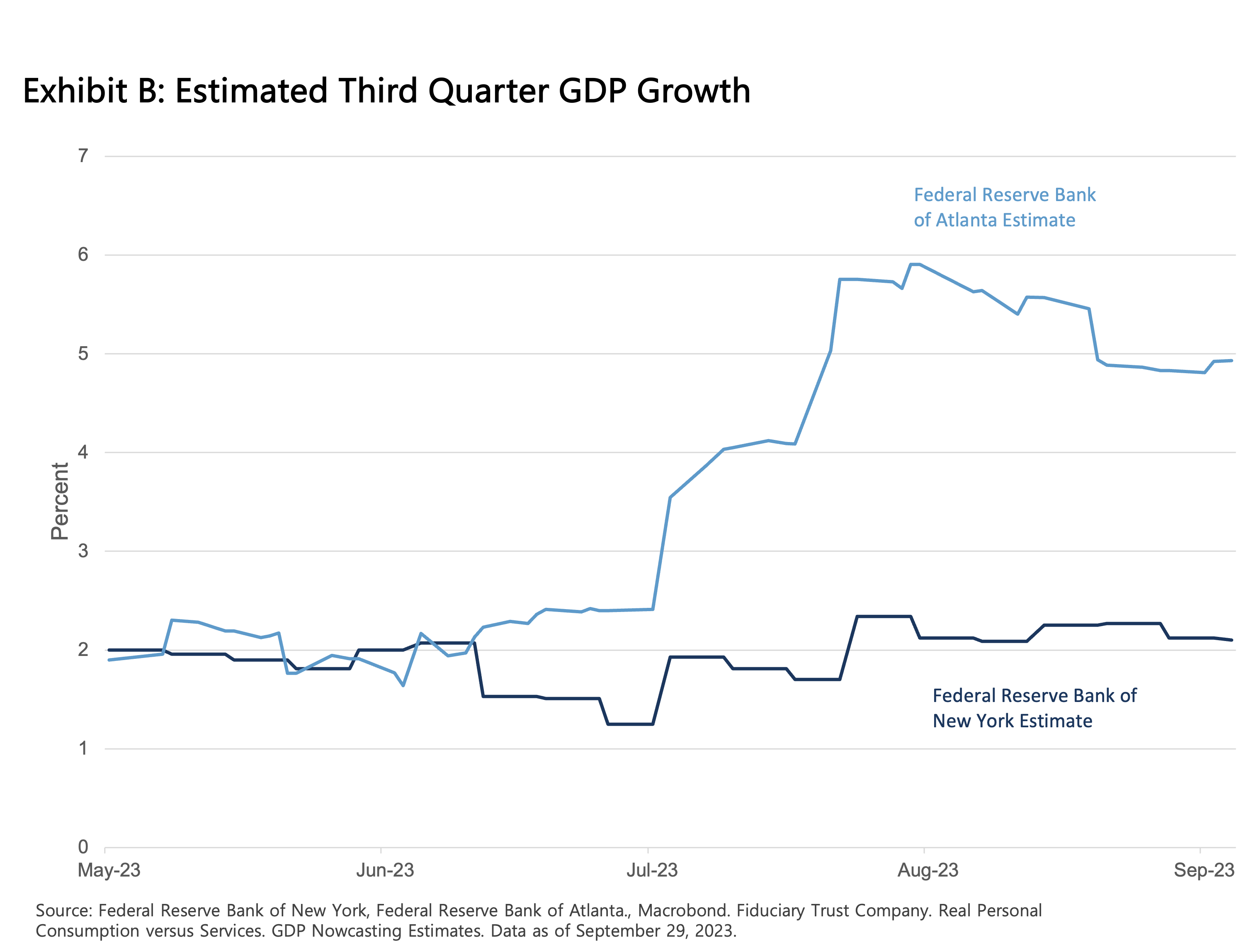

The hope of many is that the third quarter market performance is a pause that refreshes and that the march higher can resume as profit estimates for 2024 crystalize and the economy grows. And grow it does. The earlier consensus view that a recession would unfold during second half of the year looks wildly off the mark. Judging from various central bank models that track economic activity in real time, third-quarter growth will range somewhere between 2% and 5%. Moreover, while employment growth has slowed somewhat, the U.S. continues to grow the labor force—adding roughly 344,000 jobs in July and August.3 As we asserted in our last communique, recessions without rising unemployment are, by construction, nonsensical. Unless and until a reversal in the labor market occurs, recession is a fear for another day. Perhaps another year.

