People love stories. Whether listeners are sitting around a campfire, at the family dinner table, in the college lecture hall, or listening to TV/radio/streaming, a good story transports them by grabbing hold of their attention through the storyteller’s narrative. Stories are the way we learn, construct views of the world, entertain, and motivate. Without a strong narrative, stories are just a chinwag. The narrative is the skeleton on which plot, conflict, and characters hang. It’s no surprise that investors love stories: stories about economics, markets, stocks, bonds, real estate, digital thingamabobs, and so on. Remarkably the big story in the markets now is one that is missing a compelling narrative. It goes beyond the obvious lack of a consensus. Rather, the current narrative feels tired, familiar, and increasingly uncertain.

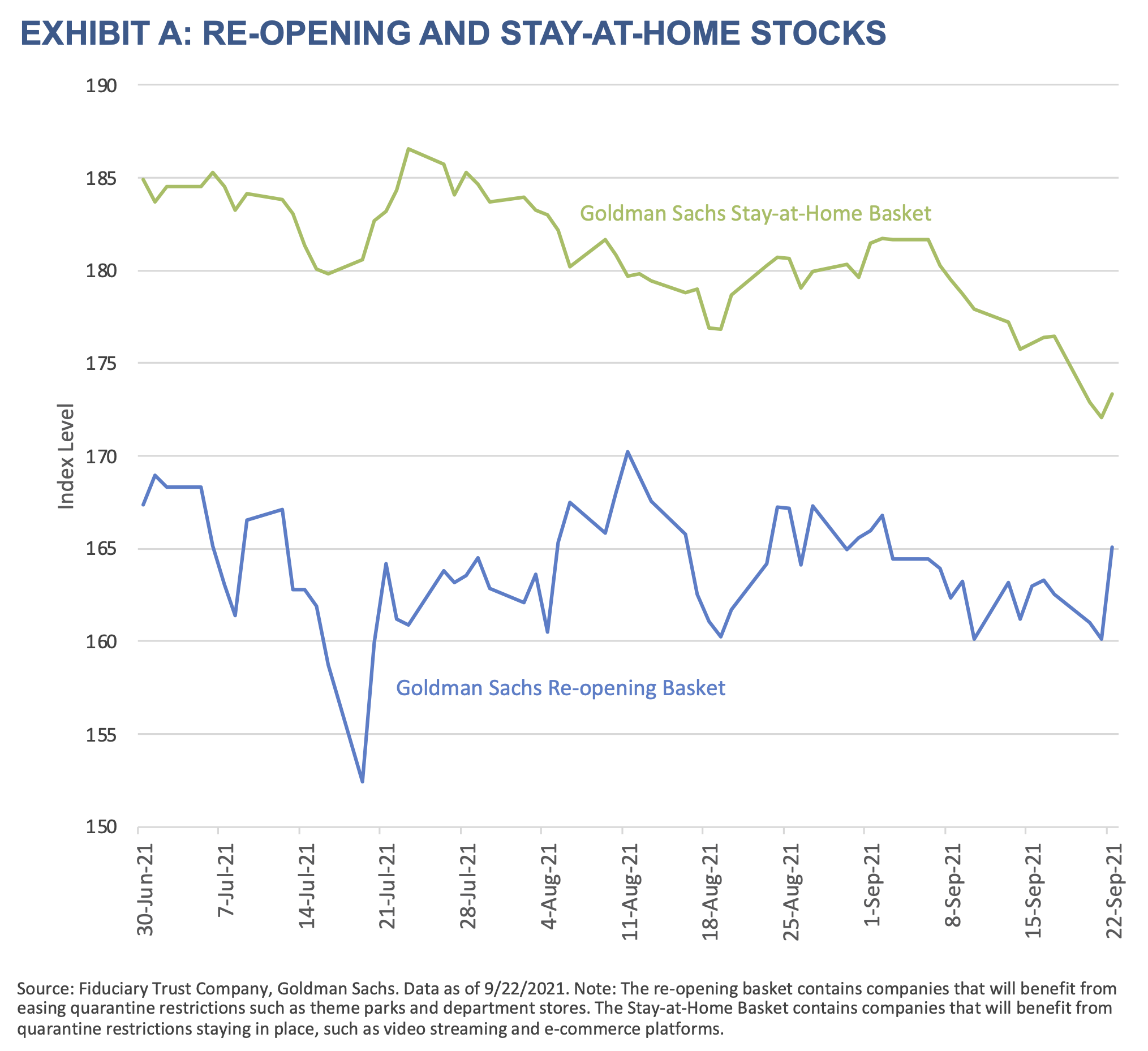

Perhaps this narrative malaise is a function of the environment in which it operates. The promise of vaccines vanquishing the nasty bug has been postponed due to the one-two punch of mutation and vaccine hesitancy. This delays a return to the normal rhythm of pre-pandemic life. Thankfully, the economy appears to continue its recovery, but shortages of labor and material hinders it. Fiscal, tax, and monetary policy all seem in various states of flux, which collectively fogs the future on which the commentariat opines. A well-intentioned but messy conclusion to America’s military involvement in Afghanistan raises questions about Uncle Sam’s future role as a global leader against the rise of the emerging collective power of China, Iran, and Russia. The ghost of Sir Halford Mackinder stalks thoughtful souls in Foggy Bottom.1 Finally, questions remain about how our post-COVID work life will look. Work from home, hybrid schedules, and a full return to the office are all possible future work configurations that help shape both narrative and outlook. Investor fatigue is apparent when examining the Goldman Sachs Re-opening and Stay-at-Home stock baskets, both of which are down for the quarter.

It is from the threads of these developments that the warp and weft of a narrative is woven.

The First Thread: Economic

