Insights & News

Access key insights from our experts as well as our latest news.

Investments – Markets

2024 Q2 Market Outlook: Great Expectations and Calendar Watching

Hans Olsen, Fiduciary Trust Company’s Chief Investment Officer, provides perspective on the economy and markets, a look ahead at the rest of 2024, and our outlook by asset class in the 2024 Q2 Market Outlook.

Wealth Planning

Wealth Planning: Is Your Financial House in Order?

Trust and Estates

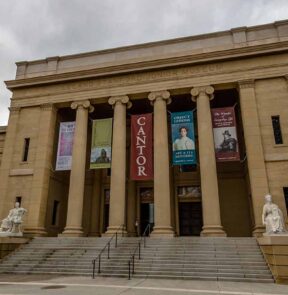

New Hampshire Trust Advantages

Filter list

Reset all

23

2024 Q2 Market Outlook: Great Expectations and Calendar Watching

Hans Olsen, Fiduciary Trust Company’s Chief Investment Officer, provides perspective on the economy and markets, a look ahead at the rest of 2024, and our outlook by asset class in the 2024 Q2 Market Outlook.

The National Debt Just Hit a Record High: Should Investors Be Worried?

The U.S. national debt now exceeds a record $34 trillion. How concerned should investors be about this figure? This insight explores how the national debt impacts the economy, the financial markets, and investors.

Planning Opportunities Before the Tax Cuts and Jobs Act Sunset

Now is the time to begin reviewing the details of your estate plan and personal tax situation to optimize your tax savings before the December 31, 2025 sunset.

2024 Market Outlook: What If There Is No Landing?

Fiduciary's CIO examines the potential scenarios for the economy and financial markets in 2024.

Choosing the Best Charitable Giving Approach

Learn about the benefits of six different charitable giving approaches to help maximize the impact of charitable giving.

Donor-Advised Fund or Private Foundation?

Understand the relative advantages of donor-advised funds and private foundations when pursuing charitable giving.

Fiduciary Trust News

FTC Shortlisted for Three Family Wealth Report Awards

Fiduciary Trust is pleased to have been named a finalist in three categories for the 2024 Family Wealth Report Awards.

FTC Recognized for Three Private Asset Management Awards

Fiduciary Trust Company is honored to have been recognized for excellence in Custody, Client Service, and Estate Planning Advisory Service at the 2024 Private Asset Management Awards.

Costa Recognized as a Top 200 Business Leader by NHBR

Fiduciary Trust of New England is pleased to share the inclusion of Michael Costa, CFA, on New Hampshire Business Review's NH 200 List.

Fiduciary Sponsors the 2024 Boston Wine & Food Festival

FTC is proud to be a Gold Sponsor of Boston's premier wine and food event series.