Why then, with an economy that is growing, a labor market that is expanding, and corporate profits that are rising, is the market visibly unsteady? Indeed, it is wobbling in the face of ideal conditions. Investors apparently are reckoning with the fact that returning inflation to the magical 2% target of the central bank will require more time with higher interest rates than earlier thought. From our perch, we always held the view that the effort was going to be a long one, which ruled out any easy and short resolution to the problem. Inflation is the genie that, once released, is hard to return to the bottle.

Examining inflation regimes and comparing the last episode, which occurred 50 years ago, to the current one reveals how long, difficult, and cruel the effort is. The Great Inflation of the 1970s really spanned from the latter 1960s to the early 1980s and involved multiple periods of elevated inflation punctuated by episodes of eye-watering surges in prices. Central bankers struggled to execute a coherent and durable response to the inflation, which created a negative feedback loop that entrenched the existing inflation. Fast forward to now and central bankers are facing inflation that is running too high and receding to targets too slowly. The prominent lesson of the 1970s inflation is to keep fighting it until the job is done, regardless of the collateral damage it causes. Then, the collateral damage was recession. Now, it is the threat of one.

We are moving into the fourth year in which inflation has either been on a trajectory or a level that has been worrisome. It is hard to see how a return to the pre-Covid status quo ante is near. The surge in energy prices (Brent crude up 12.5% from the start of the year), strikes in the automotive and entertainment sectors, and a general shortage of labor all threaten to reinforce elevating prices.