Mercifully, economic growth continues around the world, though that growth is shifting to a lower gear in the large economies. In the U.S., growth will likely slow in the coming quarters as the new COVID variant plagues the unvaccinated with a grim alacrity. The mandarins in China appear to be at ease with a pause in output as they attempt to clean up the leverage in the economy and recalibrate the relationship between the state and the private sector. Evergrande, the Chinese property conglomerate, will test the relationship between Chinese socialism and capitalism as it tells the old, familiar story of an over-leveraged property developer running into funding difficulties and causing problems for the markets.

The Chinese president, Xi Jinping, in making a bid for “president for life,” needs an economy working well to ensure his place. Indeed, he is the only leader since Mao to have his own philosophy or “thought.” Whether Xi Jinping Thought is thoughtful in its integration of capitalistic elements into socialism—creating a new system of economic organization—or whether it turns out to be a latter-day version of Mao’s Cultural Revolution remains an open question. In short, will Chinese socialism socialize market risk? To Western eyes, central planning by an elite ruling class has never been the hallmark of a vibrant and enduring commercial class and it will be sorely tested in resolving Evergrande’s problems.

However, mass creates gravity and with the combined economies of the United States and China totaling roughly 31% of global GDP, these countries create forces that pull along other economies, both developed and emerging.2 The International Monetary Fund reckons global growth will expand 6.0% this year and 4.9% in 2022.3 The U.S. and China will likely provide the force for pulling global growth higher.

The Second Thread: Policy

From a policy perspective, it is hard to overstate the importance of the juncture at which the United States stands. The fiscal and tax policies proposed by the Biden Administration and under consideration by Congress are massive. The $3.5 trillion program for social infrastructure and the taxes that fund it will have important implications for markets. Rising corporate and individual tax rates, global minimum taxes, potential changes to estate taxes, and sundry other proposals have the potential for jarring resets to investor behavior. Raising taxes lowers after-tax returns, which in turn causes changes in investor behavior. The uncertainty of what will pass clouds the future narrative. Investors are resilient creatures, however, and history is clear that whether the tax regime is accommodating or hostile, they find ways to make money.

Learn More: Proposed Tax Law Changes

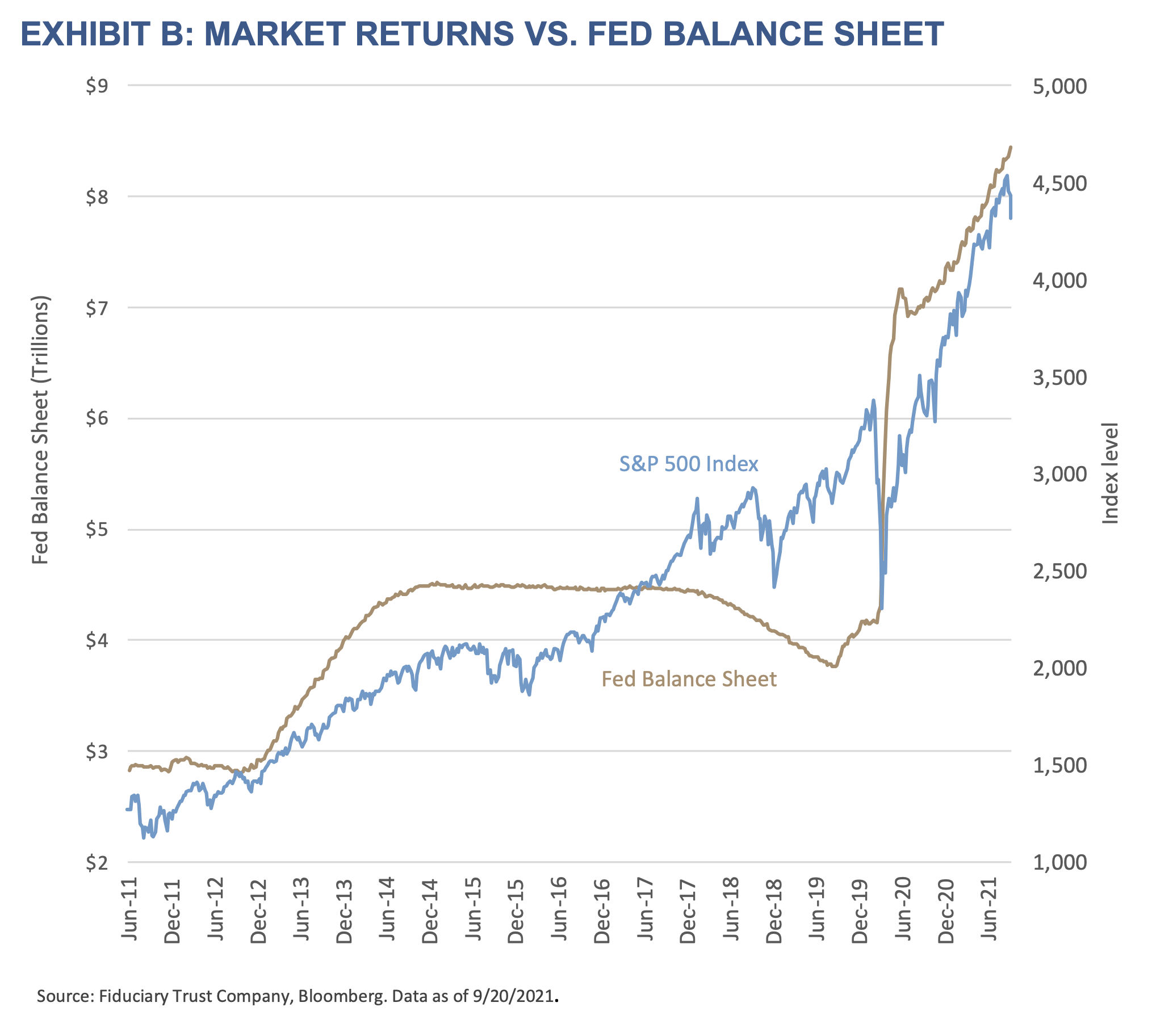

The Federal Reserve’s extraordinary monetary policy via quantitative easing has undoubtedly supported asset prices. The rise in the central bank’s balance sheet has corresponded nicely with the rise in equity and fixed income markets.

Were Yogi Berra a Fed watcher, he would likely note that the central bank finds itself at a fork in the road it must take. The direction it chooses could potentially have seismic consequences. One direction has it staying the course with asset purchases and interest rate suppression through ZIRP (zero interest rate policy). The other direction has it winding down quantitative easing as the first step to a market-determined price of money.