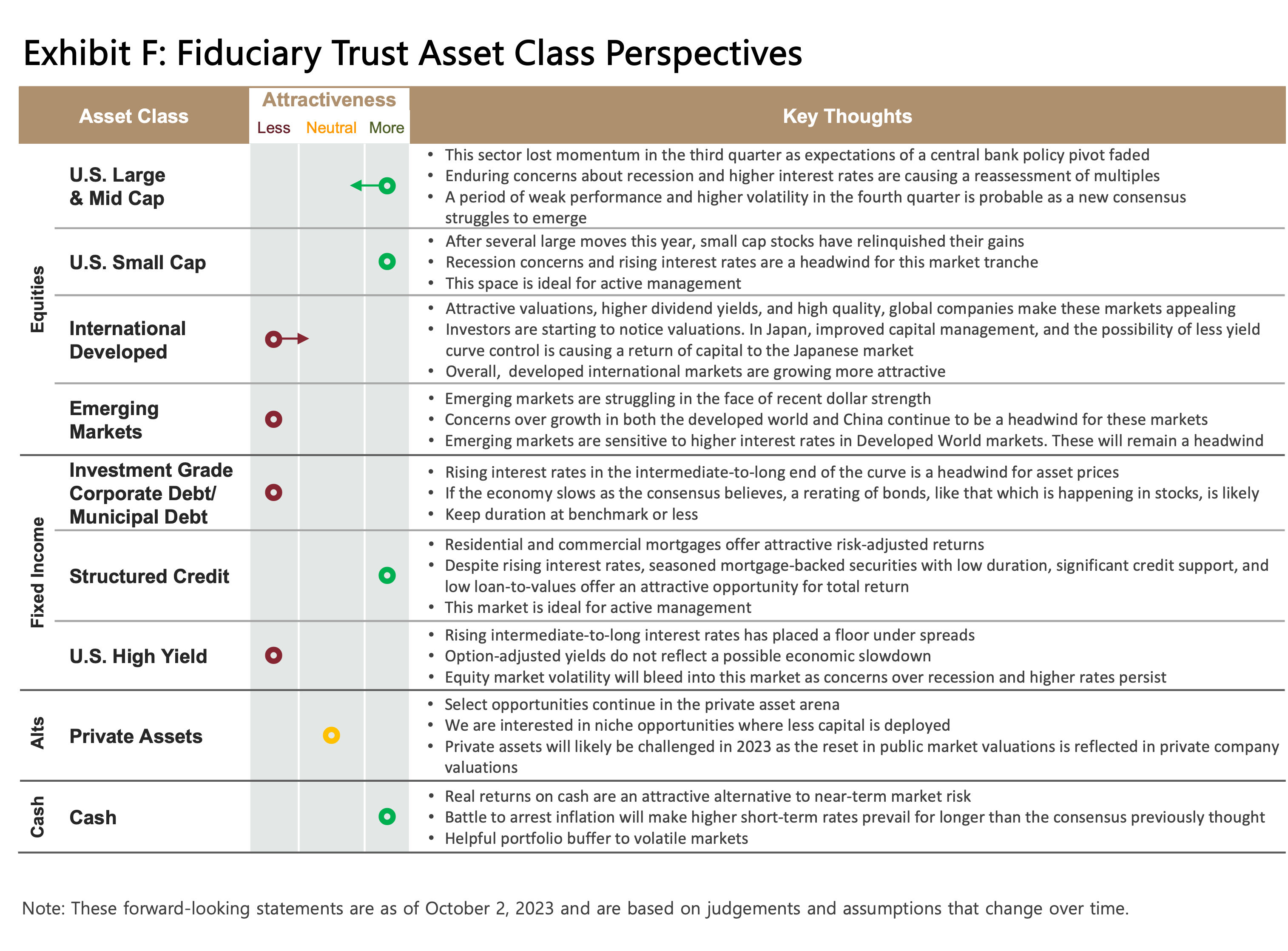

If a victory over inflation is not imminent, then neither is a reversal in the price of money. With short-term Federal Funds interest rates roughly 5.5% and likely to remain so, the hope for a near-term policy pivot from the Federal Reserve is getting binned. This, in turn, is forcing a reappraisal of price earnings multiples. It is one thing to have a 20 multiple on earnings if interest rates move from 5% to 3.5%. It is an altogether different calculation if interest rates remain elevated or could possibly go higher. In the world of higher interest rates, lower multiples generally prevail, as investors have the option of choice in where to invest their capital to protect against the looting of purchasing power that inflation causes. With investors now earning more than one percent over the inflation rate on cash, they no longer need to feel the compulsion to do something, anything, to protect purchasing power. Welcome to the world of positive real interest rates.

The Great Reassessment

Whether the central bank will raise interest rates again this year remains an open question. A cold winter, emboldened Russia, and an opportunistic Saudi Arabia could be the catalyst for $100+/barrel oil, which, if sustained, will feed into both core and headline inflation. Ultimately it will likely sustain higher interest rates for even longer. As an appreciation for this state of play becomes more commonplace, it is reasonable to expect the great swath of investors to begin questioning the assumptions on which they built their bullishness. It appears this process began unfolding during the third quarter and is likely to continue into the fourth. As this unfolds, conditions are ripe for a moderate intra-year decline in the market of more than 10%. To date the drawdown stands at 7.8%.

It is also worth noting that this reassessment of interest rates during the closing days of the quarter appears to have catalyzed a reconsideration of the high-flying, high-valuation darlings of this year. The Magnificent Seven, which we discussed in our last letter, have stumbled, falling 5.5% versus the average stock’s 3.3%.4