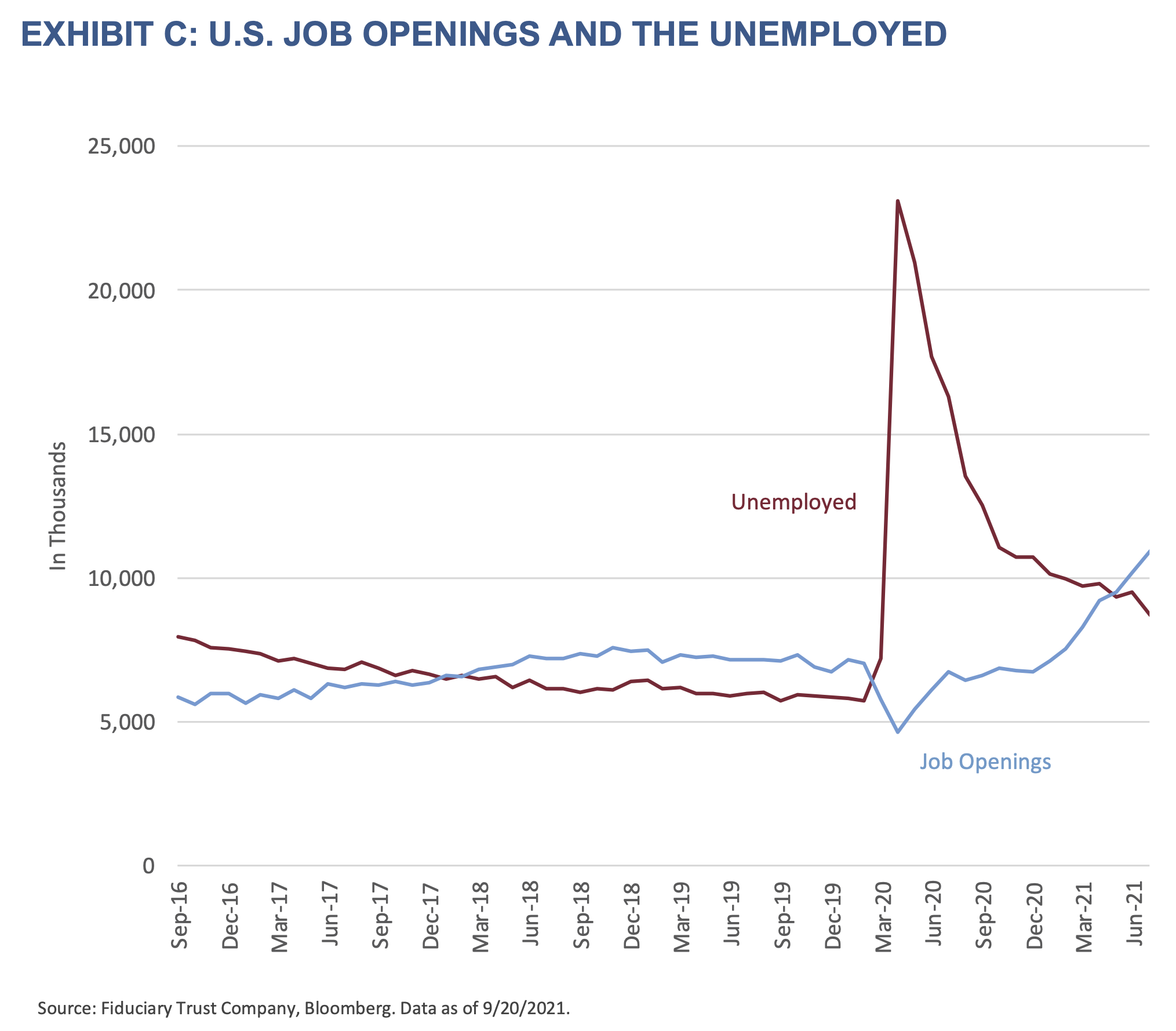

Either way, the fact that the central bank is at this place is a success story. The dual mandate of full employment and low and stable inflation appears to be essentially achieved. Currently there are more jobs looking for people than people looking for jobs (see Exhibit C). On the inflation front, consumer prices rose at an average annual rate of 1.8% over the last decade. Increases in the Consumer Price Index over the last one, two, and three years all exceeded 2.0% — the Fed’s stated target.4 Moreover, market-based expectations of inflation have been remarkably stable despite the ructions caused during the pandemic’s early days. One- and two-year moving averages of six-year inflation breakeven rates are roughly 1.8 to 1.9%, respectively.5

The Fed chairman has tipped his hand toward the direction the bank will take, and it is toward policy normalization through “tapering” of its asset purchases. When it will commence tapering, and by how much, are the questions on which investors are now fixated. How adroitly leadership can communicate its plans will ultimately be the test. The “taper tantrum” of 2013 shows that sensitive markets that are accustomed to cheap money can swoon at the thought of its removal. In the world of quantitative easing, central bankers propose and markets dispose.

Policy normalization appears appropriate given the economic snapback. However, this path of normalization is fraught with peril. Less money printed to facilitate purchases of securities in order to keep interest rates low requires that someone else step in to keep said rates low. Who that is and at what price they are enticed is hard to know. With real interest rates significantly negative, current asset prices appear high. Another complicating factor stems from pandemic-induced supply line disruptions being the source of elevated prices that feed into higher consumer inflation. The cost of getting a container box from China to the United States has risen roughly eight-fold over the last year. The freight system is so knotted that some estimate it will be several years before shipping returns to normal.6 Combine fragile supply chains with worker shortages, and conditions are ripe for rising prices.

The Third Thread: Valuation

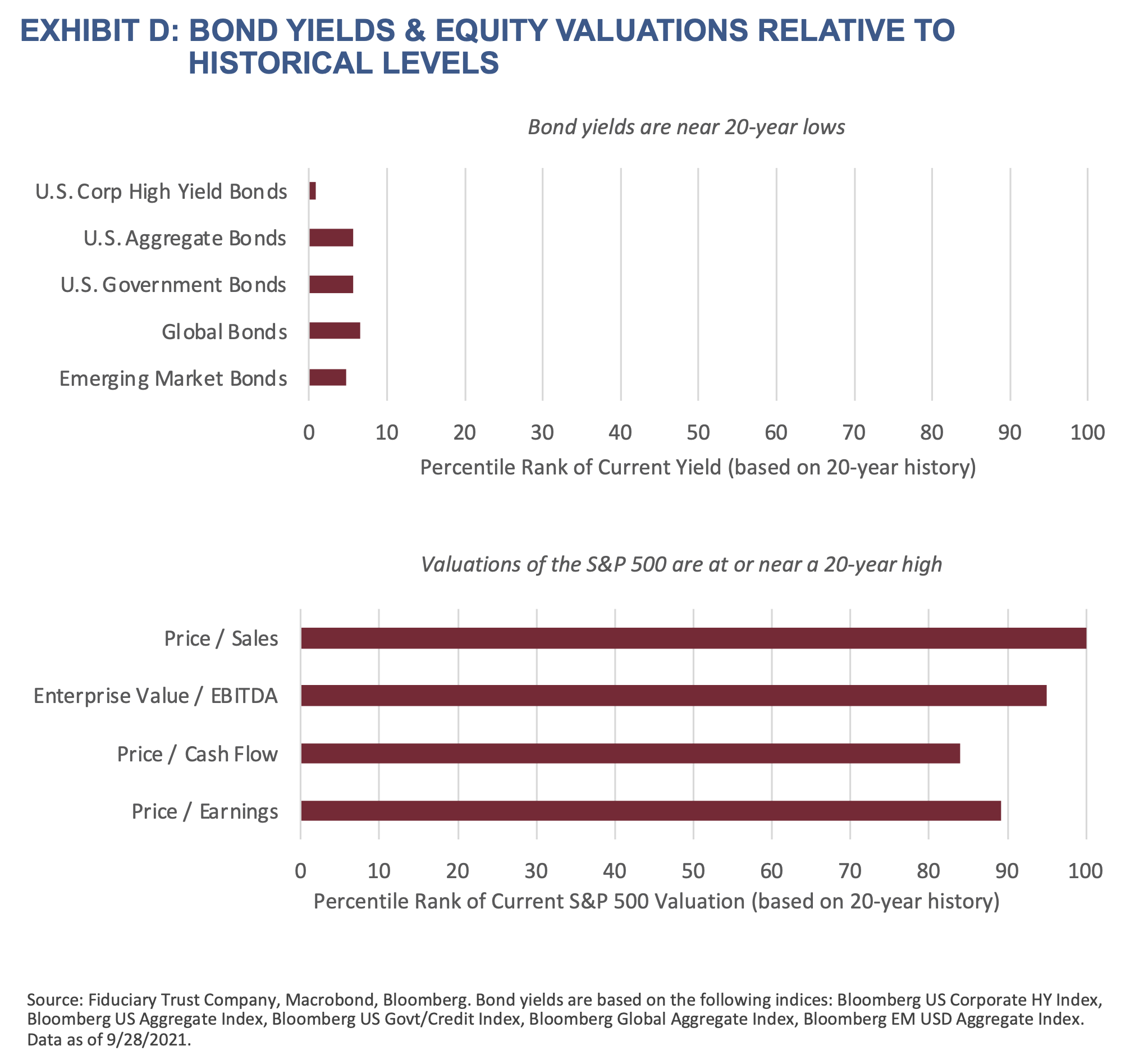

Market valuations are swollen. A clutch of valuation measures for the S&P 500 Index, which has more than $13 trillion indexed or benchmarked to it, strains under the flood of money getting invested.7 As the following table reveals, current valuation measures are at their highest or second-highest levels since 2003. In the two instances where the metric was third highest, it was due to business dislocations caused by the pandemic-related shutdown.