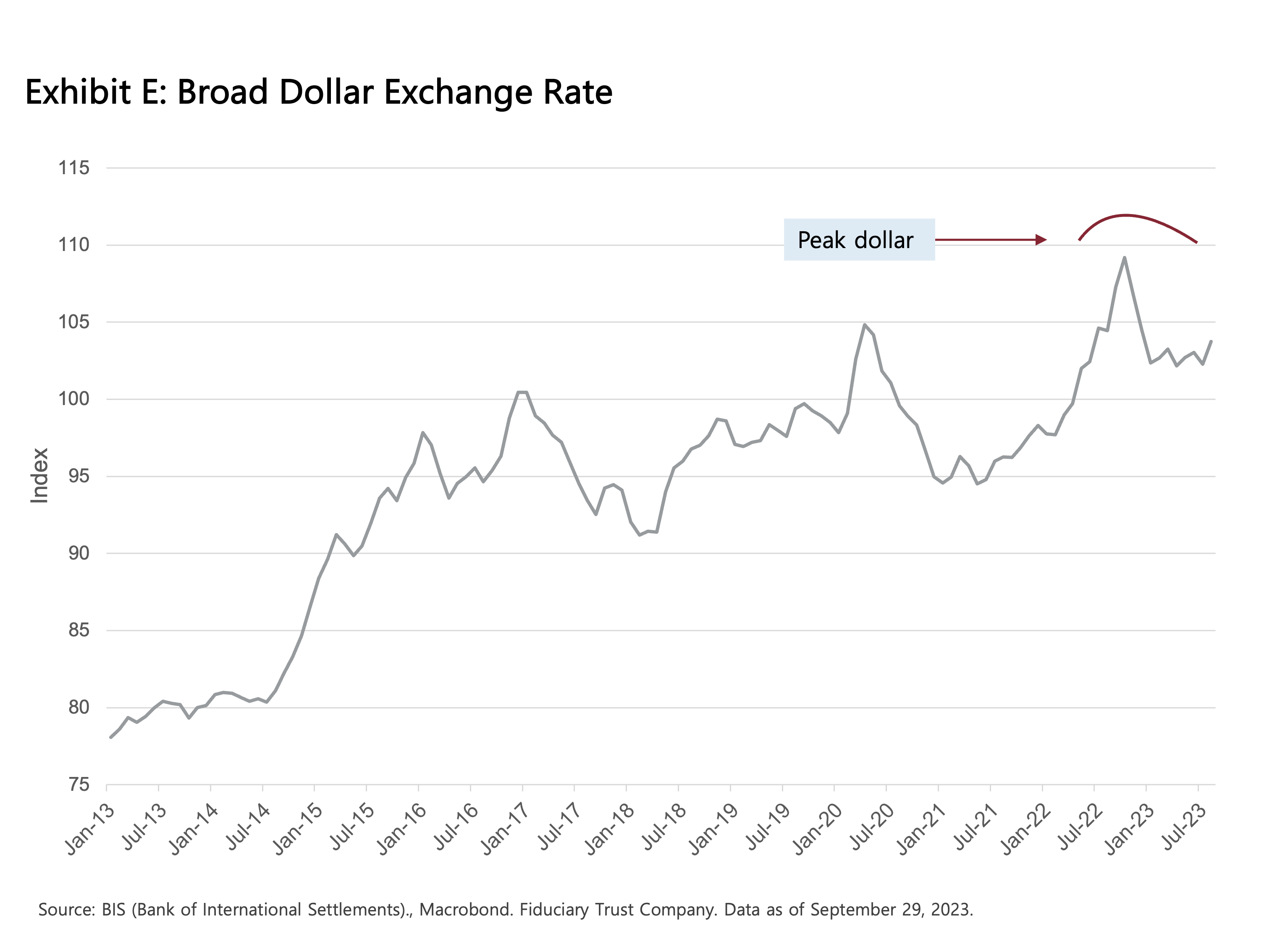

A traveling companion of higher interest rates is a strong currency. To be sure, the dollar’s run since mid-July has been impressive. Recent strength reflects how investors think about the level and direction of relative interest rates. Earlier this year, we asserted that we have likely seen peak dollar during this cycle. The recent run does little to make us reconsider. The large, important central banks—such as the Bank of England, the Bank of Japan, and the European Central Bank—have all leaned into fighting their respective bouts of inflation. The Bank of Japan continues its program of loosening yield curve control, and the Bank of England and European Central Bank have held the line on rates even though economic concerns mount. Both the level and direction of relative interest rates between the U.S. and its partners are not conducive to a retesting of the highs of last year.

However, there is the ever-present exception: should a globally significant event occur, like a war or a major financial player becoming imperiled, another level of dollar strength could unfold. These tend to be transitory as they represent a flight to safety and not economically based movements.

As I write this note, the sad and familiar battle besieging Congress to execute the most basic function of government, creating and executing a budget, rages. While an eleventh-hour bipartisan deal was struck to continue funding operations for another 47 days, it seems clear that Congress is incapable of passing a proper spending and taxing plan or a weak simulacrum of one. Sadly, this is now a normal occurrence of what should be an abnormal situation. If past is prologue, some sort of Frankenstein-like deal will be sewn together that does little to resolve the Federal Government’s problem either spending too much or taxing too little or both depending on one’s perspective. Investors will likely move beyond this latest episode, averting their eyes in embarrassment as they pass.

However, fallout from this theater of the absurd might finally follow. This time, Moody’s, the last remaining credit rating agency to maintain the AAA rating for the United States, may finally relent and follow the other agencies that have downgraded our sovereign rating. Additionally, investors may reconsider their willingness to underwrite this dysfunction and start demanding durably higher interest rates on longer-dated treasuries. For now, a downgrade would be more symbolic than economic, but it does give those looking to diversify currency exposure ample reason to do so.

Below is a link to the 2023 Q4 Fiduciary Perspective, which include the Market Outlook.