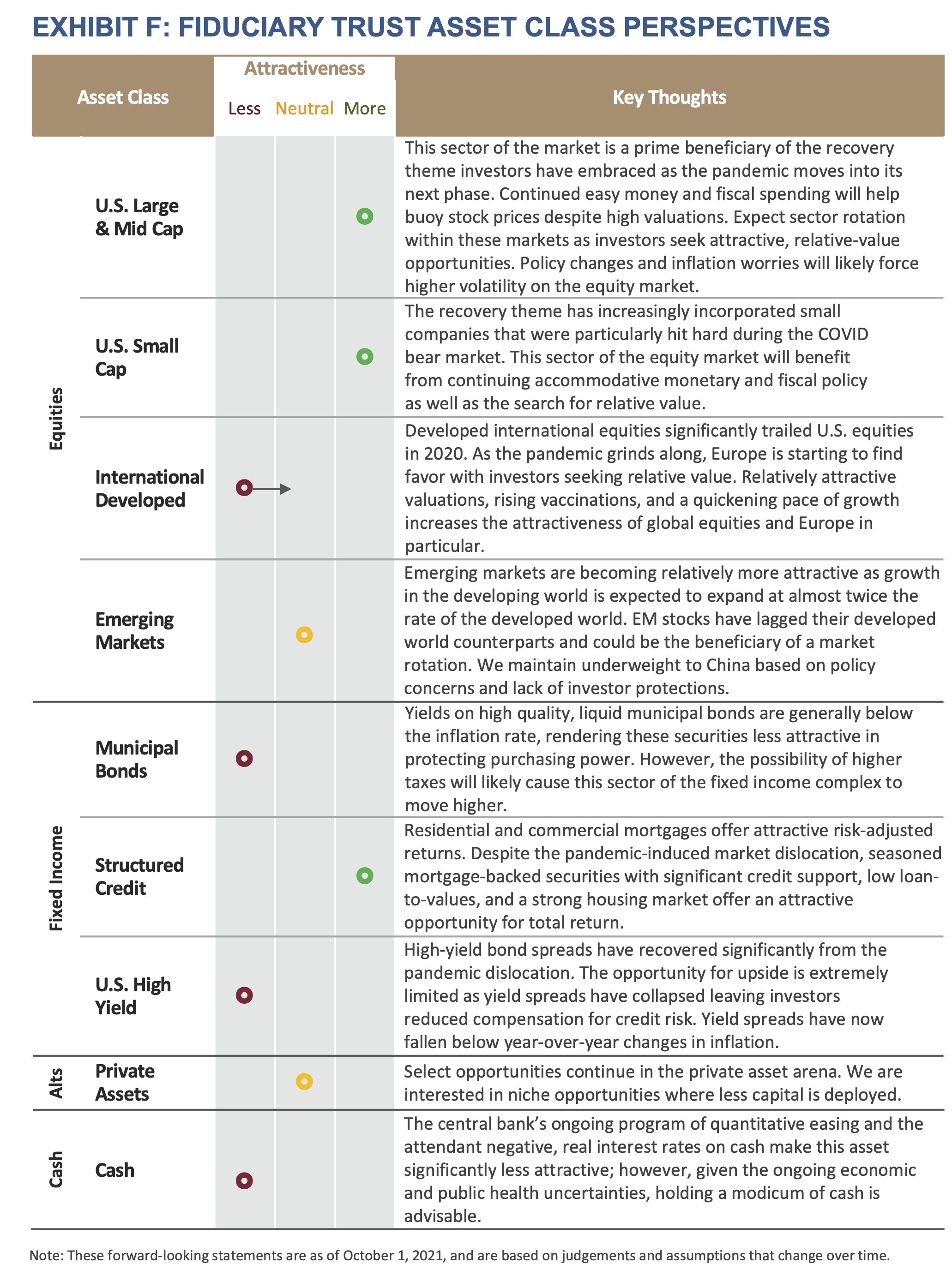

Bond prices have soared, pushing yields near pandemic lows for both investment grade and high yield bonds. The compensation for taking credit risk has scarcely been lower than it is now. Furthermore, the Treasury market’s entire yield curve is now below the inflation rate, guaranteeing the dissipation of one’s capital over time.

Housing, the largest investment for most Americans, remains in fine fettle and is so robust that it threatens to price buyers out of certain markets. The June reading of the S&P Case-Shiller 20 City Composite City Home Price Index jumped 19% from the prior year, the seventh consecutive double-digit increase since last November.8

Finally, digital thingamabobs in the form of non-fungible tokens (“NFTs”) have caught investor attention and imagination. Digital doodles can bring hard-to-imagine riches. Take the case of the 12-year-old English boy who renders digital pictures of whales. He made £290,000 pounds ($395,850 at current exchange rates) selling his art called “Weird Whales” in the form of NFTs. According to the boy’s father, the art, which he likens to “digital Pokémon cards,” is valued so highly because “collectors realized their historical significance.”9

The last two and a half decades have shown that policy makers hate uncertainty. This is especially true with central bankers, as the remit of central banks in the developed world has expanded to ensure that markets never become too disorderly. The tolerance of central bankers to endure market volatility appears to have fallen as their willingness to intervene in markets with increasing force has risen over time. When the opposing forces of high valuations and normalized interest rates collide in stomach-turning volatility, one might safely bet that a “policy recalibration” will duly occur. In short, no central banker wants to be the cause of market ructions, especially given the “financialization” of the U.S. economy.

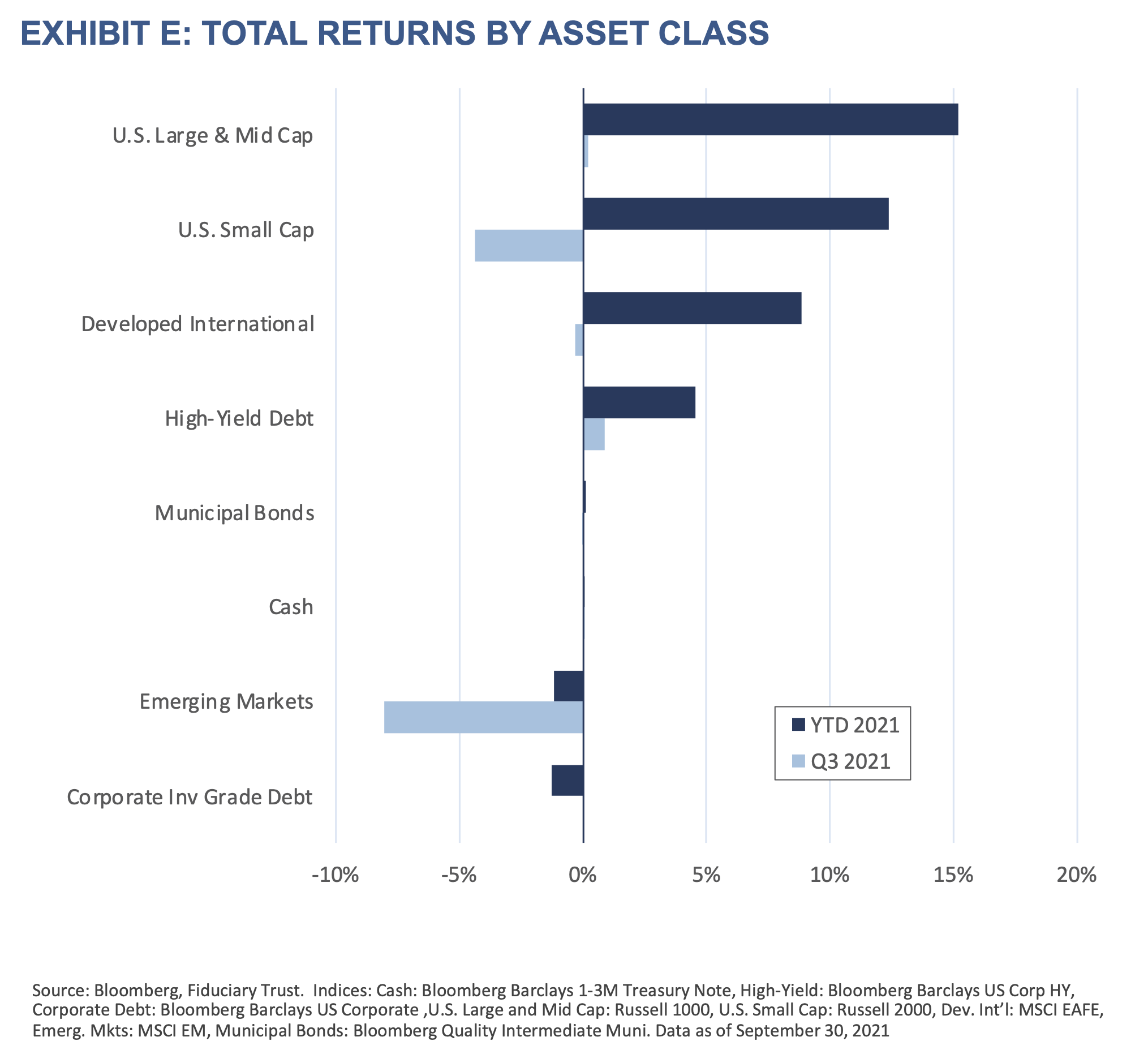

How these threads weave into a story that investors can move forward with remains to be seen. From our perch, the reality of slower growth is a product of returning to the normal rhythm of commercial life. The snap back from the pandemic lockdown is receding, and growth will return to a function of people and productivity. Some of inflation’s rise will likely prove temporary. What normal looks like going forward might be different as supply line breaks and worker shortages force price levels to grow faster than they have over the last decade. If consumer prices rise 3% per year compared to the 1.8% level of the last decade, businesses and the market will adapt. The reset will be most painful in long-duration fixed income assets; however, the equity market can live — indeed, has lived — with slightly higher inflation. With this reset, a new narrative is forming and if past is prologue, it will be painful. Investors should brace themselves for a rocky finish to the year.

The story is about to get interesting.

1 Mackinder is generally considered to be the father of geopolitics

2 CIA World Factbook, GDP numbers are 2017 figures calculated on purchasing power parity basis

3 International Monetary Fund, World Economic Outlook Update, July 2021: Fault Lines Widen in the Global Recovery

4 Year-over-year change in CPI smoothed using moving average over the periods mentioned. Data via Bloomberg.

5 Data from Bloomberg

6 “’Just Get Me a Box’: Inside the Brutal Realities of Supply Chain Hell,” Bloomberg Businessweek, September 16, 2021

7 Estimate as of December 31, 2020, S&P Global

8 Data via Bloomberg

9 “Boy, 12, makes 290,000 in non-fungible tokens with digital whale art,” The Guardian, August 27, 2021